MetLife 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Regarding Forward Looking Statements,” “Selected Financial Data” and the Company’s consolidated financial statements included else-

where herein and “Risk Factors” included in MetLife’s Annual Report on Form 10-K for the Year Ended December 31, 2010, as amended on

Form 10-K/A filed with the SEC on March 1, 2011, and as updated by MetLife’s report on Form 8-K filed with the SEC on March 1, 2011.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain or incorporate by reference

information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do

not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe”

and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. In particular, these

include statements relating to future actions, prospective services or products, future performance or results of current and anticipated

services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial

results. Any or all forward-looking statements may turn out to be wrong. Actual results could differ materially from those expressed or implied

in the forward-looking statements. See “Note Regarding Forward-Looking Statements.”

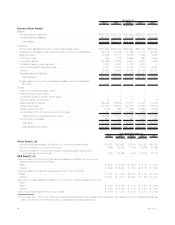

The following discussion includes references to our performance measures operating earnings and operating earnings available to

common shareholders, that are not based on accounting principles generally accepted in the United States of America (“GAAP”). Operating

earnings is the measure of segment profit or loss we use to evaluate segment performance and allocate resources and, consistent with GAAP

accounting guidance for segment reporting, is our measure of segment performance. Operating earnings is also a measure by which our

senior management’s and many other employees’ performance is evaluated for the purposes of determining their compensation under

applicable compensation plans. Operating earnings is defined as operating revenues less operating expenses, net of income tax. Operating

earnings available to common shareholders, which is used to evaluate the performance of Banking, Corporate & Other, as well as MetLife, is

defined as operating earnings less preferred stock dividends.

Operating revenues is defined as GAAP revenues (i) less net investment gains (losses) and net derivative gains (losses); (ii) less

amortization of unearned revenue related to net investment gains (losses) and net derivative gains (losses); (iii) plus scheduled periodic

settlement payments on derivatives that are hedges of investments but do not qualify for hedge accounting treatment; (iv) plus income from

discontinued real estate operations; (v) less net investment income related to contractholder-directed unit-linked investments; and (vi) plus,

for operating joint ventures reported under the equity method of accounting, the aforementioned adjustments, those identified in the definition

of operating expenses and changes in the fair value of hedges of operating joint venture liabilities, all net of income tax.

Operating expenses is defined as GAAP expenses (i) less changes in policyholder benefits associated with asset value fluctuations related

to experience-rated contractholder liabilities and certain inflation-indexed liabilities; (ii) less costs related to business combinations (since

January 1, 2009) and noncontrolling interests; (iii) less amortization of deferred policy acquisition costs (“DAC”) and value of business

acquired (“VOBA”) and changes in the policyholder dividend obligation related to net investment gains (losses) and net derivative gains

(losses); (iv) less interest credited to policyholder account balances (“PABs”) related to contractholder-directed unit-linked investments; and

(v) plus scheduled periodic settlement payments on derivatives that are hedges of PABs but do not qualify for hedge accounting treatment.

In addition, operating revenues and operating expenses do not reflect the consolidation of certain securitization entities that are variable

interest entities (“VIEs”) as required under GAAP.

We believe the presentation of operating earnings and operating earnings available to common shareholders as we measure it for

management purposes enhances the understanding of our performance by highlighting the results of operations and the underlying

profitability drivers of our businesses. Operating earnings and operating earnings available to common shareholders should not be viewed as

substitutes for GAAP income (loss) from continuing operations, net of income tax. Reconciliations of operating earnings and operating

earnings available to common shareholders to GAAP income (loss) from continuing operations, net of income tax, the most directly

comparable GAAP measure, are included in “— Results of Operations.”

In this discussion, we sometimes refer to sales activity for various products. These sales statistics do not correspond to revenues under

GAAP, but are used as relevant measures of business activity.

Executive Summary

MetLife is a leading global provider of insurance, annuities and employee benefit programs throughout the United States (“U.S.”), Japan,

Latin America, Asia Pacific, Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto

and homeowners insurance, retail banking and other financial services to individuals, as well as group insurance and retirement & savings

products and services to corporations and other institutions. MetLife is organized into five segments: Insurance Products, Retirement

Products, Corporate Benefit Funding and Auto & Home (collectively, “U.S. Business”) and International. The assets and liabilities of American

Life Insurance Company (“American Life”) and Delaware American Life Insurance Company (“DelAm,” together with American Life, collectively,

“ALICO”) as of November 30, 2010 and the operating results of ALICO from November 1, 2010 (the “Acquisition Date”) through November 30,

2010 are included in the International segment. In addition, the Company reports certain of its results of operations in Banking, Corporate &

Other, which is comprised of MetLife Bank, National Association (“MetLife Bank”) and other business activities. For reporting periods

beginning in 2011, our non-U.S. Business results will be presented within two separate segments: Japan and Other International Regions.

On the Acquisition Date, the Holding Company completed the acquisition of American Life from ALICO Holdings LLC (“ALICO Holdings”), a

subsidiary of American International Group, Inc. (“AIG”), and DelAm from AIG, (the “Acquisition”) for a total purchase price of $16.4 billion. The

business acquired in the Acquisition provides consumers and businesses with life insurance, accident and health insurance, retirement and

wealth management solutions. This transaction delivers on our global growth strategies, adding significant scale and reach to MetLife’s

international footprint, furthering our diversification in geographic mix and product offerings, as well as increasing our distribution strength.

See Note 2 of the Notes to the Consolidated Financial Statements.

As the U.S. and global financial markets continue to recover, we have experienced a significant improvement in net investment income and

favorable changes in net investment and net derivative gains (losses). We also continue to experience an increase in market share and sales in

some of our businesses, in part, from a flight to quality in the industry. These positive factors were somewhat dampened by the negative

impact of general economic conditions, including high levels of unemployment, on the demand for certain of our products.

6MetLife, Inc.