MetLife 2010 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

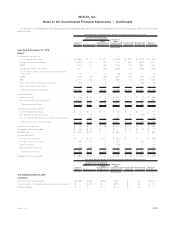

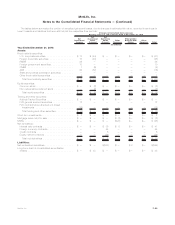

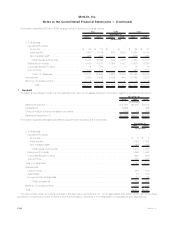

FVO Mortgage Loans Held-For-Sale

The following table presents residential mortgage loans held-for-sale carried under the FVO at:

2010 2009

December 31,

(In millions)

Unpaidprincipalbalance.................................................. $2,473 $2,418

Excessofestimatedfairvalueoverunpaidprincipalbalance........................... 37 52

Carryingvalueatestimatedfairvalue.......................................... $2,510 $2,470

Loansinnon-accrualstatus................................................ $ 2 $ 4

Loansmorethan90dayspastdue ........................................... $ 3 $ 2

Loans in non-accrual status or more than 90 days past due, or both — difference between

aggregateestimatedfairvalueandunpaidprincipalbalance.......................... $ (1) $ (2)

Residential mortgage loans held-for-sale accounted for under the FVO are initially measured at estimated fair value. Interest income on

residential mortgage loans held-for-sale is recorded based on the stated rate of the loan and is recorded in net investment income. Gains and

losses from initial measurement, subsequent changes in estimated fair value and gains or losses on sales are recognized in other revenues.

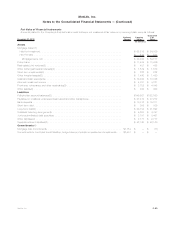

Such changes in estimated fair value for these loans were due to the following:

2010 2009 2008

Years Ended

December 31,

(In millions)

Instrument-specific credit risk based on changes in credit spreads for non-agency loans and

adjustmentsinindividualloanquality....................................... $ (1) $ (2) $—

Otherchangesinestimatedfairvalue........................................ 487 600 55

Totalgains(losses)recognizedinotherrevenues ................................ $486 $598 $55

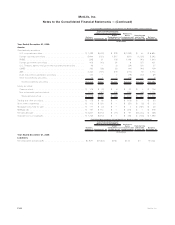

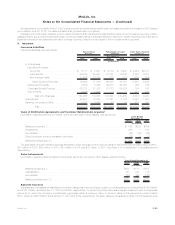

FVO Consolidated Securitization Entities

As discussed in Note 1, upon the adoption of new guidance effective January 1, 2010, the Company elected fair value accounting for the

following assets and liabilities held by CSEs: commercial mortgage loans, securities and long-term debt. Information on the estimated fair

value of the securities classified as trading and other securities is presented in Note 3. The following table presents these commercial

mortgage loans carried under the FVO at:

December 31, 2010

(In millions)

Unpaidprincipalbalance .................................................. $6,636

Excessofestimatedfairvalueoverunpaidprincipalbalance ........................... 204

Carryingvalueatestimatedfairvalue........................................... $6,840

The following table presents the long-term debt carried under the FVO related to both the commercial mortgage loans and securities

classified as trading and other securities at:

December 31, 2010

(In millions)

Contractualprincipalbalance................................................ $6,619

Excessofestimatedfairvalueovercontractualprincipalbalance......................... 201

Carryingvalueatestimatedfairvalue........................................... $6,820

Interest income on both commercial mortgage loans and securities classified as trading and other securities held by CSEs is recorded in

net investment income. Interest expense on long-term debt of CSEs is recorded in other expenses. Gains and losses from initial

measurement, subsequent changes in estimated fair value and gains or losses on sales of both the commercial mortgage loans and

long-term debt are recognized in net investment gains (losses), which is summarized in Note 3.

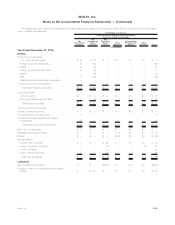

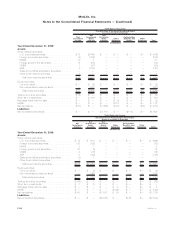

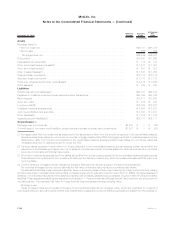

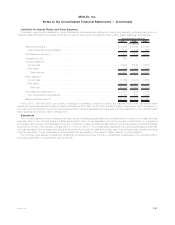

Non-Recurring Fair Value Measurements

Certain assets are measured at estimated fair value on a non-recurring basis and are not included in the tables presented above. The

amounts below relate to certain investments measured at estimated fair value during the period and still held at the reporting dates.

F-87MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)