MetLife 2010 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

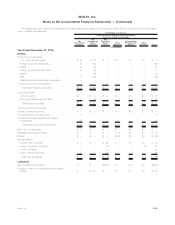

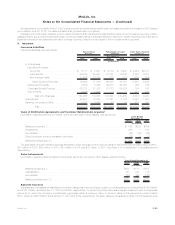

Net

Investment

Income

Net

Investment

Gains

(Losses)

Net

Derivative

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

Changes in Unrealized Gains (Losses)

Relating to Assets and Liabilities Held at December 31, 2009

(In millions)

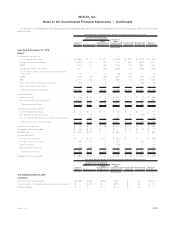

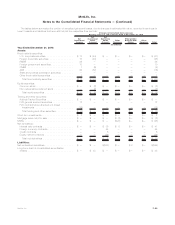

Year Ended December 31, 2009:

Assets:

Fixed maturity securities:

U.S. corporate securities . . . . . . . . . . . . . . . . $ 18 $(412) $ — $ — $ — $— $ (394)

Foreigncorporatesecurities .............. (3) (176) — — — — (179)

RMBS............................. 30 6 — — — — 36

Foreigngovernmentsecurities............. 11 — — — — — 11

CMBS ............................ 1 (61) — — — — (60)

ABS.............................. 8 (136) — — — — (128)

State and political subdivision securities . . . . . . — — — — — — —

Otherfixedmaturitysecurities ............. 1 — — — — — 1

Total fixed maturity securities . . . . . . . . . . . . $ 66 $(779) $ — $ — $ — $— $ (713)

Equity securities:

Commonstock....................... $— $ (1) $ — $ — $ — $— $ (1)

Non-redeemablepreferredstock ........... — (168) — — — — (168)

Total equity securities . . . . . . . . . . . . . . . . . $ — $(169) $ — $ — $ — $— $ (169)

Tradingandothersecurities................ $15 $ — $ — $ — $ — $— $ 15

Short-terminvestments................... $— $ 1 $ — $ — $ — $— $ 1

Mortgageloansheld-for-sale ............... $— $ — $ — $ (3) $ — $— $ (3)

MSRs .............................. $— $ — $ — $147 $ — $— $ 147

Netderivatives ........................ $(13) $ — $ (194) $ 5 $ — $(2) $ (204)

Liabilities:

Net embedded derivatives . . . . . . . . . . . . . . . . . $ — $ — $1,697 $ — $(114) $— $1,583

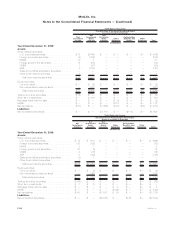

Net

Investment

Income

Net

Investment

Gains

(Losses)

Net

Derivative

Gains

(Losses) Other

Revenues

Policyholder

Benefits and

Claims Other

Expenses Total

Changes in Unrealized Gains (Losses)

Relating to Assets and Liabilities Held at December 31, 2008

(In millions)

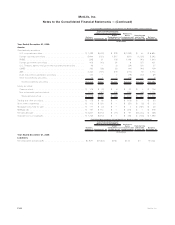

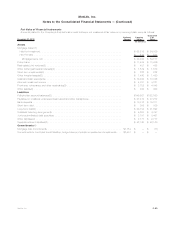

Year Ended December 31, 2008:

Assets:

Fixed maturity securities:

U.S. corporate securities . . . . . . . . . . . . . . . . $ 12 $(497) $ — $ — $ — $— $ (485)

Foreigncorporatesecurities.............. 117 (125) — — — — (8)

RMBS ............................ 4 — — — — — 4

Foreigngovernmentsecurities............. 23 — — — — — 23

CMBS............................ 4 (69) — — — — (65)

ABS ............................. 3 (102) — — — — (99)

State and political subdivision securities . . . . . . (1) — — — — — (1)

Otherfixedmaturitysecurities............. 1 — — — — — 1

Total fixed maturity securities . . . . . . . . . . . . $163 $(793) $ — $ — $ — $— $ (630)

Equity securities:

Commonstock ...................... $ — $ (1) $ — $ — $ — $— $ (1)

Non-redeemablepreferredstock........... — (163) — — — — (163)

Total equity securities . . . . . . . . . . . . . . . . . $ — $(164) $ — $ — $ — $— $ (164)

Tradingandothersecurities ............... $(17) $ — $ — $ — $ — $— $ (17)

Short-terminvestments .................. $ — $ — $ — $ — $ — $— $ —

Mortgageloansheld-for-sale............... $ — $ — $ — $ 3 $ — $— $ 3

MSRs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ — $(150) $ — $— $ (150)

Netderivatives........................ $114 $ — $1,504 $ 38 $ — $— $1,656

Liabilities:

Netembeddedderivatives................. $ — $ — $(2,779) $ — $182 $— $(2,597)

F-86 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)