MetLife 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

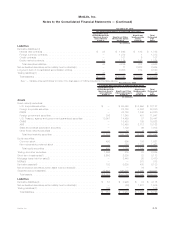

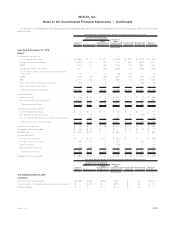

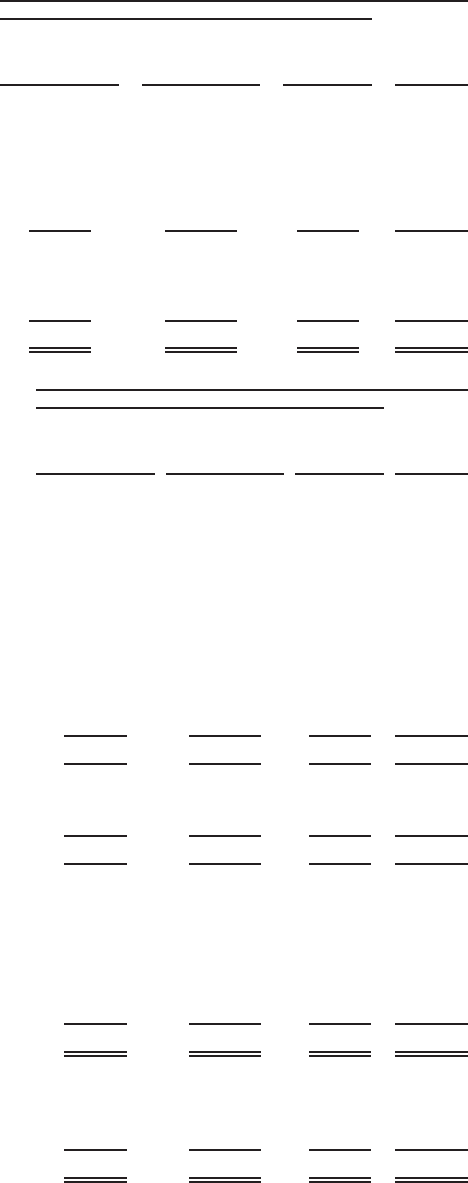

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Fair Value Measurements at Reporting Date Using

December 31, 2010

(In millions)

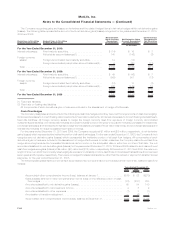

Liabilities

Derivative liabilities:(4)

Interestratecontracts............................... $ 35 $ 1,598 $ 125 $ 1,758

Foreigncurrencycontracts ........................... — 1,372 1 1,373

Creditcontracts .................................. — 101 6 107

Equitymarketcontracts.............................. 10 1,174 140 1,324

Totalderivativeliabilities............................ 45 4,245 272 4,562

Net embedded derivatives within liability host contracts(5) . . . . . . . . . — 11 2,623 2,634

Long-term debt of consolidated securitization entities. . . . . . . . . . . . — 6,636 184 6,820

Tradingliabilities(7).................................. 46 — — 46

Totalliabilities.................................... $ 91 $ 10,892 $ 3,079 $ 14,062

See“—VariableInterestEntities”inNote3fordiscussion of CSEs included in the table above.

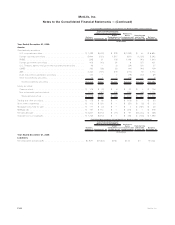

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Fair Value Measurements at Reporting Date Using

December 31, 2009

(In millions)

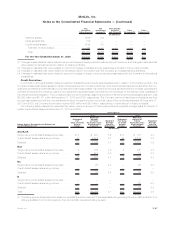

Assets

Fixed maturity securities:

U.S.corporatesecurities ................................ $ — $ 65,493 $ 6,694 $ 72,187

Foreigncorporatesecurities .............................. — 32,738 5,292 38,030

RMBS ............................................ — 42,180 1,840 44,020

Foreigngovernmentsecurities............................. 306 11,240 401 11,947

U.S. Treasury, agency and government guaranteed securities . . . . . . . . 10,951 14,459 37 25,447

CMBS ............................................ — 15,483 139 15,622

ABS.............................................. — 10,450 2,712 13,162

Stateandpoliticalsubdivisionsecurities ...................... — 7,139 69 7,208

Otherfixedmaturitysecurities............................. — 13 6 19

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,257 199,195 17,190 227,642

Equity securities:

Commonstock....................................... 490 995 136 1,621

Non-redeemablepreferredstock ........................... — 359 1,104 1,463

Totalequitysecurities................................. 490 1,354 1,240 3,084

Tradingandothersecurities................................ 1,886 415 83 2,384

Short-terminvestments(1)................................. 5,650 2,500 23 8,173

Mortgageloansheld-for-sale(2) ............................. — 2,445 25 2,470

MSRs(3) ............................................ — — 878 878

Derivativeassets(4) ..................................... 103 5,600 430 6,133

Netembeddedderivativeswithinassethostcontracts(5) ............. — — 76 76

Separate account assets(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,601 129,545 1,895 149,041

Totalassets......................................... $36,987 $341,054 $21,840 $399,881

Liabilities

Derivativeliabilities(4).................................... $ 51 $ 3,990 $ 74 $ 4,115

Net embedded derivatives within liability host contracts(5) . . . . . . . . . . . . — (26) 1,531 1,505

Tradingliabilities(7)...................................... 106 — — 106

Totalliabilities........................................ $ 157 $ 3,964 $ 1,605 $ 5,726

F-71MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)