MetLife 2010 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

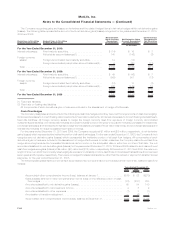

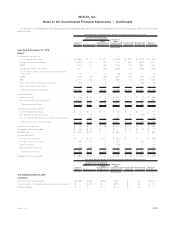

5. Fair Value

Considerable judgment is often required in interpreting market data to develop estimates of fair value and the use of different assumptions

or valuation methodologies may have a material effect on the estimated fair value amounts.

Assets and Liabilities Measured at Fair Value

Recurring Fair Value Measurements

The assets and liabilities measured at estimated fair value on a recurring basis, including those items for which the Company has elected

the FVO, were determined as described below. These estimated fair values and their corresponding placement in the fair value hierarchy are

summarized as follows:

Quoted Prices in

Active Markets for

Identical Assets

and Liabilities

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Estimated

Fair

Value

Fair Value Measurements at Reporting Date Using

December 31, 2010

(In millions)

Assets

Fixed maturity securities:

U.S.corporatesecurities............................. $ — $ 85,419 $ 7,149 $ 92,568

Foreigncorporatesecurities........................... — 62,401 5,777 68,178

RMBS......................................... 274 43,037 1,422 44,733

Foreigngovernmentsecurities ......................... 149 40,092 3,159 43,400

U.S. Treasury, agency and government guaranteed securities . . . . . 14,602 18,623 79 33,304

CMBS......................................... — 19,664 1,011 20,675

ABS .......................................... — 10,142 4,148 14,290

Stateandpoliticalsubdivisionsecurities................... — 10,083 46 10,129

Otherfixedmaturitysecurities ......................... — 3 4 7

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . 15,025 289,464 22,795 327,284

Equity securities:

Commonstock................................... 832 1,094 268 2,194

Non-redeemablepreferredstock........................ — 507 905 1,412

Totalequitysecurities ............................. 832 1,601 1,173 3,606

Trading and other securities:

ActivelyTradedSecurities ............................ — 453 10 463

FVOgeneralaccountsecurities ........................ — 54 77 131

FVO contractholder-directed unit-linked investments . . . . . . . . . . . 6,270 10,789 735 17,794

FVO securities held by consolidated securitization entities . . . . . . . — 201 — 201

Totaltradingandothersecurities ...................... 6,270 11,497 822 18,589

Short-terminvestments(1) ............................. 3,026 4,681 858 8,565

Mortgage loans:

Mortgage loans held by consolidated securitization entities . . . . . . . — 6,840 — 6,840

Mortgageloansheld-for-sale(2) ........................ — 2,486 24 2,510

Totalmortgageloans.............................. — 9,326 24 9,350

MSRs(3)......................................... — — 950 950

Otherinvestedassets—investmentfunds................... 373 121 — 494

Derivative assets:(4)

Interestratecontracts............................... 131 3,583 39 3,753

Foreigncurrencycontracts ........................... 2 1,711 74 1,787

Creditcontracts .................................. — 125 50 175

Equitymarketcontracts.............................. 23 1,757 282 2,062

Totalderivativeassets ............................. 156 7,176 445 7,777

Net embedded derivatives within asset host contracts(5) . . . . . . . . . — — 185 185

Separate account assets(6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,660 155,589 2,088 183,337

Totalassets ..................................... $51,342 $479,455 $29,340 $560,137

F-70 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)