MetLife 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

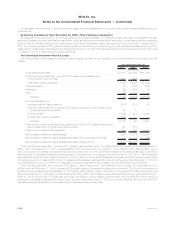

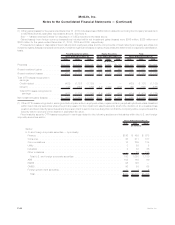

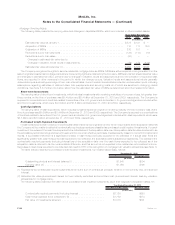

(3) The Company held in trust certain investments, primarily fixed maturity securities, in connection with certain reinsurance transactions.

(4) The Company has pledged fixed maturity securities and mortgage loans in support of its funding agreements with, and advances from, the

Federal Home Loan Bank of New York (“FHLB of NY”) and has pledged fixed maturity securities in support of its funding agreements with

the Federal Home Loan Bank of Boston (“FHLB of Boston”). The nature of these Federal Home Loan Bank arrangements is described in

Notes 8 and 11.

(5) The Company has pledged certain agricultural mortgage loans in connection with funding agreements issued to certain SPEs that have

issued securities guaranteed by the Federal Agricultural Mortgage Corporation (“Farmer Mac”). The nature of these Farmer Mac

arrangements is described in Note 8.

(6) The Company has pledged qualifying mortgage loans and fixed maturity securities in connection with collateralized borrowings from the

Federal Reserve Bank of New York’s Term Auction Facility. The nature of the Federal Reserve Bank of New York arrangements is described

in Note 11.

(7) The Holding Company has pledged certain collateral in support of the collateral financing arrangements described in Note 12.

(8) Certain of the Company’s invested assets are pledged as collateral for various derivative transactions as described in Note 4.

(9) Certain of the Company’s Actively Traded Securities and cash and cash equivalents are pledged to secure liabilities associated with short

sale agreements in the Actively Traded Securities portfolio.

See also “— Securities Lending” for the amount of the Company’s cash received from and due back to counterparties pursuant to the

Company’s securities lending program. See “— Variable Interest Entities” for assets of certain CSEs that can only be used to settle liabilities of

such entities.

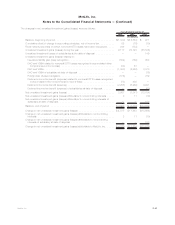

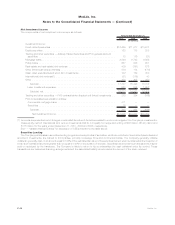

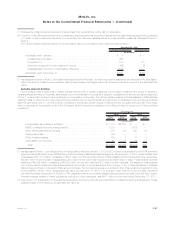

Trading and Other Securities

The tables below present certain information about the Company’s trading securities and other securities for which the FVO has been

elected:

2010 2009

December 31,

(In millions)

ActivelyTradedSecurities ................................................ $ 463 $ 420

FVOgeneralaccountsecurities............................................. 131 78

FVOcontractholder-directedunit-linkedinvestments ............................... 17,794 1,886

FVOsecuritiesheldbyconsolidatedsecuritizationentities............................ 201 —

Totaltradingandothersecurities—atestimatedfairvalue.......................... $18,589 $2,384

ActivelyTradedSecurities—atestimatedfairvalue................................ $ 463 $ 420

Shortsaleagreementliabilities—atestimatedfairvalue............................. (46) (106)

Netlong/shortposition—atestimatedfairvalue.................................. $ 417 $ 314

Investmentspledgedtosecureshortsaleagreementliabilities......................... $ 465 $ 496

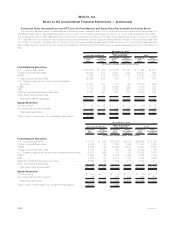

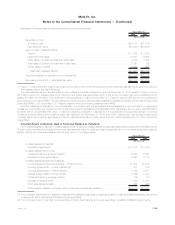

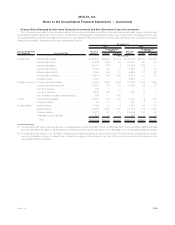

2010 2009 2008

Years Ended

December 31,

(In millions)

Actively Traded Securities:

Netinvestmentincome .............................................. $ 54 $ 98 $ (13)

Changesinestimatedfairvalueincludedinnetinvestmentincome .................. $ 12 $ 18 $ (2)

FVO general account securities:

Netinvestmentincome .............................................. $ 19 $ 18 $ (14)

Changesinestimatedfairvalueincludedinnetinvestmentincome .................. $ 18 $ 16 $ (17)

FVO contractholder-directed unit-linked investments:

Net investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $372 $284 $(166)

Changes in estimated fair value included in net investment income . . . . . . . . . . . . . . . . . . $322 $275 $(155)

FVO securities held by consolidated securitization entities:

Netinvestmentincome .............................................. $ 15 $ — $ —

Changesinestimatedfairvalueincludedinnetinvestmentgains(losses).............. $(78) $ — $ —

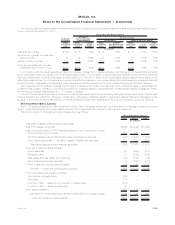

See Note 1 for discussion of FVO contractholder-directed unit-linked investments and “— Variable Interest Entities” for discussion of

CSEs included in the tables above. The FVO contractholder-directed unit-linked investments held as of December 31, 2010 were primarily

duetotheAcquisition(seeNote2).

F-50 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)