MetLife 2010 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In connection with the collateral financing arrangement, the Holding Company entered into an agreement with the same unaffiliated

financial institution under which the Holding Company is entitled to the return on the investment portfolio held by the trusts established in

connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial

institution of 3-month LIBOR plus 0.70%, payable quarterly. The collateral financing agreement may be extended by agreement of the Holding

Company and the unaffiliated financial institution on each anniversary of the closing. The Holding Company may also be required to make

payments to the unaffiliated financial institution, for deposit into the trusts, related to any decline in the estimated fair value of the assets held

by the trusts, as well as amounts outstanding upon maturity or early termination of the collateral financing arrangement. During 2010, no

payments were made or received by the Holding Company. During 2009 and 2008, the Holding Company contributed $360 million and

$320 million, respectively, as a result of declines in the estimated fair value of the assets in the trusts. Cumulatively, since May 2007, the

Holding Company has contributed a total of $680 million as a result of declines in the estimated fair value of the assets in the trusts, all of which

was deposited into the trusts.

In addition, the Holding Company may be required to pledge collateral to the unaffiliated financial institution under this agreement. At

December 31, 2010 and 2009, the Holding Company had pledged $63 million and $80 million, respectively, under the agreement.

Transaction costs associated with the collateral financing arrangement of $5 million have been capitalized, are included in other assets,

and are being amortized over the period from May 2007, the date the Holding Company entered into the collateral financing arrangement, to

its expiration. Total interest expense related to the collateral financing arrangement was $30 million, $44 million and $107 million for the years

ended December 31, 2010, 2009 and 2008, respectively.

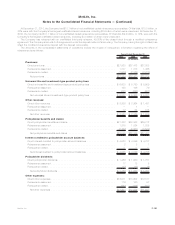

13. Junior Subordinated Debt Securities

Outstanding Junior Subordinated Debt Securities

Outstanding junior subordinated debt securities and trust securities which MetLife, Inc. will exchange for junior subordinated debt

securities prior to redemption or repayment were as follows:

Issuer Issue Date Face

Value Interest

Rate(2) Scheduled

Redemption Date

Interest Rate

Subsequent to

Scheduled

Redemption

Date(3) Final

Maturity 2010 2009

Carrying Value

at December 31,

(In millions) (In millions)

MetLife,Inc. ............. July2009 $ 500 10.750%August2039 LIBOR + 7.548% August 2069 $ 500 $ 500

MetLifeCapitalTrustX(1)...... April2008 $ 750 9.250% April 2038 LIBOR + 5.540% April 2068 750 750

MetLife Capital Trust IV(1) . . . . . December 2007 $ 700 7.875% December 2037 LIBOR + 3.960% December 2067 694 694

MetLife,Inc. ............. December 2006 $1,250 6.400% December 2036 LIBOR + 2.205% December 2066 1,247 1,247

$3,191 $3,191

(1) MetLife Capital Trust X and MetLife Capital Trust IV are VIEs which are consolidated in the financial statements of the Company. The

securities issued by these entities are exchangeable surplus trust securities, which will be exchanged for a like amount of the Holding

Company’s junior subordinated debt securities on the scheduled redemption date; mandatorily under certain circumstances, and at any

time upon the Holding Company exercising its option to redeem the securities. The exchangeable surplus trust securities are classified as

junior subordinated debt securities for purposes of financial statement presentation.

(2) Prior to the scheduled redemption date, interest is payable semiannually in arrears.

(3) In the event the securities are not redeemed on or before the scheduled redemption date, interest will accrue after such date at an annual

rate of 3-month LIBOR plus a margin, payable quarterly in arrears.

In connection with each of the securities described above, the Holding Company may redeem or may cause the redemption of the

securities (i) in whole or in part, at any time on or after the date five years prior to the scheduled redemption date at their principal amount plus

accrued and unpaid interest to, but excluding, the date of redemption, or (ii) in certain circumstances, in whole or in part, prior to the date five

years prior to the scheduled redemption date at their principal amount plus accrued and unpaid interest to, but excluding, the date of

redemption or, if greater, a make-whole price. The Holding Company also has the right to, and in certain circumstances the requirement to,

defer interest payments on the securities for a period up to ten years. Interest compounds during such periods of deferral. If interest is

deferred for more than five consecutive years, the Holding Company is required to use proceeds from the sale of its common stock or

warrants on common stock to satisfy interest payment obligation. In connection with each of the securities described above, the Holding

Company entered into a replacement capital covenant (“RCC”). As part of the RCC, the Holding Company agreed that it will not repay,

redeem, or purchase the securities on or before a date ten years prior to the final maturity date of each issuance, unless, subject to certain

limitations, it has received proceeds during a specified period from the sale of specified replacement securities. The RCC will terminate upon

the occurrence of certain events, including an acceleration of the securities due to the occurrence of an event of default. The RCC is not

intended for the benefit of holders of the securities and may not be enforced by them. The RCC is for the benefit of holders of one or more

other designated series of the Holding Company’s indebtedness (which will initially be its 5.70% senior notes due June 2035). The Holding

Company also entered into a replacement capital obligation which will commence during the six month period prior to the scheduled

redemption date and under which the Holding Company must use reasonable commercial efforts to raise replacement capital to permit

repayment of the securities through the issuance of certain qualifying capital securities.

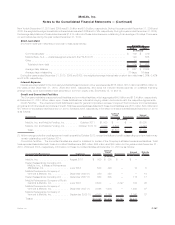

Issuance costs associated with the issuance of the securities of $5 million and $8 million were incurred during the years ended

December 31, 2009 and 2008, respectively. These issuance costs have been capitalized, are included in other assets, and are amortized

over the period from the issuance date until the scheduled redemption date of the respective issuances. Interest expense on outstanding

F-109MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)