MetLife 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

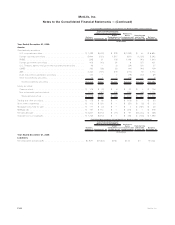

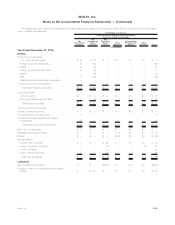

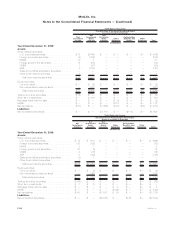

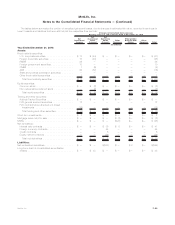

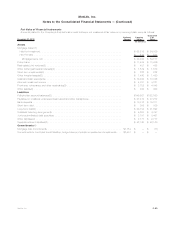

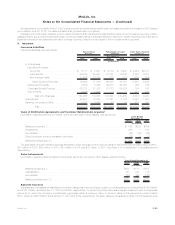

December 31, 2009 Notional

Amount Carrying

Value

Estimated

Fair

Value

(In millions)

Assets

Mortgage loans:(1)

Held-for-investment ..................................................... $48,181 $46,315

Held-for-sale.......................................................... 258 258

Mortgageloans,net.................................................... $48,439 $46,573

Policyloans............................................................ $10,061 $11,294

Realestatejointventures(2) ................................................. $ 115 $ 127

Otherlimitedpartnershipinterests(2)............................................ $ 1,571 $ 1,581

Short-terminvestments(3)................................................... $ 201 $ 201

Otherinvestedassets(2).................................................... $ 1,241 $ 1,284

Cashandcashequivalents.................................................. $10,112 $10,112

Accruedinvestmentincome ................................................. $ 3,173 $ 3,173

Premiums,reinsuranceandotherreceivables(2) .................................... $ 3,375 $ 3,532

Otherassets(2) ......................................................... $ 425 $ 440

Liabilities

Policyholderaccountbalances(2).............................................. $97,131 $96,735

Payables for collateral under securities loaned and other transactions . . . . . . . . . . . . . . . . . . . . . . $24,196 $24,196

Bankdeposits .......................................................... $10,211 $10,300

Short-termdebt ......................................................... $ 912 $ 912

Long-termdebt(2)........................................................ $13,185 $13,831

Collateralfinancingarrangements.............................................. $ 5,297 $ 2,877

Juniorsubordinateddebtsecurities ............................................ $ 3,191 $ 3,167

Otherliabilities(2) ........................................................ $ 1,788 $ 1,788

Separateaccountliabilities(2) ................................................ $32,171 $32,171

Commitments (4)

Mortgageloancommitments................................................. $2,220 $ — $ (48)

Commitments to fund bank credit facilities, bridge loans and private corporate bond investments . . . . $1,261 $ — $ (52)

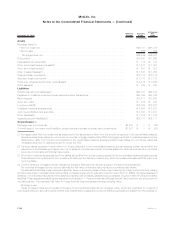

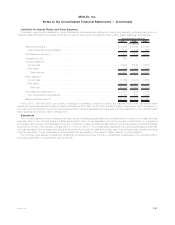

(1) Mortgage loans held-for-investment as presented in the tables above differ from the amount presented in the consolidated balance

sheets because these tables do not include commercial mortgage loans held by CSEs. Mortgage loans held-for-sale as presented in the

tables above differ from the amount presented in the consolidated balance sheets because these tables do not include residential

mortgage loans held-for-sale accounted for under the FVO.

(2) Carrying values presented herein differ from those presented in the consolidated balance sheets because certain items within the

respective financial statement caption are not considered financial instruments. Financial statement captions excluded from the table

above are not considered financial instruments.

(3) Short-term investments as presented in the tables above differ from the amounts presented in the consolidated balance sheets because

these tables do not include short-term investments that meet the definition of a security, which are measured at estimated fair value on a

recurring basis.

(4) Commitments are off-balance sheet obligations. Negative estimated fair values represent off-balance sheet liabilities.

The methods and assumptions used to estimate the fair value of financial instruments are summarized as follows:

The assets and liabilities measured at estimated fair value on a recurring basis include: fixed maturity securities, equity securities, trading

and other securities, mortgage loans held by CSEs, mortgage loans held-for-sale accounted for under the FVO, MSRs, derivative assets and

liabilities, net embedded derivatives within asset and liability host contracts, separate account assets, long-term debt of CSEs and trading

liabilities. These assets and liabilities are described in the section “— Recurring Fair Value Measurements” and, therefore, are excluded from

the tables above. The estimated fair value for these financial instruments approximates carrying value.

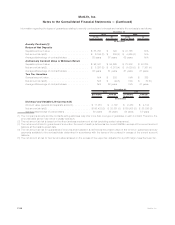

Mortgage Loans

These mortgage loans are principally comprised of commercial and agricultural mortgage loans, which are originated for investment

purposes and are primarily carried at amortized cost. Residential mortgage and consumer loans are generally purchased from third parties for

F-90 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)