MetLife 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

mortgage loans, respectively, at December 31, 2010; and for all mortgage loans, was $209 million and $263 million at December 31, 2010

and 2009, respectively.

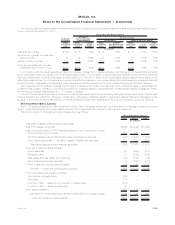

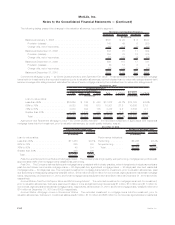

Impaired Mortgage Loans. The unpaid principal balance, recorded investment, valuation allowances and carrying value, net of valuation

allowances, for impaired mortgage loans held-for-investment, by portfolio segment, at December 31, 2010 and for all impaired mortgage

loans held-for-investment at December 31, 2009, were as follows at:

Unpaid

Principal

Balance Recorded

Investment Valuation

Allowances Carrying

Value

Unpaid

Principal

Balance Recorded

Investment

Unpaid

Principal

Balance Carrying

Value

Loans with a Valuation Allowance Loans without

a Valuation Allowance All Impaired Loans

Impaired Mortgage Loans

(In millions)

At December 31, 2010:

Commercial mortgage loans . . . . . . . . . $120 $120 $ 36 $ 84 $ 99 $ 87 $219 $171

Agricultural mortgage loans . . . . . . . . . . 146 146 52 94 123 119 269 213

Residentialmortgageloans.......... 3 3 — 3 16 16 19 19

Total ....................... $269 $269 $ 88 $181 $238 $222 $507 $403

Total mortgage loans at December 31,

2009 ........................ $316 $316 $123 $193 $106 $106 $422 $299

Unpaid principal balance is generally prior to any charge-off.

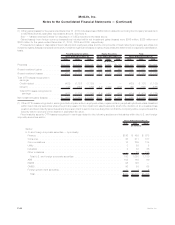

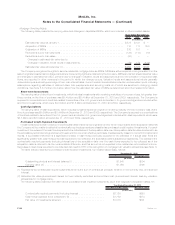

The average investment in impaired mortgage loans held-for-investment, and the related interest income, by portfolio segment, for the

year ended December 31, 2010 and for all mortgage loans for the years ended December 31, 2009 and 2008, respectively, was:

Cash Basis Accrual Basis

Interest Income Recognized

Impaired Mortgage Loans

Average Investment

(In millions)

For the Year Ended December 31, 2010:

Commercialmortgageloans............................ $192 $ 5 $ 1

Agriculturalmortgageloans............................. 284 6 2

Residentialmortgageloans............................. 16 — —

Total.......................................... $492 $11 $ 3

For the Year Ended December 31, 2009 ................... $338 $ 8 $ 1

For the Year Ended December 31, 2008 ................... $389 $12 $10

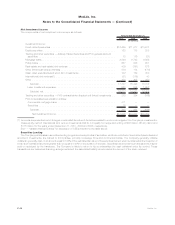

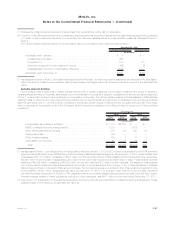

Real Estate and Real Estate Joint Ventures

Real estate investments by type consisted of the following:

Carrying

Value %of

Total Carrying

Value %of

Total

2010 2009

December 31,

(In millions)

Traditional ............................................... $5,163 64.3% $4,135 60.0%

Realestatejointventuresandfunds .............................. 2,707 33.7 2,579 37.4

Realestateandrealestatejointventures.......................... 7,870 98.0 6,714 97.4

Foreclosed .............................................. 152 1.9 127 1.8

Realestateheld-for-investment................................ 8,022 99.9 6,841 99.2

Realestateheld-for-sale...................................... 8 0.1 55 0.8

Total real estate and real estate joint ventures . . . . . . . . . . . . . . . . . . . . . . . $8,030 100.0% $6,896 100.0%

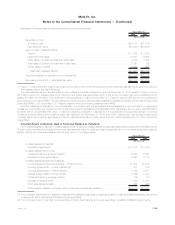

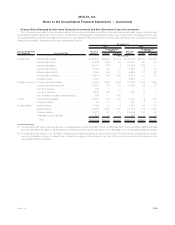

The Company classifies within traditional real estate its investment in income-producing real estate, which is comprised primarily of

wholly-owned real estate and, to a much lesser extent joint ventures with interests in single property income-producing real estate. The

Company classifies within real estate joint ventures and funds, its investments in joint ventures with interests in multi-property projects with

varying strategies ranging from the development of properties to the operation of income-producing properties as well as its investments in

real estate private equity funds. From time to time, the Company transfers investments from these joint ventures to traditional real estate, if the

Company retains an interest in the joint venture after a completed property commences operations and the Company intends to retain an

interest in the property.

F-53MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)