MetLife 2010 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

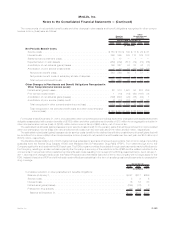

operations. The Company does not intend to repatriate these earnings to fund U.S. operations. Deferred taxes are provided for earnings of

non-U.S. affiliates and associated companies when the Company plans to remit those earnings. At December 31, 2010, the Company has

not made a provision for U.S. taxes on approximately $1,045 million of the excess of the amount for financial reporting over the tax basis of

investments in foreign subsidiaries that are essentially permanent in duration. It is not practicable to estimate the amount of deferred tax

liability related to investments in these foreign subsidiaries.

The Company files income tax returns with the U.S. federal government and various state and local jurisdictions, as well as foreign

jurisdictions. The Company is under continuous examination by the IRS and other tax authorities in jurisdictions in which the Company has

significant business operations. The income tax years under examination vary by jurisdiction. With a few exceptions, the Company is no

longer subject to U.S. federal, state and local, or foreign income tax examinations by tax authorities for years prior to 2000. In early 2009, the

Company and the IRS completed and substantially settled the audit years of 2000 to 2002. A few issues not settled have been escalated to

the next level, IRS Appeals. In April 2010, the IRS exam of the current audit cycle, years 2003 to 2006 began.

The Company’s liability for unrecognized tax benefits may decrease in the next 12 months pending the outcome of remaining issues, tax-

exempt income and tax credits associated with the 2000 to 2002 IRS audit. A reasonable estimate of the decrease cannot be made at this

time. However, the Company continues to believe that the ultimate resolution of the issues will not result in a material change to its

consolidated financial statements, although the resolution of income tax matters could impact the Company’s effective tax rate for a particular

future period.

The Company classifies interest accrued related to unrecognized tax benefits in interest expense, included within other expenses, while

penalties are included in income tax expense.

At December 31, 2010, the Company’s total amount of unrecognized tax benefits was $810 million and the total amount of unrecognized

tax benefits that would affect the effective tax rate, if recognized, was $536 million. The total amount of unrecognized tax benefits increased

by $37 million from December 31, 2009 primarily due to increases for tax positions of prior years offset by reductions for tax positions of prior

years and settlements reached with the IRS. The increases for tax positions of prior years included $169 million from the acquisition of

American Life. Settlements with tax authorities amounted to $59 million, all of which was reclassified to current and deferred income tax

payable, as applicable, with $3 million paid in 2010.

At December 31, 2009, the Company’s total amount of unrecognized tax benefits was $773 million and the total amount of unrecognized

tax benefits that would affect the effective tax rate, if recognized, was $583 million. The total amount of unrecognized tax benefits increased

by $7 million from December 31, 2008 primarily due to additions for tax positions of the current and prior years offset by settlements reached

with the IRS. Settlements with tax authorities amounted to $46 million, of which $44 million was reclassified to current income tax payable and

paid in 2009 and $2 million reduced current income tax expense.

At December 31, 2008, the Company’s total amount of unrecognized tax benefits was $766 million and the total amount of unrecognized

tax benefits that would affect the effective tax rate, if recognized, was $567 million. The total amount of unrecognized tax benefits decreased

by $74 million from December 31, 2007 primarily due to settlements reached with the IRS with respect to certain significant issues involving

demutualization, leasing and tax credits offset by additions for tax positions of the current year. As a result of the settlements, items within the

liability for unrecognized tax benefits, in the amount of $153 million, were reclassified to current and deferred income tax payable, as

applicable, of which $20 million was paid in 2008 and $133 million was paid in 2009.

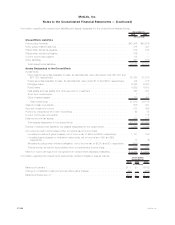

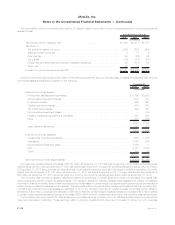

A reconciliation of the beginning and ending amount of unrecognized tax benefits was as follows:

2010 2009 2008

Years Ended

December 31,

(In millions)

BalanceatJanuary1,................................................. $773 $766 $840

Additionsfortaxpositionsofprioryears..................................... 186 43 11

Reductionsfortaxpositionsofprioryears.................................... (84) (33) (51)

Additionsfortaxpositionsofcurrentyear.................................... 13 52 147

Reductionsfortaxpositionsofcurrentyear................................... (8) (9) (22)

Settlementswithtaxauthorities .......................................... (59) (46) (153)

Lapsesofstatutesoflimitations .......................................... (11) — (6)

BalanceatDecember31, .............................................. $810 $773 $766

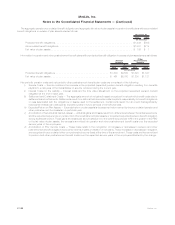

During the year ended December 31, 2010, the Company recognized $39 million in interest expense associated with the liability for

unrecognized tax benefits. At December 31, 2010, the Company had $221 million of accrued interest associated with the liability for

unrecognized tax benefits. The $23 million increase from December 31, 2009 in accrued interest associated with the liability for unrecognized

tax benefits resulted primarily from an increase of $20 million from the acquisitionofAmericanLife,alongwithanincreaseof$39millionof

interest expense and a $36 million decrease primarily resulting from the aforementioned IRS settlements. Of the $36 million decrease,

$18 million has been reclassified to current income tax payable, of which $2 million was paid in 2010. The remaining $18 million reduced

interest expense.

During the year ended December 31, 2009, the Company recognized $44 million in interest expense associated with the liability for

unrecognized tax benefits. At December 31, 2009, the Company had $198 million of accrued interest associated with the liability for

unrecognized tax benefits. The $22 million increase from December 31, 2008 in accrued interest associated with the liability for unrecognized

tax benefits resulted from an increase of $44 million of interest expense and a $22 million decrease primarily resulting from the

F-113MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)