MetLife 2010 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

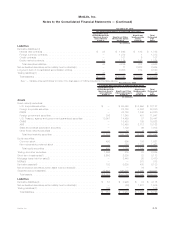

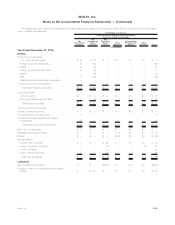

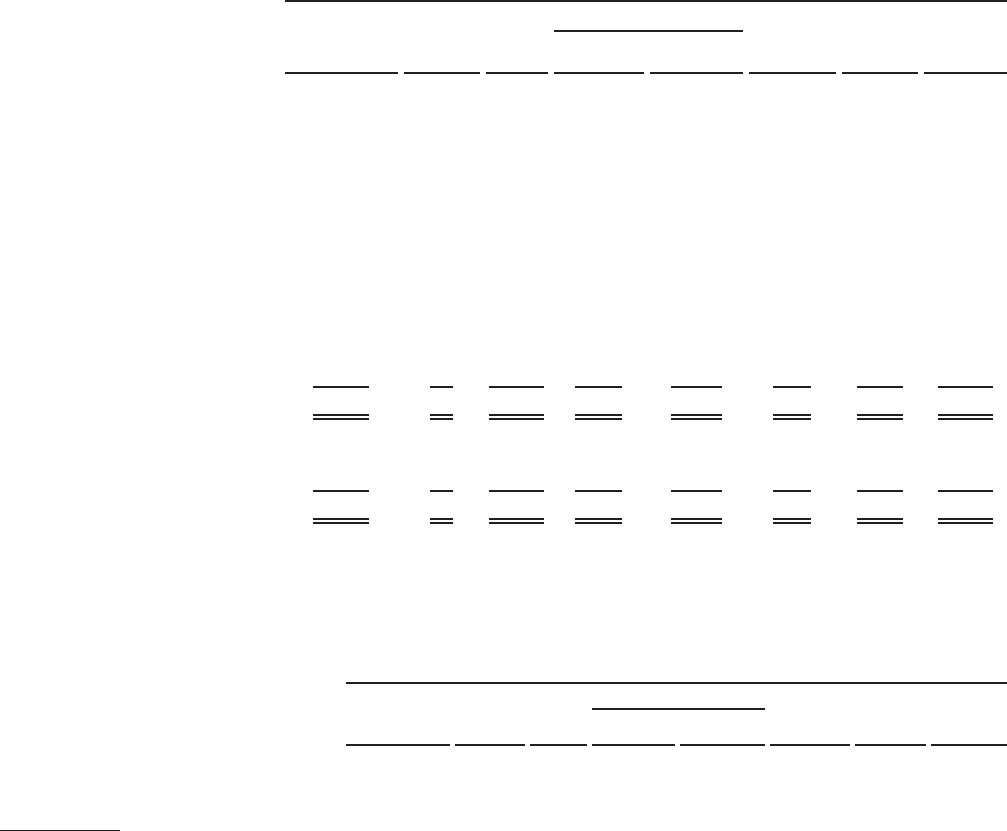

Balance,

December 31, 2007 Impact of

Adoption(11) Balance,

January 1, Earnings(1), (2)

Other

Comprehensive

Income (Loss)

Purchases,

Sales,

Issuances and

Settlements(3)

Transfer Into

and/or Out

of Level 3 (4) Balance,

December 31,

Total Realized/Unrealized

Gains (Losses) included in:

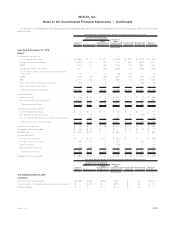

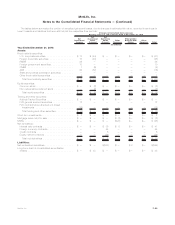

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

(In millions)

Year Ended December 31, 2008:

Assets:

Fixed maturity securities:

U.S. corporate securities . . . . . . . . . $ 8,368 $— $ 8,368 $ (696) $(1,758) $ 859 $ 725 $ 7,498

Foreign corporate securities . . . . . . . . 7,228 (8) 7,220 (12) (2,873) (57) 1,666 5,944

RMBS..................... 1,423 — 1,423 4 (218) (204) (410) 595

Foreign government securities . . . . . . 785 — 785 19 (101) (295) — 408

U.S. Treasury, agency and government

guaranteedsecurities .......... 80 — 80 — (1) 3 6 88

CMBS..................... 539 — 539 (72) (136) 2 (73) 260

ABS...................... 4,490 — 4,490 (125) (1,136) (740) (37) 2,452

State and political subdivision

securities ................. 124 — 124 — (8) 45 (38) 123

Other fixed maturity securities . . . . . . 289 — 289 1 (41) (209) — 40

Total fixed maturity securities . . . . . . $23,326 $ (8) $23,318 $ (881) $(6,272) $(596) $1,839 $17,408

Equity securities:

Commonstock ............... $ 183 $— $ 183 $ (2) $ (12) $ (46) $ (18) $ 105

Non-redeemable preferred stock . . . . . 2,188 — 2,188 (195) (466) (242) (11) 1,274

Total equity securities . . . . . . . . . . $ 2,371 $— $ 2,371 $ (197) $ (478) $(288) $ (29) $ 1,379

Tradingandothersecurities......... $ 183 $8 $ 191 $ (26) $ — $ 18 $ (8) $ 175

Short-terminvestments............ $ 179 $— $ 179 $ — $ — $ (79) $ — $ 100

Mortgageloansheld-for-sale ........ $ — $— $ — $ 4 $ — $171 $ 2 $ 177

MSRs(5),(6) .................. $ — $— $ — $ (149) $ — $340 $ — $ 191

Netderivatives(7) ............... $ 789 $(1) $ 788 $1,729 $ — $ 29 $ 1 $2,547

Separate account assets(8) . . . . . . . . . $ 1,464 $— $ 1,464 $ (129) $ — $ 90 $ 333 $ 1,758

Balance,

December 31, 2007 Impact of

Adoption(11) Balance,

January 1, Earnings(1), (2)

Other

Comprehensive

Income (Loss)

Purchases,

Sales,

Issuances and

Settlements(3)

Transfer Into

and/or Out

of Level 3(4) Balance,

December 31,

Total Realized/Unrealized

(Gains) Losses included in:

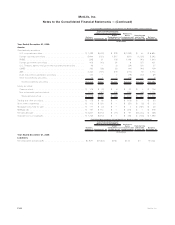

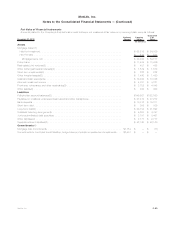

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

(In millions)

Year Ended December 31, 2008:

Liabilities:

Netembeddedderivatives(9) ................. $278 $(24) $254 $2,500 $81 $94 $— $2,929

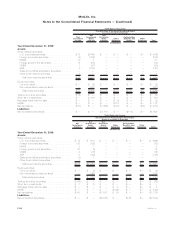

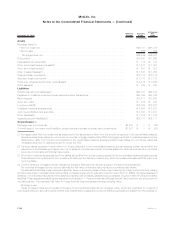

(1) Amortization of premium/discount is included within net investment income which is reported within the earnings caption of total gains

(losses). Impairments charged to earnings on securities and certain mortgage loans are included within net investment gains (losses)

which are reported within the earnings caption of total gains (losses); while changes in estimated fair value of certain mortgage loans and

MSRs are recorded in other revenues. Lapses associated with embedded derivatives are included with the earnings caption of total

gains (losses).

(2) Interest and dividend accruals, as well as cash interest coupons and dividends received, are excluded from the rollforward.

(3) The amount reported within purchases, sales, issuances and settlements is the purchase/issuance price (for purchases and issuances)

and the sales/settlement proceeds (for sales and settlements) based upon the actual date purchased/issued or sold/settled. Items

purchased/issued and sold/settled in the same period are excluded from the rollforward. For embedded derivatives, attributed fees are

included within this caption along with settlements, if any. Purchases, sales, issuances and settlements for the year ended Decem-

ber 31, 2010 include financial instruments acquired from ALICO as follows: fixed maturity securities $5,435 million, equity securities

$68 million, trading and other securities $582 million, short-term investments $216 million, net derivatives ($10) million, separate

account assets $244 million and net embedded derivatives ($116) million.

(4) Total gains and losses (in earnings and other comprehensive income (loss)) are calculated assuming transfers into and/or out of Level 3

occurred at the beginning of the period. Items transferred into and out in the same period are excluded from the rollforward.

(5) The additions and reductions (due to loan payments and sales) affecting MSRs were $330 million and ($179) million, respectively, for the

year ended December 31, 2010. The additions and reductions (due to loan payments) affecting MSRs were $628 million and

F-81MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)