MetLife 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company’s diversification by product, distribution and geography, meaningfully accelerate MetLife’s global growth strategy, and create the

opportunity to build an international franchise leveraging the key strengths of ALICO. ALICO’s largest international market is Japan. As of

December 31, 2010, the Japan operation’s total assets represented approximately 12% of the Company’s total assets.

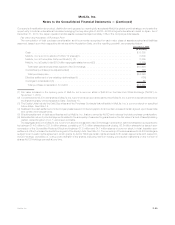

Fair Value and Allocation of Purchase Price

The computation of total purchase consideration and the amounts recognized for each major class of assets acquired and liabilities

assumed, based upon their respective fair values at the Acquisition Date, and the resulting goodwill, are presented below:

November 1, 2010

(In millions)

Cash................................................................ $ 6,800

MetLife, Inc.’s common stock (78,239,712 shares)(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,200

MetLife,Inc.’sConvertiblePreferredStock(1),(2) ................................... 2,805

MetLife,Inc.’sEquityUnits($3.0billionaggregatestatedamount)(3)....................... 3,189

TotalcashpaidandsecuritiesissuedtoALICOHoldings ............................. $15,994

Contractualpurchasepriceadjustments(4) ....................................... 396

Totalpurchaseprice..................................................... $16,390

Effectivesettlementofpre-existingrelationships(5).................................. (186)

Contingentconsideration(6) ................................................. 88

TotalpurchaseconsiderationforALICO ........................................ $16,292

(1) Fair value is based on the opening price of MetLife, Inc.’s common stock of $40.90 on the New York Stock Exchange (“NYSE”) on

November 1, 2010.

(2) Convertible into 68,570,000 shares of MetLife, Inc.’s common stock upon a favorable vote of MetLife, Inc.’s common stockholders before

the first anniversary of the Acquisition Date. See Note 18.

(3) The Equity Units include the Debt Securities and the Purchase Contracts that will settle in MetLife, Inc.’s common stock on specified

future dates. See Note 14.

(4) Relates to the cash settlement of intercompany balances prior to the Acquisition for amounts in excess of certain agreed-upon thresholds

and certain other adjustments.

(5) Effective settlement of debt securities issued by MetLife, Inc. that are owned by ALICO and reduces the total purchase consideration.

(6) Estimated fair value of potential payments related to the adequacy of reserves for guarantees on the fair value of a fund of assets backing

certain United Kingdom (“U.K.”) unit-linked contracts.

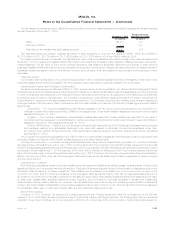

The aggregate amount of MetLife, Inc.’s common stock to be issued to ALICO Holdings in connection with the transaction is expected to

be between 214.6 million to 231.5 million shares, consisting of 78.2 million shares issued at closing, 68.6 million shares to be issued upon

conversion of the Convertible Preferred Stock and between 67.8 million and 84.7 million shares of common stock, in total, issuable upon

settlement of the Purchase Contracts forming part of the Equity Units. See Note 14. The ownership of the shares issued to ALICO Holdings is

subject to an investor rights agreement, which grants to ALICO Holdings certain rights and sets forth certain agreements with respect to

ALICO Holdings’ ownership of, voting on and transfer of the shares, including minimum holding periods and restrictions on the number of

shares ALICO Holdings can sell at one time.

F-29MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)