MetLife 2010 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Preferred Shares do not have voting rights except in certain circumstances where the dividends have not been paid for an equivalent

of six or more dividend payment periods whether or not those periods are consecutive. Under such circumstances, the holders of the

Preferred Shares have certain voting rights with respect to members of the Board of Directors of the Holding Company.

The Preferred Shares are not subject to any mandatory redemption, sinking fund, retirement fund, purchase fund or similar provisions. The

Preferred Shares are redeemable at the Holding Company’s option in whole or in part, at a redemption price of $25 per Preferred Share, plus

declared and unpaid dividends.

In December 2008, the Holding Company entered into an RCC related to the Preferred Shares. As a part of the RCC, the Holding Company

agreed that it will not repay, redeem or purchase the Preferred Shares on or before December 31, 2018, unless such repayment, redemption

or purchase is made from the proceeds of the issuance of certain capital securities. The RCC is for the benefit of holders of one or more series

of its indebtedness as designated from time to time by the Holding Company. The RCC will terminate upon the occurrence of certain events,

including the date on which there are no series of outstanding eligible debt securities.

In connection with the offering of the Preferred Shares, the Holding Company incurred $57 million of issuance costs which have been

recorded as a reduction of additional paid-in capital.

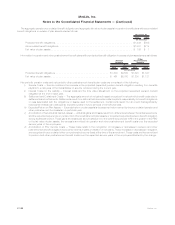

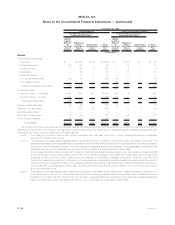

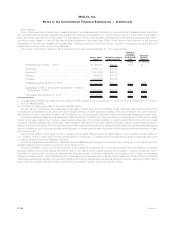

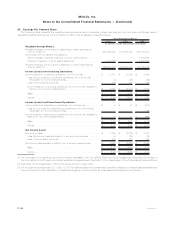

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Preferred Shares

is as follows:

Declaration Date Record Date Payment Date Series A

Per Share Series A

Aggregate Series B

Per Share Series B

Aggregate

Dividend

(In millions, except per share data)

November 15, 2010 . . . . . November 30, 2010 December 15, 2010 $0.2527777 $ 7 $0.4062500 $24

August 16, 2010 . . . . . . . August 31, 2010 September 15, 2010 $0.2555555 6 $0.4062500 24

May17,2010......... May31,2010 June 15, 2010 $0.2555555 7 $0.4062500 24

March 5, 2010 ........ February28,2010 March 15, 2010 $0.2500000 6 $0.4062500 24

$26 $96

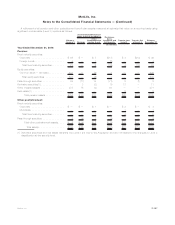

November 16, 2009 . . . . . November 30, 2009 December 15, 2009 $0.2527777 $ 7 $0.4062500 $24

August 17, 2009 . . . . . . . August 31, 2009 September 15, 2009 $0.2555555 6 $0.4062500 24

May15,2009......... May31,2009 June 15, 2009 $0.2555555 7 $0.4062500 24

March 5, 2009 ........ February28,2009 March 16, 2009 $0.2500000 6 $0.4062500 24

$26 $96

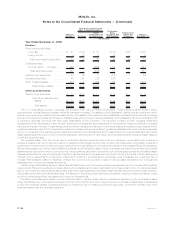

November 17, 2008 . . . . . November 30, 2008 December 15, 2008 $0.2527777 $ 7 $0.4062500 $24

August 15, 2008 . . . . . . . August 31, 2008 September 15, 2008 $0.2555555 6 $0.4062500 24

May15,2008......... May31,2008 June 16, 2008 $0.2555555 7 $0.4062500 24

March 5, 2008 ........ February29,2008 March 17, 2008 $0.3785745 9 $0.4062500 24

$29 $96

See Note 24 for information on subsequent dividends declared.

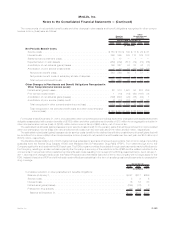

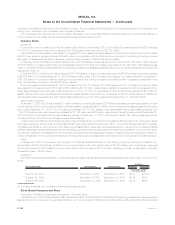

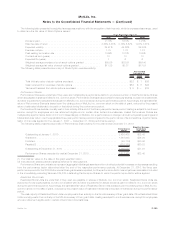

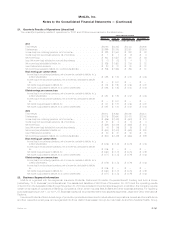

Convertible Preferred Stock

In connection with the financing of the Acquisition (see Note 2) in November 2010, the Holding Company issued to ALICO Holdings

6,857,000 shares of Convertible Preferred Stock with a $0.01 par value per share, a liquidation preference of $0.01 per share and a fair value

of $2,805 million.

The Convertible Preferred Stock will convert into 68,570,000 shares of the Holding Company’s common stock (subject to anti-dilution

adjustments) upon a favorable vote of the Holding Company’s common stockholders. If the Company (i) pays a dividend or makes another

distribution on common stock to all holders of common stock payable, in whole or in part, in shares of common stock; (ii) subdivides or splits

the outstanding shares of common stock into a greater number of shares; or (iii) combines or reclassifies the outstanding shares of common

stock into a smaller number of shares, then the conversion rate will be adjusted by multiplying the conversion rate by the number of shares of

common stock which a person who owns only one share of common stock immediately before the record date or effective date of the

applicable event would own immediately after giving effect to such dividend, distribution, subdivision, split, combination or reclassification. If

a favorable vote of its common stockholders is not obtained by the first anniversary of the Acquisition Date, then the Company must pay

ALICO Holdings approximately $300 million and use reasonable efforts to list the preferred stock on NYSE. The Convertible Preferred Stock

ranks senior to the common stock with respect to dividends and liquidation rights, and holders of the Convertible Preferred Stock will be

entitled to receive dividend payments only when, as and if declared by the Holding Company’s Board of Directors. Under the terms of the

Convertible Preferred Stock, the Board will declare a dividend payment or other distribution on the Convertible Preferred Stock on an as-

converted basis at any time and with the same terms as any dividend or other distribution declared on MetLife, Inc.’s common stock. No

distribution is payable on the Convertible Preferred Stock unless there is a concurrent distribution on the MetLife, Inc. common stock.

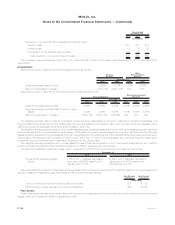

The Convertible Preferred Stock does not have voting rights except in certain circumstances when the Convertible Preferred Stock is

listed on the same exchange on which MetLife, Inc.’s common stock is listed, and where the dividends have not been paid notwithstanding

payment of dividends on MetLife, Inc.’s common stock for an equivalent of six or more dividend payment periods whether or not those periods

are consecutive. Under such circumstances, the holders of the Convertible Preferred Stock have certain voting rights with respect to

F-131MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)