MetLife 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

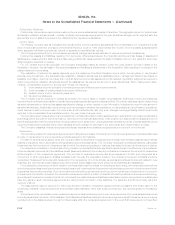

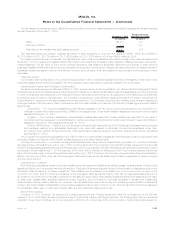

The fair values of business acquired, distribution agreements and customer relationships and the weighted average amortization periods

are as follows as of November 1, 2010:

November 1, 2010 Weighted Average

Amortization Period

(In millions) (In years)

VOBA.................................................. $9,210 8.2

VODAandVOCRA.......................................... 341 10.3

Totalvalueofamortizableintangibleassetsacquired.................... $9,551 8.6

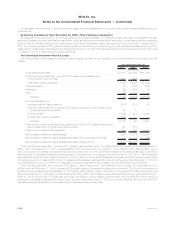

The estimated future amortization expense allocated to other expenses for the next five years for VOBA, VODA and VOCRA is

$1,312 million in 2011, $1,076 million in 2012, $884 million in 2013, $759 million in 2014 and $653 million in 2015.

For certain acquired blocks of business, the estimated fair value of acquired liabilities exceeded the initial policy reserves assumed at

November 1, 2010, resulting in a negative VOBA of $4.4 billion recorded at the Acquisition Date. Negative VOBA is recorded in other policy-

related balances. The fair value of the in-force contract obligations was based on actuarially determined projections for each block of

business. Negative VOBA is amortized over the policy period in proportion to premiums or the approximate consumption of losses included in

the liability usually expressed in terms of insurance in-force or account value. Such amortization is recorded as a contra-expense in other

expenses.

Trademark Assets

In connection with the Acquisition, the Company recognized $47 million in trademark assets recorded in other assets. The fair value of the

trademark assets will be recognized ratably over their expected useful lives which is generally between five to ten years.

Indemnification Assets and Contingent Consideration

The stock purchase agreement dated as of March 7, 2010, as amended by and among MetLife, Inc., AIG and ALICO Holdings (the “Stock

Purchase Agreement”) and related agreements include indemnification provisions that allocate the risk of losses arising out of contingencies

or other uncertainties that existed as of the Acquisition Date in accordance with the terms, and subject to the limitations and procedures,

provided by such provisions. As applicable, the Company recognizes anindemnificationassetatthesametimethatitrecognizesthe

indemnified item, measured on the same basis as the indemnified item. The Company recognized the following indemnification assets and

contingencies as of the Acquisition Date in accordance with the indemnification provisions of the Stock Purchase Agreement and related

agreements:

Investments — The Company established indemnification assets for the fair value of amounts expected to be recovered from

defaults of certain fixed maturity securities, CMBS and mortgage loans. These indemnification assets are included in other invested

assets at December 31, 2010.

Litigation — The Company established indemnification assets associated with certain settlements expected to be made in

connection with the suspension of withdrawals from certain unit-linked funds offered to certain policyholders. These indemnification

assets are included in other assets at December 31, 2010.

Section 338 Elections — MetLife, Inc. and American Life will be fully indemnified by ALICO Holdings for all taxes and any interest

and penalties resulting from anticipated elections to be made with respect to American Life and its subsidiaries under Sec-

tion 338(h)(10) and Section 338(g) of the Code. This indemnification asset is included in premiums, reinsurance and other receivables

at December 31, 2010.

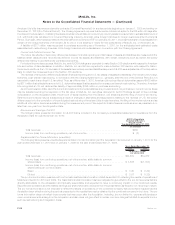

The Company recognized an aggregate amount of $574 million for indemnification assets as of the Acquisition Date in accordance with

the indemnification provisions of the Stock Purchase Agreement and related agreements.

Contingent Consideration — American Life has guaranteed that the fair value of a fund of assets backing certain U.K. unit-linked contracts

will have a value of at least £1 per unit on July 1, 2012. In accordance with the provisions of the Stock Purchase Agreement if the shortfall

between the aggregate guaranteed amount and the fair value of the fund exceeds £106 million AIG will pay the difference to American Life and

conversely, if the shortfall at July 1, 2012 is less than £106 million ALICO will pay the difference to AIG. The Company believes that the fair

value of the fund will equal or exceed the guaranteed amount by July 1, 2012. Therefore, the Company recognized a contingent consideration

liability in the amount of $88 million as of the Acquisition Date which was included as additional purchase consideration in determining the

amount paid for ALICO.

Indemnification Collateral

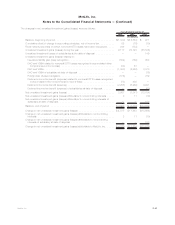

ALICO Holdings may satisfy certain of its indemnification and other payment obligations by delivering cash, shares of stock or Equity Units

issued by MetLife, Inc. in connection with the Acquisition. The Equity Units were deposited into an indemnification collateral account on the

Acquisition Date as security for these obligations. This collateral will be released periodically over a 30-month period on each of the

12-month, 24-month and 30-month anniversaries of the Acquisition Date as follows: Equity Units with an aggregate stated amount of

$1.0 billion (or such amount of net cash proceeds from the sale of Equity Units or other eligible collateral equal to such stated amount), less,

on each such release date, specified reserve amounts, including, but not limited to, amounts necessary to satisfy then outstanding

indemnification claims made by MetLife, Inc. However, if an AIG bankruptcy event occurs, any then remaining indemnification collateral will

remain in the indemnification collateral account and will be released in part on each of the 30-month, 36-month and 48-month anniversaries of

the Acquisition Date, less, on each such release date, any such specified reserved amounts.

Branch Restructuring

On March 4, 2010, American Life entered into a closing agreement (the “Closing Agreement”) with the Commissioner of the IRS with

respect to a U.S. withholding tax issue arising as a result of payments made by its foreign branches. The Closing Agreement provides that

American Life’s foreign branches will not be required to withhold U.S. income tax on the income portion of payments made pursuant to

F-31MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)