MetLife 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The December 31, 2009 table reflects rating agency designations assigned by nationally recognized rating agencies including Moody’s,

S&P and Fitch.

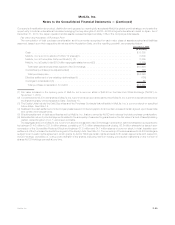

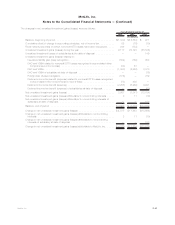

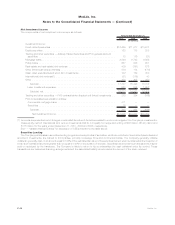

The NAIC rating distribution of the Company’s holdings of CMBS was as follows at:

2010 2009

December 31,

NAIC1................................................................. 93.7% 96.0%

NAIC2................................................................. 3.2% 2.8%

NAIC3................................................................. 1.8% 1.0%

NAIC4................................................................. 1.0% 0.1%

NAIC5................................................................. 0.3% 0.1%

NAIC6................................................................. —% —%

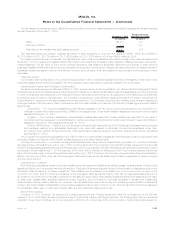

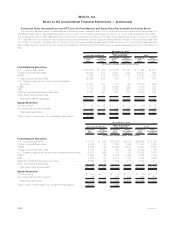

Concentrations of Credit Risk (Fixed Maturity Securities) — ABS. The Company’s holdings in ABS were $14.3 billion and $13.2 billion at

estimated fair value at December 31, 2010 and 2009, respectively. The Company’s ABS are diversified both by collateral type and by issuer.

The following table presents the collateral type and certain other information about ABS held by the Company at:

Estimated

Fair

Value %of

Total

Estimated

Fair

Value %of

Total

2010 2009

December 31,

(In millions)

By collateral type:

Creditcardloans ....................................... $ 6,027 42.2% $ 7,057 53.6%

Studentloans.......................................... 2,416 16.9 1,855 14.1

RMBSbackedbysub-primemortgageloans...................... 1,119 7.8 1,044 7.9

Automobileloans ....................................... 605 4.2 963 7.3

Otherloans........................................... 4,123 28.9 2,243 17.1

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14,290 100.0% $13,162 100.0%

PortionratedAaa/AAA ..................................... $10,411 72.9% $ 9,354 71.1%

PortionratedNAIC1....................................... $13,136 91.9% $11,573 87.9%

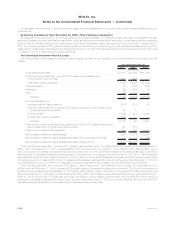

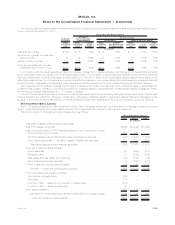

The Company had ABS supported by sub-prime mortgage loans with estimated fair values of $1,119 million and $1,044 million and

unrealized losses of $317 million and $593 million at December 31, 2010 and 2009, respectively. Approximately 54% of this portfolio was

rated Aa or better, of which 88% was in vintage year 2005 and prior at December 31, 2010. Approximately 61% of this portfolio was rated Aa or

better, of which 91% was in vintage year 2005 and prior at December 31, 2009. These older vintages from 2005 and prior benefit from better

underwriting, improved enhancement levels and higher residential property price appreciation. Approximately 66% and 73% of this portfolio

was rated NAIC 2 or better at December 31, 2010 and 2009, respectively.

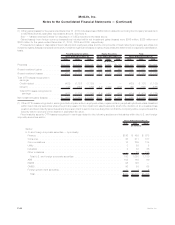

Concentrations of Credit Risk (Equity Securities). The Company was not exposed to any concentrations of credit risk in its equity

securities holdings of any single issuer greater than 10% of the Company’s equity or 1% of total investments at December 31, 2010 and 2009.

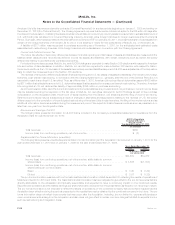

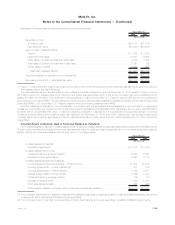

Maturities of Fixed Maturity Securities. The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity

date (excluding scheduled sinking funds), were as follows at:

Amortized

Cost

Estimated

Fair

Value Amortized

Cost

Estimated

Fair

Value

2010 2009

December 31,

(In millions)

Dueinoneyearorless............................... $ 8,593 $ 8,715 $ 6,845 $ 6,924

Due after one year through five years . . . . . . . . . . . . . . . . . . . . . . 65,378 67,040 38,408 39,399

Due after five years through ten years . . . . . . . . . . . . . . . . . . . . . 77,054 80,163 40,448 41,568

Dueaftertenyears ................................. 89,577 91,668 67,838 66,947

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 240,602 247,586 153,539 154,838

RMBS,CMBSandABS .............................. 79,406 79,698 76,170 72,804

Totalfixedmaturitysecurities.......................... $320,008 $327,284 $229,709 $227,642

Actual maturities may differ from contractual maturities due to the exercise of call or prepayment options. Fixed maturity securities not due

at a single maturity date have been included in the above table in the year of final contractual maturity. RMBS, CMBS and ABS are shown

separately in the table, as they are not due at a single maturity.

F-39MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)