MetLife 2010 Annual Report Download - page 209

Download and view the complete annual report

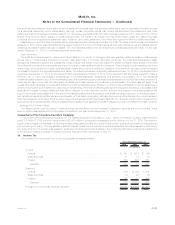

Please find page 209 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mortgage Loan Commitments

The Company has issued interest rate lock commitments on certain residential mortgage loan applications totaling $2.5 billion and

$2.7 billion at December 31, 2010 and 2009, respectively. The Company intends to sell the majority of these originated residential mortgage

loans. Interest rate lock commitments to fund mortgage loans that will be held-for-sale are considered derivatives and their estimated fair

value and notional amounts are included within interest rate forwards in Note 4.

The Company also commits to lend funds under certain other mortgage loan commitments that will be held-for-investment. The amounts

of these mortgage loan commitments were $3.8 billion and $2.2 billion at December 31, 2010 and 2009, respectively.

Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The Company commits to lend funds under bank credit facilities, bridge loans and private corporate bond investments. The amounts of

these unfunded commitments were $2.4 billion and $1.3 billion at December 31, 2010 and 2009, respectively.

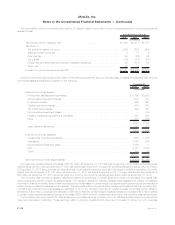

Guarantees

In the normal course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties

pursuant to which it may be required to make payments now or in the future. In the context of acquisition, disposition, investment and other

transactions, the Company has provided indemnities and guarantees, including those related to tax, environmental and other specific

liabilities and other indemnities and guarantees that are triggered by, among other things, breaches of representations, warranties or

covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifications to counterparties

in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third-party lawsuits. These obligations are often

subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of law, such as applicable

statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is subject to a contractual

limitation ranging from less than $1 million to $800 million, with a cumulative maximum of $1.6 billion, while in other cases such limitations are

not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does not believe that it is possible to

determine the maximum potential amount that could become due under these guarantees in the future. Management believes that it is unlikely

the Company will have to make any material payments under these indemnities, guarantees, or commitments.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to

limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount that

could become due under these indemnities in the future.

The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws.

Since these guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to

determine the maximum potential amount that could become due under these guarantees in the future.

During the year ended December 31, 2010, the Company did not record any additional liabilities for indemnities, guarantees and

commitments. The Company’s recorded liabilities were $5 million at both December 31, 2010 and 2009, for indemnities, guarantees and

commitments.

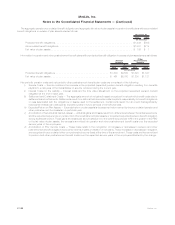

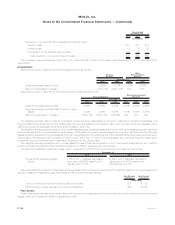

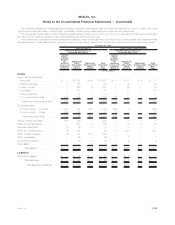

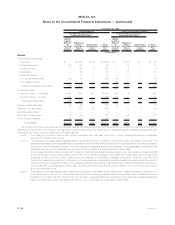

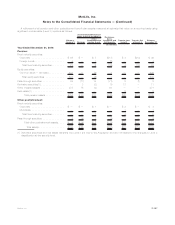

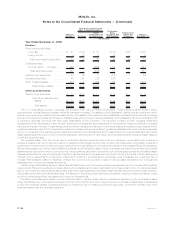

17. Employee Benefit Plans

Pension and Other Postretirement Benefit Plans

The Subsidiaries sponsor and/or administer various qualified and non-qualified defined benefit pension plans and other postretirement

employee benefit plans covering employees and sales representatives who meet specified eligibility requirements. Pension benefits are

provided utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits that are primarily based upon

years of credited service and final average earnings. The cash balance formula primarily utilizes hypothetical or notional accounts which credit

participants with benefits equal to a percentage of eligible pay, as well as earnings credits, determined annually based upon the average

annual rate of interest on 30-year U.S. Treasury securities, for each account balance. At December 31, 2010, the majority of active

participants were accruing benefits under the cash balance formula; however, approximately 90% of the Subsidiaries’ obligations result from

benefits calculated with the traditional formula. The U.S. non-qualified pension plans provide supplemental benefits in excess of limits

applicable to a qualified plan.

The Subsidiaries also provide certain postemployment benefits and certain postretirement medical and life insurance benefits for retired

employees. Employees of the Subsidiaries who were hired prior to 2003 (or, in certain cases, rehired during or after 2003) and meet age and

service criteria while working for one of the Subsidiaries may become eligible for these other postretirement benefits, at various levels, in

accordance with the applicable plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total costs of postretirement

medical benefits. Employees hired after 2003 are not eligible for any employer subsidy for postretirement medical benefits.

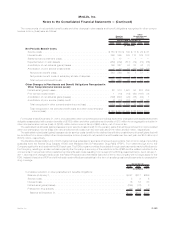

In connection with the Acquisition, domestic American Life employees who became employees of certain Subsidiaries (including those

who remained employees of companies acquired in the Acquisition) were credited with service recognized by AIG for purposes of determining

eligibility under the pension plans with respect to benefits earned under the pension plans subsequent to the closing date of the Acquisition.

Additionally, in connection with the Acquisition, the Company acquired certain pension plans sponsored by American Life. As of the end of

the year, these plans had liabilities of approximately $595 million and assets of approximately $97 million.

Measurement dates used for all of the Subsidiaries’ defined benefit pension and other postretirement benefit plans correspond with the

fiscal year ends of sponsoring Subsidiaries, which are December 31 for most Subsidiaries and November 30 for American Life.

F-120 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)