MetLife 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

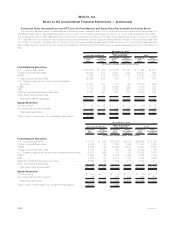

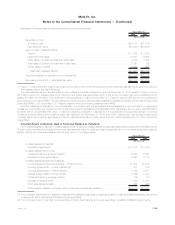

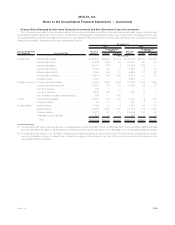

The following tables present the changes in the valuation allowance, by portfolio segment:

CommercialAgriculturalResidential Total

Mortgage Loan Valuation Allowances

(In millions)

Balance at January 1, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $167 $ 24 $ 6 $197

Provision(release)................................... 145 49 6 200

Charge-offs,netofrecoveries........................... (80) (12) (1) (93)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . 232 61 11 304

Provision(release)................................... 384 79 12 475

Charge-offs,netofrecoveries........................... (27) (25) (6) (58)

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . 589 115 17 721

Provision(release)................................... (5) 12 2 9

Charge-offs,netofrecoveries........................... (22) (39) (5) (66)

Balance at December 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . $562 $ 88 $14 $664

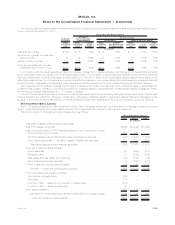

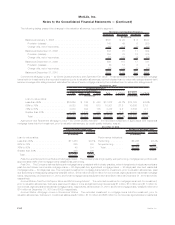

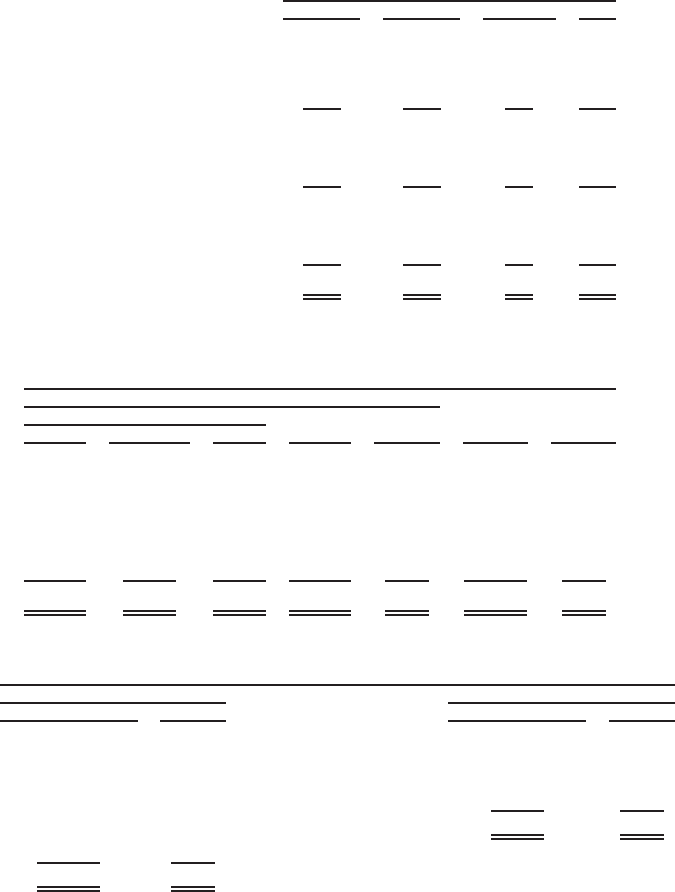

Commercial Mortgage Loans — by Credit Quality Indicators with Estimated Fair Value: Presented below for the commercial mortgage

loans held-for-investment is the recorded investment, prior to valuation allowances, by the indicated loan-to-value ratio categories and debt

service coverage ratio categories and estimated fair value of such mortgage loans by the indicated loan-to-value ratio categories at:

H1.20x 1.00x - 1.20x G1.00x Total % of Total Estimated

Fair Value % of Total

Debt Service Coverage Ratios

Recorded Investment

December 31, 2010

(In millions) (In millions)

Loan-to-value ratios:

Less than 65% . . . . . . . . . . . . . . . $16,664 $ 125 $ 483 $17,272 45.7% $18,183 46.9%

65% to 75% . . . . . . . . . . . . . . . . . 9,023 765 513 10,301 27.2 10,686 27.6

76% to 80% . . . . . . . . . . . . . . . . . 3,033 304 135 3,472 9.2 3,536 9.1

Greater than 80% . . . . . . . . . . . . . 4,155 1,813 807 6,775 17.9 6,374 16.4

Total . . . . . . . . . . . . . . . . . . . . $32,875 $3,007 $1,938 $37,820 100.0% $38,779 100.0%

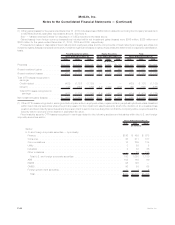

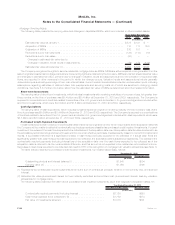

Agricultural and Residential Mortgage Loans — by Credit Quality Indicator: The recorded investment in agricultural and residential

mortgage loans held-for-investment, prior to valuation allowances, by credit quality indicator, was at:

Recorded Investment % of Total Recorded Investment % of Total

Agricultural Mortgage Loans Residential Mortgage Loans

December 31, 2010

(In millions) (In millions)

Loan-to-value ratios: Performance indicators:

Lessthan65% .................. $11,483 90.1% Performing ........ $2,225 96.4%

65%to75%.................... 885 6.9 Nonperforming...... 83 3.6

76% to 80% . . . . . . . . . . . . . . . . . . . . 48 0.4 Total . . . . . . . . . . . $2,308 100.0%

Greaterthan80% ................ 335 2.6

Total........................ $12,751 100.0%

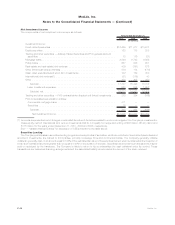

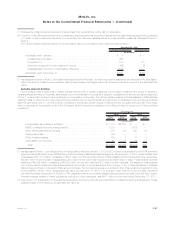

Past Due and Interest Accrual Status of Mortgage Loans. The Company has a high quality, well performing, mortgage loan portfolio with

approximately 99% of all mortgage loans classified as performing.

Past Due. The Company defines delinquent mortgage loans consistent with industry practice, when interest and principal payments are

past due as follows: commercial mortgage loans — 60 days past due; agricultural mortgage loans — 90 days past due; and residential

mortgage loans — 60 days past due. The recorded investment in mortgage loans held-for-investment, prior to valuation allowances, past

due according to these aging categories was $58 million, $159 million and $79 million for commercial, agricultural and residential mortgage

loans, respectively, at December 31, 2010; and for all mortgage loans was $296 million and $220 million at December 31, 2010 and 2009,

respectively.

Accrual Status. Past Due 90 Days or More and Still Accruing Interest. The recorded investment in mortgage loans held-for-investment,

prior to valuation allowances, that were past due 90 days or more and still accruing interest was $1 million, $13 million and $11 million for

commercial, agricultural and residential mortgage loans, respectively, at December 31, 2010; and for all mortgage loans, was $25 million and

$14 million at December 31, 2010 and 2009, respectively.

Accrual Status. Mortgage Loans in Nonaccrual Status. The recorded investment in mortgage loans held-for-investment, prior to

valuation allowances, that were in nonaccrual status was $7 million, $177 million and $25 million for commercial, agricultural and residential

F-52 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)