MetLife 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

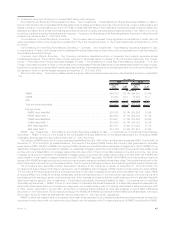

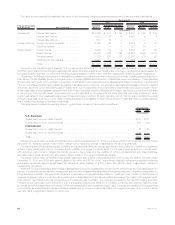

A rollforward of the fair value measurements for net embedded derivatives measured at estimated fair value on a recurring basis using

significantunobservable(Level3)inputsisasfollows:

Year Ended

December 31, 2010

(In millions)

Balance,atJanuary1, .................................................... $(1,455)

Total realized/unrealized gains (losses) included in:

Earnings .......................................................... (335)

Othercomprehensiveincome(loss)......................................... (226)

Purchases,sales,issuancesandsettlements.................................... (422)

Transferinand/oroutofLevel3 ............................................ —

Balance,atDecember31,.................................................. $(2,438)

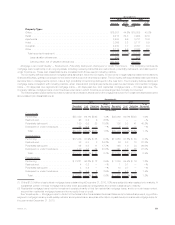

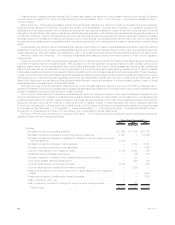

The valuation of guaranteed minimum benefits includes an adjustment for nonperformance risk. Included in net derivative gains (losses) for

the years ended December 31, 2010 and 2009 were gains (losses) of ($96) million and ($1,932) million, respectively, in connection with this

adjustment. These amounts are net of a loss of $955 million relating to a refinement for estimating nonperformance risk in fair value

measurements implemented at June 30, 2010. See “— Summary of Critical Accounting Estimates.”

See “— Summary of Critical Accounting Estimates — Embedded Derivatives” for further information on the estimates and assumptions

that affect the amounts reported above.

Off-Balance Sheet Arrangements

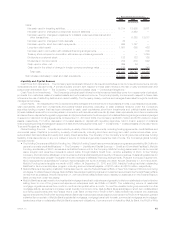

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business for the purpose of enhancing the

Company’s total return on its investment portfolio. The amounts of these unfunded commitments were $3.8 billion and $4.1 billion at

December 31, 2010 and 2009, respectively. The Company anticipates that these amounts will be invested in partnerships over the next five

years.

Mortgage Loan Commitments

The Company has issued interest rate lock commitments on certain residential mortgage loan applications totaling $2.5 billion and

$2.7 billion at December 31, 2010 and 2009, respectively. The Company intends to sell the majority of these originated residential mortgage

loans. Interest rate lock commitments to fund mortgage loans that will be held-for-sale are considered derivatives pursuant to the guidance on

derivatives and hedging, and their estimated fair value and notional amounts are included within interest rate forwards.

The Company also commits to lend funds under certain other mortgage loan commitments that will be held-for-investment in the normal

course of business for the purpose of enhancing the Company’s total return on its investment portfolio. The amounts of these mortgage loan

commitments were $3.8 billion and $2.2 billion at December 31, 2010 and 2009, respectively.

Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The Company commits to lend funds under bank credit facilities, bridge loans and private corporate bond investments in the normal

course of business for the purpose of enhancing the Company’s total return on its investment portfolio. The amounts of these unfunded

commitments were $2.4 billion and $1.3 billion at December 31, 2010 and 2009, respectively.

There are no other material obligations or liabilities arising from the commitments to fund partnership investments, mortgage loans, bank

credit facilities, and bridge loans and private corporate bond investment arrangements.

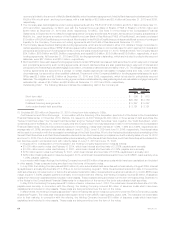

Lease Commitments

The Company, as lessee, has entered into various lease and sublease agreements for office space, information technology and other

equipment. The Company’s commitments under such lease agreements are included within the contractual obligations table. See “—

Liquidity and Capital Resources — The Company — Liquidity and Capital Uses — Contractual Obligations.”

Credit Facilities, Committed Facilities and Letters of Credit

The Company maintains committed and unsecured credit facilities and letters of credit with various financial institutions. See “— Liquidity

and Capital Resources — The Company — Liquidity and Capital Sources — Credit and Committed Facilities,” for further descriptions of

such arrangements.

Guarantees

See “Guarantees” in Note 16 of the Notes to the Consolidated Financial Statements.

Collateral for Securities Lending

The Company has no non-cash collateral for securities lending on deposit from customers, which cannot be sold or repledged, and which

has not been recorded on its consolidated balance sheets.

Insolvency Assessments

See Note 16 of the Notes to the Consolidated Financial Statements.

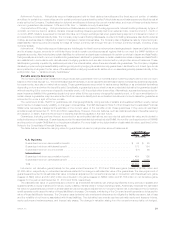

Policyholder Liabilities

The Company establishes, and carries as liabilities, actuarially determined amounts that are calculated to meet policy obligations when a

policy matures or is surrendered, an insured dies or becomes disabled or upon the occurrence of other covered events, or to provide for

future annuity payments. Amounts for actuarial liabilities are computed and reported in the consolidated financial statements in conformity

with GAAP. For more details on Policyholder Liabilities, see “— Summary of Critical Accounting Estimates.” Also see Notes 1 and 8 of the

Notes to the Consolidated Financial Statements for an analysis of certain policyholder liabilities at December 31, 2010 and 2009.

57MetLife, Inc.