MetLife 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

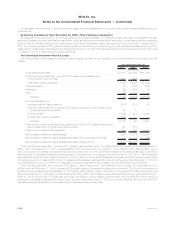

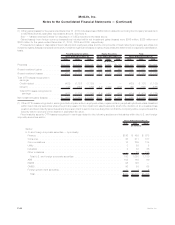

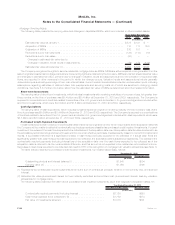

Net Investment Income

The components of net investment income were as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Investment income:

Fixedmaturitysecurities......................................... $12,489 $11,617 $13,577

Equitysecurities .............................................. 128 178 258

Trading and other securities — Actively Traded Securities and FVO general account

securities ................................................. 73 116 (27)

Mortgageloans............................................... 2,826 2,743 2,855

Policyloans................................................. 657 648 601

Realestateandrealestatejointventures .............................. 439 (197) 572

Otherlimitedpartnershipinterests................................... 879 174 (170)

Cash,cashequivalentsandshort-terminvestments ....................... 102 129 353

Internationaljointventures(1)...................................... (81) (115) 43

Other ..................................................... 235 205 350

Subtotal................................................. 17,747 15,498 18,412

Less:Investmentexpenses...................................... 930 945 1,957

Subtotal,net.............................................. 16,817 14,553 16,455

Trading and other securities — FVO contractholder-directed unit-linked investments . . 372 284 (166)

FVO consolidated securitization entities:

Commercialmortgageloans..................................... 411 — —

Securities................................................. 15 — —

Subtotal................................................. 798 284 (166)

Netinvestmentincome...................................... $17,615 $14,837 $16,289

(1) Amounts are presented net of changes in estimated fair value of derivatives related to economic hedges of the Company’s investment in

these equity method international joint venture investments that do not qualify for hedge accounting of $36 million, ($143) million and

$178 million for the years ended December 31, 2010, 2009 and 2008, respectively.

See “— Variable Interest Entities” for discussion of CSEs included in the table above.

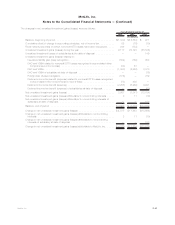

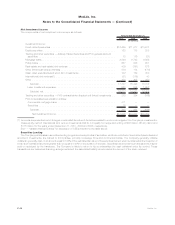

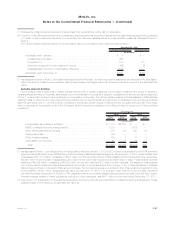

Securities Lending

The Company participates in securities lending programs whereby blocks of securities, which are included in fixed maturity securities and

short-term investments, are loaned to third parties, primarily brokerage firms and commercial banks. The Company generally obtains

collateral, generally cash, in an amount equal to 102% of the estimated fair value of the securities loaned, which is obtained at the inception of

a loan and maintained at a level greater than or equal to 100% for the duration of the loan. Securities loaned under such transactions may be

sold or repledged by the transferee. The Company is liable to return to its counterparties the cash collateral under its control. These

transactions are treated as financing arrangements and the associated liability is recorded at the amount of the cash received.

F-48 MetLife, Inc.

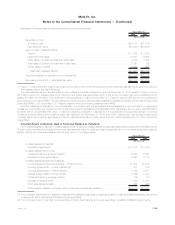

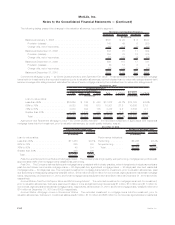

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)