MetLife 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

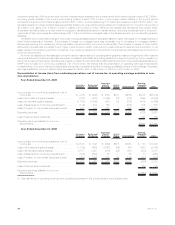

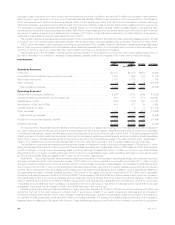

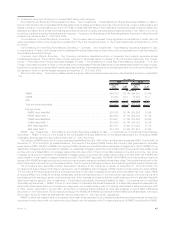

2010 2009 2008

At and for the Years Ended December 31,

(In millions)

Total Investments:

Grossinvestmentincomeyield(1)................................. 5.29% 4.90% 5.68%

Investmentfeesandexpensesyield ............................... (0.14) (0.14) (0.16)

Investment Income Yield(3) .................................. 5.15% 4.76% 5.52%

Grossinvestmentincome...................................... $ 17,786 $ 15,522 $ 16,660

Investmentfeesandexpenses .................................. (465) (433) (460)

Investment Income(3), (6) .................................... $ 17,321 $ 15,089 $ 16,200

Ending Carrying Value(3) .................................... $451,204 $337,679 $322,518

Grossinvestmentgains(3) ..................................... $ 1,200 $ 1,232 $ 1,802

Grossinvestmentlosses(3)..................................... (848) (1,429) (1,935)

Writedowns............................................... (545) (2,845) (2,042)

Investment Portfolio Gains (Losses)(3), (6) ....................... $ (193) $ (3,042) $ (2,175)

Investment portfolio gains (losses) income tax (expense) benefit . . . . . . . . . . . . . 53 1,121 795

Investment Portfolio Gains (Losses), Net of Income Tax .............. $ (140) $ (1,921) $ (1,380)

Derivative Gains (Losses)(6) .................................. $ (614) $ (5,106) $ 3,782

Derivativegains(losses)incometax(expense)benefit ................... $ 160 $ 1,803 $ (1,438)

Derivative Gains (Losses), Net of Income Tax ..................... $ (454) $ (3,303) $ 2,344

As described in the footnotes below, the yield table reflects certain differences from the presentation of invested assets, net investment

income, net investment gains (losses) and net derivative gains (losses) as presented in the consolidated balance sheets and consolidated

statements of operations, including the exclusion of contractholder-directed unit-linked investments classified within trading and other

securities, as the contractholder, not the Company, directs the investment of the funds; and the exclusion of the effects of consolidating

under GAAP certain VIEs that are consolidated securitization entities (“CSEs”). We believe this yield table presentation is consistent with

how we measure our investment performance for management purposes enhances understanding.

(1) Yields are based on average of quarterly average asset carrying values, excluding recognized and unrealized investment gains (losses),

collateral received from counterparties associated with our securities lending program, the effects of consolidating under GAAP certain

VIEs that are treated as CSEs and, effective October 1, 2010, contractholder-directed unit-linked investments. Yields also exclude

investment income recognized on mortgage loans and securities held by CSEs and, effective October 1, 2010, contractholder-directed

unit-linked investments.

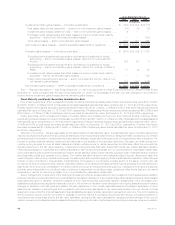

(2) Fixed maturity securities include $594 million, $2,384 million and $946 million at estimated fair value of trading and other securities at

December 31, 2010, 2009 and 2008, respectively. Fixed maturity securities include $234 million, $400 million and ($193) million of

investment income related to trading and other securities for the years ended December 31, 2010, 2009 and 2008, respectively.

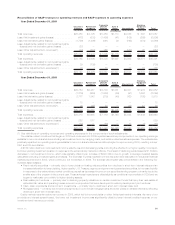

(3) (a) Fixed maturity securities ending carrying values as presented herein, exclude (i) contractholder-directed unit-linked investments —

reported within trading and other securities of $17,794 million, and (ii) securities held by CSEs that are consolidated under GAAP —

reported within trading and other securities of $201 million at December 31, 2010. Net investment income as presented herein, excludes

investment income on contractholder-directed unit-linked investments — reported within trading and other securities effective October 1,

2010 as shown in footnote (6) to this yield table.

(b) Ending carrying values, investment income and investment gains (losses) as presented herein, exclude the effects of consolidating

under GAAP certain VIEs that are treated as CSEs. The adjustment to investment income and investment gains (losses) in the aggregate

are as shown in footnote (6) to this yield table. The adjustments to ending carrying value, investment income and investment gains (losses)

by invested asset class are presented below. Both the invested assets and long-term debt of the CSEs are accounted for under the FVO.

The adjustment to investment gains (losses) presented below and in footnote (6) to this yield table includes the effects of remeasuring both

the invested assets and long-term debt in accordance with the FVO.

40 MetLife, Inc.