MetLife 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

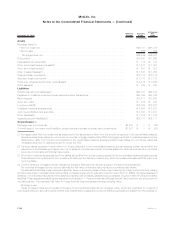

described in the section “— Recurring Fair Value Measurements,” the Company believes the value of those assets approximates the

estimated fair value of the related separate account liabilities.

Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond

Investments

The estimated fair values for mortgage loan commitments that will be held for investment and commitments to fund bank credit facilities,

bridge loans and private corporate bonds that will be held for investment reflected in the above tables represent the difference between the

discounted expected future cash flows using interest rates that incorporate current credit risk for similar instruments on the reporting date and

the principal amounts of the commitments.

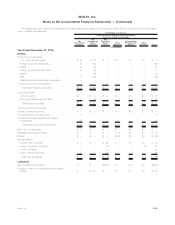

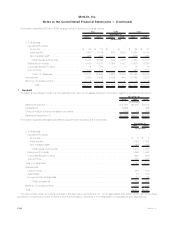

6. Deferred Policy Acquisition Costs and Value of Business Acquired

Information regarding DAC and VOBA is as follows:

DAC VOBA Total

(In millions)

Balance at January 1, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $14,260 $ 3,550 $17,810

Capitalizations.............................................. 3,092 — 3,092

Acquisitions ............................................... — (5) (5)

Subtotal................................................. 17,352 3,545 20,897

Amortization related to:

Netinvestmentgains(losses)................................... (489) (32) (521)

Otherexpenses............................................ (2,460) (508) (2,968)

Totalamortization ......................................... (2,949) (540) (3,489)

Unrealizedinvestmentgains(losses)................................ 2,753 599 3,352

Effectofforeigncurrencytranslationandother......................... (503) (113) (616)

Balance at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,653 3,491 20,144

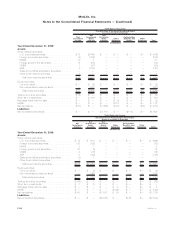

Capitalizations.............................................. 3,019 — 3,019

Subtotal................................................. 19,672 3,491 23,163

Amortization related to:

Netinvestmentgains(losses)................................... 625 87 712

Otherexpenses............................................ (1,754) (265) (2,019)

Totalamortization ......................................... (1,129) (178) (1,307)

Unrealizedinvestmentgains(losses)................................ (2,314) (505) (2,819)

Effectofforeigncurrencytranslationandother......................... 163 56 219

Balance at December 31, 2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,392 2,864 19,256

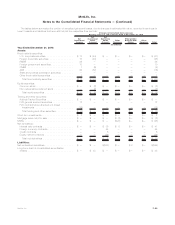

Capitalizations.............................................. 3,343 — 3,343

Acquisitions ............................................... — 9,210 9,210

Subtotal................................................. 19,735 12,074 31,809

Amortization related to:

Netinvestmentgains(losses)................................... (108) (16) (124)

Otherexpenses............................................ (2,247) (494) (2,741)

Totalamortization ......................................... (2,355) (510) (2,865)

Unrealizedinvestmentgains(losses)................................ (1,258) (125) (1,383)

Effectofforeigncurrencytranslationandother......................... 97 (351) (254)

Balance at December 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $16,219 $11,088 $27,307

See Note 2 for a description of acquisitions and dispositions.

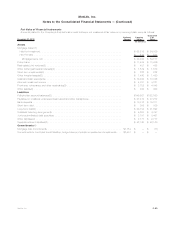

The estimated future amortization expense allocated to other expenses for the next five years for VOBA is $1,661 million in 2011,

$1,373 million in 2012, $1,128 million in 2013, $959 million in 2014 and $816 million in 2015.

Amortization of DAC and VOBA is attributed to both investment gains and losses and to other expenses for the amount of gross margins or

profits originating from transactions other than investment gains and losses. Unrealized investment gains and losses represent the amount of

DAC and VOBA that would have been amortized if such gains and losses had been recognized.

F-93MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)