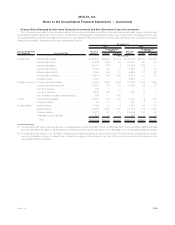

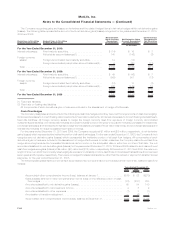

MetLife 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

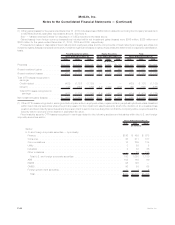

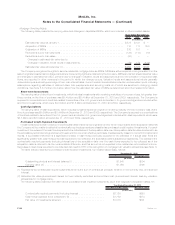

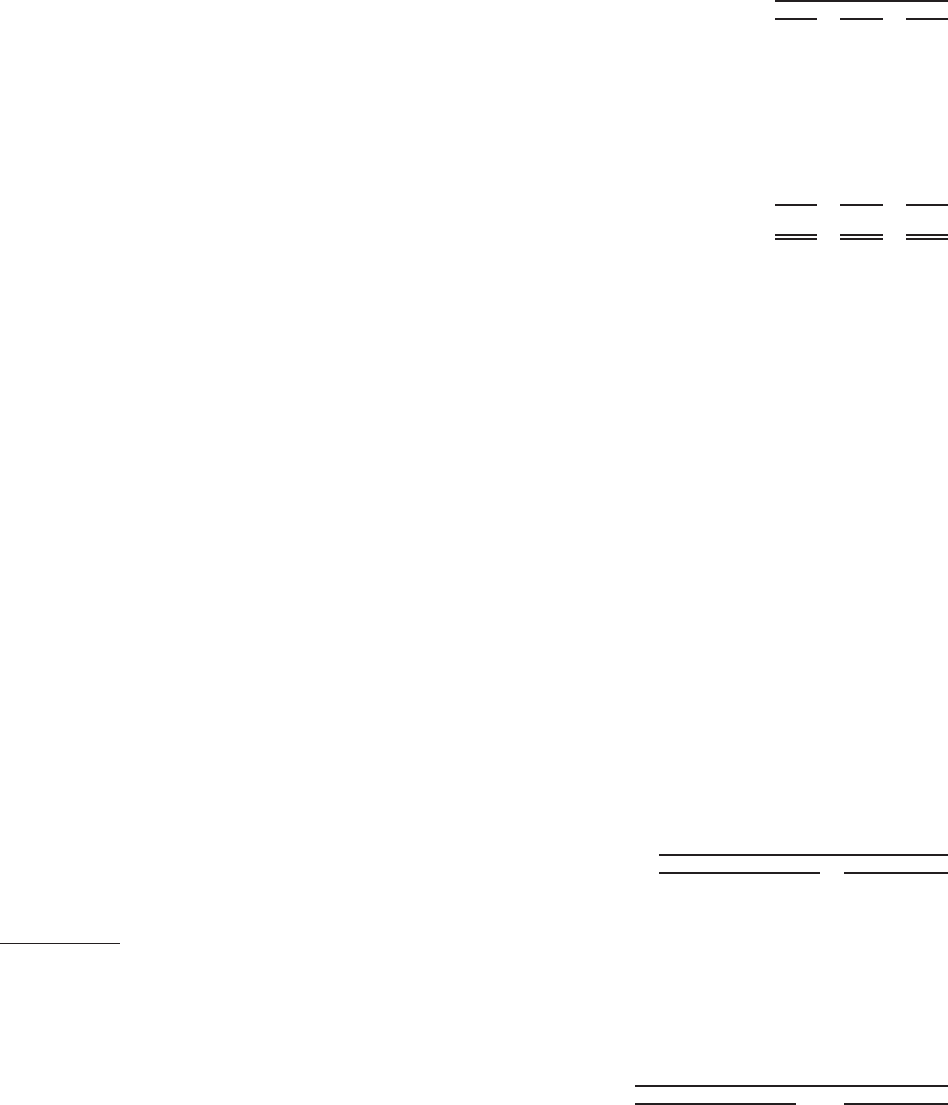

Mortgage Servicing Rights

The following table presents the carrying value and changes in capitalized MSRs, which are included in other invested assets:

2010 2009 2008

Years Ended December 31,

(In millions)

EstimatedfairvalueatJanuary1, ........................................ $878 $191 $ —

AcquisitionofMSRs................................................. 110 117 350

OriginationofMSRs................................................. 220 511 —

Reductionsduetoloanpayments ........................................ (136) (113) (10)

Reductionsduetoloansales........................................... (43) — —

Changes in estimated fair value due to:

Changesinvaluationmodelinputsorassumptions............................ (79) 172 (149)

EstimatedfairvalueatDecember31,...................................... $950 $878 $191

The Company recognizes the rights to service residential mortgage loans as MSRs. MSRs are either acquired or are generated from the

sale of originated residential mortgage loans where the servicing rights are retained by the Company. MSRs are carried at estimated fair value

and changes in estimated fair value, primarily due to changes in valuation inputs and assumptions and to the collection of expected cash

flows, are reported in other revenues in the period in which the change occurs. Valuation inputs and assumptions include generally

observable inputs such as type and age of loan, loan interest rates, current market interest rates and certain unobservable inputs, including

assumptions regarding estimates of discount rates, loan prepayments and servicing costs, all of which are sensitive to changing market

conditions. See Note 5 for further information about how the estimated fair value of MSRs is determined and other related information.

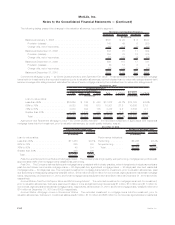

Short-term Investments

The carrying value of short-term investments, which includes investments with remaining maturities of one year or less, but greater than

three months, at the time of purchase was $9.4 billion and $8.4 billion at December 31, 2010 and 2009, respectively. The Company is

exposed to concentrations of credit risk related to securities of the U.S. government and certain U.S. government agencies included within

short-term investments, which were $4.0 billion and $7.5 billion at December 31, 2010 and 2009, respectively.

Cash Equivalents

The carrying value of cash equivalents, which includes investments with an original or remaining maturity of three months or less, at the

time of purchase was $9.6 billion and $8.4 billion at December 31, 2010 and 2009, respectively. The Company is exposed to concentrations

of credit risk related to securities of the U.S. government and certain U.S. government agencies included within cash equivalents, which were

$5.8 billion and $6.0 billion at December 31, 2010 and 2009, respectively.

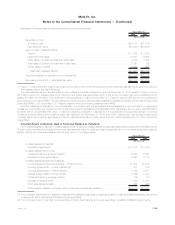

PurchasedCreditImpairedInvestments

Investments acquired with evidence of credit quality deterioration since origination and for which it is probable at the acquisition date that

the Company will be unable to collect all contractually required payments are classified as purchased credit impaired investments. For each

investment, the excess of the cash flows expected to be collected as of the acquisition date over its acquisition date fair value is referred to as

the accretable yield and is recognized as net investment income on an effective yield basis. If subsequently, based on current information and

events, it is probable that there is a significant increase in cash flows previously expected to be collected or if actual cash flows are

significantly greater than cash flows previously expected to be collected, the accretable yield is adjusted prospectively. The excess of the

contractually required payments (including interest) as of the acquisition date over the cash flows expected to be collected as of the

acquisition date is referred to as the nonaccretable difference, and this amount is not expected to be realized as net investment income.

Decreases in cash flows expected to be collected can result in OTTI or the recognition of mortgage loan valuation allowances (see Note 1).

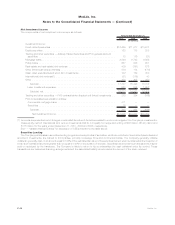

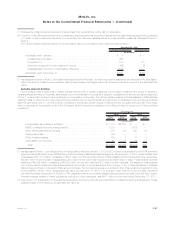

The table below presents the purchased credit impaired investments, by invested asset class, held at:

Fixed Maturity Securities Mortgage Loans

December 31, 2010

(In millions)

Outstandingprincipalandinterestbalance(1) ...................... $1,548 $504

Carryingvalue(2) ........................................ $1,050 $195

(1) Represents the contractually required payments which is the sum of contractual principal, whether or not currently due, and accrued

interest.

(2) Estimated fair value plus accrued interest for fixed maturity securities and amortized cost, plus accrued interest, less any valuation

allowances for mortgage loans.

The following table presents information about purchased credit impaired investments, as of their respective acquisition dates, for:

Fixed Maturity Securities Mortgage Loans

Year Ended December 31, 2010

(In millions)

Contractually required payments (including interest) . . . . . . . . . . . . . . . . $2,126 $553

Cashflowsexpectedtobecollected(1)(2)...................... $1,782 $374

Fairvalueofinvestmentsacquired ........................... $1,076 $201

F-56 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)