MetLife 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Company Outlook

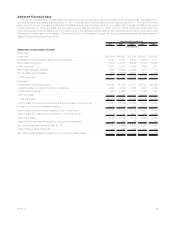

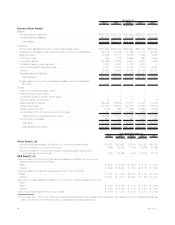

As a result of the Acquisition, operations outside the U.S. are expected to contribute approximately 30% of the premiums, fees and other

revenues and approximately 40% of MetLife’s operating earnings in 2011.

In 2010, general economic conditions improved and interest rates remained low throughout the year. In 2011, we expect a significant

improvement in the operating earnings of the Company, driven primarily by the following:

• Premiums, fees and other revenues growth in 2011 of approximately 30%, of which 27% is directly attributable to the Acquisition. The

remaining 3% increase is driven by:

• Increases in our non-U.S. businesses from continuing organic growth throughout our various geographic regions;

• Higher fees earned on separate accounts, as the equity markets continue to improve, thereby increasing the value of those separate

accounts. In addition, net flows of variable annuities are expected to continue to be strong in 2011, which also increases the account

values upon which these fees are earned;

• Increased sales in the pension closeout business, both in the U.S. and the United Kingdom (“U.K.”), as we expect the demand for

these products to return to a more normal level in 2011.

• Focus on disciplined underwriting. We see no significant changes to the underlying trends that drive underwriting results and anticipate

solid results in 2011.

• Focus on expense management. We continue to focus on expense control throughout the Company, specifically managing the costs

associated with the integration of ALICO. We also expect to begin realizing cost synergies later in 2011.

• Returns on investment portfolio. Although the market environment remains challenging, we expect the returns on our investment

portfolio in 2011, with respect to both income and realized gains and losses, will be in line with the results achieved in 2010.

More difficult to predict is the impact of potential changes in fair value of freestanding and embedded derivatives as even relatively small

movements in market variables, including interest rates, equity levels and volatility, can have a large impact on the fair value of derivatives and

net derivative gains (losses). Additionally, changes in fair value of embedded derivatives within certain insurance liabilities may have a material

impact on net derivative gains (losses) related to the inclusion of an adjustment for nonperformance risk.

Industry Trends

Despite improvement in general economic conditions in 2010, we continue to be impacted by the unstable global financial and economic

environment that has been affecting the industry.

Financial and Economic Environment. Our business and results of operations are materially affected by conditions in the global capital

markets and the economy, generally, both in the U.S. and elsewhere around the world. The global economy and markets are now recovering

from a period of significant stress that began in the second half of 2007 and substantially increased through the first quarter of 2009. This

disruption adversely affected the financial services industry, in particular. The U.S. economy entered a recession in late 2007. This recession

ended in mid-2009, but the recovery from the recession has been below historic averages and the unemployment rate is expected to remain

high for some time. In addition, inflation has fallen over the last several years and is expected to remain at low levels for some time. Some

economists believe that some level of disinflation and deflation risk remains in the economy.

Throughout 2008 and continuing in 2009, Congress, the Federal Reserve Bank of New York, the Federal Deposit Insurance Corporation

(“FDIC”), the U.S. Treasury and other agencies of the Federal government took a number of increasingly aggressive actions (in addition to

continuing a series of interest rate reductions that began in the second half of 2007) intended to provide liquidity to financial institutions and

markets, to avert a loss of investor confidence in particular troubled institutions, to prevent or contain the spread of the financial crisis and to

spur economic growth. Most of these programs have run their course or have been discontinued. The monetary policy by the Federal Reserve

Board and the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which was signed by President Obama in July

2010, are more likely to be relevant to MetLife, Inc. and will significantly change financial regulation in the U.S. See “— Regulatory Changes.”

In addition, the oversight body of the Basel Committee on Banking Supervision announced in December 2010 increased capital and liquidity

requirements (commonly referred to as “Basel III”) for bank holding companies, such as MetLife, Inc. Assuming these requirements are

endorsed and adopted by the U.S., they are to be phased in beginning January 1, 2013. It is possible that even more stringent capital and

liquidity requirements could be imposed under Dodd-Frank and Basel III.

It is not certain what effect the enactment of Dodd-Frank or Basel III will have on the financial markets, the availability of credit, asset prices

and MetLife’s operations. We cannot predict whether the funds made available by the U.S. Federal government and its agencies will be

enough to continue stabilizing or to further revive the financial markets or, if additional amounts are necessary, whether Congress will be willing

to make the necessary appropriations, what the public’s sentiment would be towards any such appropriations, or what additional require-

ments or conditions might be imposed on the use of any such additional funds.

The imposition of additional regulation on large financial institutions may have, over time, the effect of supporting some aspects of the

financial services industry more than others. This could adversely affect our competitive position.

Although the disruption in the global financial markets has moderated, not all such markets are functioning normally, and some remain

reliant upon government intervention and liquidity. The global recession and disruption of the financial markets has also led to concerns over

capital markets access and the solvency of certain European Union member states, including Portugal, Ireland, Italy, Greece and Spain. In

response, on May 10, 2010, the European Union, the European Central Bank and the International Monetary Fund announced a rescue

package of up to a750 billion, or approximately $1 trillion, for European nations in the Eurozone. This rescue package is intended to stabilize

these economies. The Japanese economy, to which we face increased exposure as a result of the Acquisition, continues to experience low

nominal growth, a deflationary environment, and weak consumer spending.

Recent global economic conditions have had and could continue to have an adverse effect on the financial results of companies in the

financial services industry, including MetLife. Such global economic conditions, as well as the global financial markets, continue to impact our

net investment income, our net investment and net derivative gains (losses), and the demand for and the cost and profitability of certain of our

products, including variable annuities and guarantee benefits. See “— Results of Operations” and “— Liquidity and Capital Resources.”

Competitive Pressures. The life insurance industry remains highly competitive. The product development and product life-cycles have

shortened in many product segments, leading to more intense competition with respect to product features. Larger companies have the

ability to invest in brand equity, product development, technology and risk management, which are among the fundamentals for sustained

8MetLife, Inc.