MetLife 2010 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

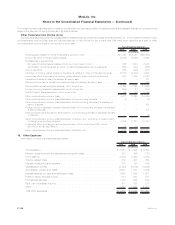

Operations

Texas Life Insurance Company

During the fourth quarter of 2008, the Holding Company entered into an agreement to sell its wholly-owned subsidiary, Cova, the parent

company of Texas Life, to a third-party and the sale occurred in March 2009. See Note 2. The following table presents the amounts related to

the operations of Cova that have been reflected as discontinued operations in the consolidated statements of operations:

2009 2008

Years Ended December 31,

(In millions)

Totalrevenues ................................................... $25 $134

Totalexpenses................................................... 19 119

Incomebeforeprovisionforincometax ................................... 6 15

Provisionforincometax............................................. 2 4

Income from operations of discontinued operations, net of income tax . . . . . . . . . . . . . . . 4 11

Gainondisposal,netofincometax ..................................... 28 37

Incomefromdiscontinuedoperations,netofincometax ........................ $32 $ 48

Reinsurance Group of America, Incorporated

As more fully described in Note 2, the Company completed a tax-free split-off of its majority-owned subsidiary, RGA in September 2008.

The following table presents the amounts related to the operations of RGA that have been reflected as discontinued operations in the

consolidated statements of operations: Year Ended

December 31, 2008

(In millions)

Totalrevenues ......................................................... $3,952

Totalexpenses......................................................... 3,796

Incomebeforeprovisionforincometax ......................................... 156

Provisionforincometax................................................... 53

Income from discontinued operations, net of income tax, available to MetLife, Inc.’s common

shareholders......................................................... 103

Income from discontinued operations, net of income tax, attributable to noncontrolling interests . . . . 94

Lossondisposal,netofincometax ........................................... (458)

Income(loss)fromdiscontinuedoperations,netofincometax .......................... $ (261)

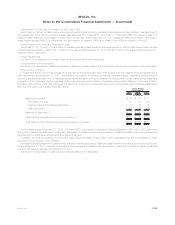

The operations of RGA included direct policies and reinsurance agreements with MetLife and some of its subsidiaries. These agreements

are generally terminable by either party upon 90 days written notice with respect to future new business. Agreements related to existing

business generally are not terminable, unless the underlying policies terminate or are recaptured. These direct policies and reinsurance

agreements do not constitute significant continuing involvement by the Company with RGA. Included in continuing operations in the

Company’s consolidated statements of operations are amounts related to these transactions, including ceded amounts that reduced

premiums and fees by $158 million and ceded amounts that reduced policyholder benefits and claims by $136 million for the year ended

December 31, 2008 that have not been eliminated as these transactions have continued after the RGA disposition.

24. Subsequent Events

Dividends

On February 18, 2011, the Holding Company announced dividends of $0.2500000 per share, for a total of $6 million, on its Series A

preferred shares, and $0.4062500 per share, for a total of $24 million, on its Series B preferred shares, subject to the final confirmation that it

has met the financial tests specified in the Series A and Series B preferred shares, which the Company anticipates will be made on or about

March 7, 2011. Both dividends will be payable March 15, 2011 to shareholders of record as of February 28, 2011.

Credit Facility

On February 1, 2011, the Holding Company entered into a committed facility with a third-party bank to provide letters of credit for the

benefit of Missouri Reinsurance (Barbados) Inc. (“MoRe”), a captive reinsurance subsidiary, to address its short-term solvency needs based

on guidance from the regulator. This one-year facility provides for the issuance of letters of credit in amounts up to $350 million. Under the

facility, a letter of credit for $250 million was issued on February 2, 2011 and increased to $295 million on February 23, 2011, which

management believes satisfies MoRe’s solvency requirements.

F-146 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)