MetLife 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

MetLife, Inc. 2010

Table of contents

-

Page 1

ANNUAL REPORT MetLife, Inc. 2010 -

Page 2

...business benefited from growth in our group life and dental businesses - two product lines in which MetLife is a leader. We also made further progress on our efforts to help consumers address their life insurance protection needs by making it easier for the underserved middle market to purchase term... -

Page 3

... with managing their pension liabilities. • MetLife's Auto & Home business, which is one of the largest providers of group auto and home insurance, continued to deliver strong performance in 2010. Sales of new policies increased 11% for our homeowners business and 4% for our auto business compared... -

Page 4

... Accountants on Accounting and Financial Disclosure Management's Annual Report on Internal Control Over Financial Reporting ...Attestation Report of the Company's Registered Public Accounting Firm ...Financial Statements ...Board of Directors ...Executive Officers ...Contact Information ...Corporate... -

Page 5

... policy acquisition costs, deferred sales inducements, value of business acquired or goodwill; (27) increased expenses relating to pension and postretirement benefit plans, as well as health care and other employee benefits; (28) exposure to losses related to variable annuity guarantee benefits... -

Page 6

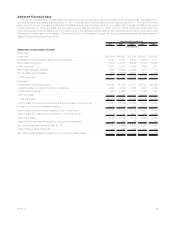

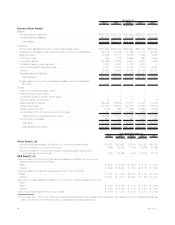

...,052 Universal life and investment-type product policy fees ...6,037 5,203 5,381 5,238 4,711 Net investment income ...Other revenues ...Net investment gains (losses) ...Net derivative gains (losses) ...Total revenues ...Expenses: Policyholder benefits and claims ...Interest credited to policyholder... -

Page 7

...(1) Assets: General account assets(2) ...Separate account assets ...Total assets ...Liabilities: Policyholder liabilities and other policy-related balances(3) ...Payables for collateral under securities loaned and other transactions Bank deposits ...Short-term debt ...Long-term debt(2) ...Collateral... -

Page 8

... profitability. U.S. Business provides a variety of insurance and financial services products - including life, dental, disability, auto and homeowner insurance, guaranteed interest and stable value products, and annuities - through both proprietary and independent retail distribution channels... -

Page 9

... Japan, Latin America, Asia Pacific, Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance, retail banking and other financial services to individuals, as well as group insurance and retirement & savings products... -

Page 10

... earnings was an increase in net guaranteed annuity benefit costs and a charge related to our closed block of business, a specific group of participating life policies that were segregated in connection with the demutualization of Metropolitan Life Insurance Company ("MLIC"). The favorable impact of... -

Page 11

...as well as the global financial markets, continue to impact our net investment income, our net investment and net derivative gains (losses), and the demand for and the cost and profitability of certain of our products, including variable annuities and guarantee benefits. See "- Results of Operations... -

Page 12

... of insured depository institutions (such as MetLife Bank) to engage in proprietary trading or sponsor or invest in hedge funds or private equity funds. See "Risk Factors - Various Aspects of Dodd-Frank Could Impact Our Business Operations, Capital Requirements and Profitability and Limit Our Growth... -

Page 13

... operations. Estimated Fair Value of Investments The Company's investments in fixed maturity and equity securities, investments in trading and other securities, certain short-term investments, most mortgage loans held-for-sale, and MSRs are reported at their estimated fair value. In determining the... -

Page 14

... by the Company. The estimated fair value of MSRs is principally determined through the use of internal discounted cash flow models which utilize various assumptions. Valuation inputs and assumptions include generally observable items such as type and age of loan, loan interest rates, current market... -

Page 15

...the Company uses credit derivatives, such as credit default swaps, to synthetically replicate investment risks and returns which are not readily available in the cash market. The estimated fair value of derivatives is determined through the use of quoted market prices for exchange-traded derivatives... -

Page 16

... Statements describes the Company's accounting policy relating to DAC and VOBA amortization for various types of contracts. Separate account rates of return on variable universal life contracts and variable deferred annuity contracts affect in-force account balances on such contracts each reporting... -

Page 17

... gross profits decreased as a result of increased investment losses from the portfolios associated with the hedging of guaranteed insurance obligations on variable annuities, resulting in a decrease of DAC and VOBA amortization of $141 million. • Changes in net investment gains (losses) resulted... -

Page 18

... of economic capital required to support the mix of business, long-term growth rates, comparative market multiples, the account value of in-force business, projections of new and renewal business, as well as margins on such business, the level of interest rates, credit spreads, equity market levels... -

Page 19

... sheet date using enacted tax rates expected to apply to taxable income in the years the temporary differences are expected to reverse. For U.S. federal income tax purposes, the Company anticipates making an election under the Internal Revenue Code Section 338 as it relates to the Acquisition. As... -

Page 20

...,712 common shares at $43.25 per share was $6.4 billion, of which MetLife received $3.0 billion. Concurrent with the common stock offerings, ALICO Holdings sold 40,000,000 common equity units of MetLife, Inc., which it received from MetLife in connection with the Acquisition. The Company used all of... -

Page 21

... 31, 2010 2009 (In millions) Change % Change Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Net derivative gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims and... -

Page 22

... equity markets, counterparty specific factors such as financial performance, credit rating and collateral valuation, and internal factors such as portfolio rebalancing, that can generate gains and losses. As an investor in the fixed income, equity security, mortgage loan and certain other invested... -

Page 23

... common shareholders Year Ended December 31, 2010 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home International (In millions) Banking, Corporate & Other Total Income (loss) from continuing operations, net of income tax ...Less: Net investment gains (losses) ...Less: Net... -

Page 24

Year Ended December 31, 2009 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home (In millions) International Banking, Corporate & Other Total Total revenues ...Less: Net investment gains (losses) ...Less: Net derivative gains (losses) ...Less: Adjustments related to net ... -

Page 25

... Insurance Products Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends... -

Page 26

...Retirement Products Years Ended December 31, 2010 2009 Change % Change (In millions) Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends... -

Page 27

... growth in our fixed annuity policyholder account balances. Corporate Benefit Funding Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating... -

Page 28

... by $20 million. Auto & Home Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...$2,923 Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends ...Capitalization of DAC ...Amortization... -

Page 29

...free interest income representing a larger portion of pre-tax income. International Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...$4,447 Universal life and investment-type product policy fees ...1,329 Net investment income ...Other revenues ...Total... -

Page 30

... and business expenses in India. Banking, Corporate & Other Years Ended December 31, 2010 2009 (In millions) Change % Change Operating Revenues Premiums ...$ 11 Net investment income ...992 Other revenues ...1,044 Total operating revenues ...Operating Expenses Policyholder benefits and dividends... -

Page 31

... market and healthy growth in the reverse mortgage arena. Years Ended December 31, 2009 2008 (In millions) Change % Change Revenues Premiums ...Universal life and investment-type product policy Net investment income ...Other revenues ...Net investment gains (losses) ...Net derivative gains (losses... -

Page 32

... specific factors such as financial performance, credit rating and collateral valuation, and internal factors such as portfolio rebalancing that can generate gains and losses. As an investor in the fixed income, equity security, mortgage loan and certain other invested asset classes, we are... -

Page 33

... common shareholders Year Ended December 31, 2009 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home (In millions) International Banking, Corporate & Other Total Income (loss) from continuing operations, net of income tax ...Less: Net investment gains (losses) ...Less: Net... -

Page 34

... Year Ended December 31, 2009 Insurance Products Retirement Products Corporate Benefit Funding Auto & Home (In millions) International Banking, Corporate & Other Total Total revenues ...Less: Net investment gains (losses) ...Less: Net derivative gains (losses) ...Less: Adjustments related to net... -

Page 35

... mortgage platform acquisitions in late 2008 benefited Banking, Corporate & Other's 2009 results. Insurance Products Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...$ Universal life and investment-type product policy fees ...Net investment income... -

Page 36

...Retirement Products Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends... -

Page 37

...in the current year versus prior year. Corporate Benefit Funding Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating... -

Page 38

... and revenue enhancement initiative. Auto & Home Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends ...Capitalization of... -

Page 39

.... International Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Total operating revenues ...Operating Expenses Policyholder benefits and dividends... -

Page 40

...due to business growth. Banking, Corporate & Other Years Ended December 31, 2009 2008 (In millions) Change % Change Operating Revenues Premiums ...$ 19 Net investment income ...477 Other revenues ...1,092 Total operating revenues ...Operating Expenses Policyholder benefits and dividends ...Interest... -

Page 41

... non-guaranteed elements of its products, such as the resetting of credited interest and dividend rates for policies that permit such adjustments. The Company also uses certain derivative instruments in the management of credit, interest rate, currency and equity market risks. Current Environment... -

Page 42

... 2010 had a positive impact on returns and net investment income on private equity funds, hedge funds and real estate funds, which are included within other limited partnership interests and real estate and real estate joint venture portfolios. Although the disruption in the global financial markets... -

Page 43

... also exclude investment income recognized on mortgage loans and securities held by CSEs and, effective October 1, 2010, contractholder-directed unit-linked investments. (2) Fixed maturity securities include $594 million, $2,384 million and $946 million at estimated fair value of trading and other... -

Page 44

...Total - With all Trading and Other Securities and CSEs Trading and Other Securities (included within Fixed Maturity Securities): Ending carrying value ...Investment income ...Investment gains (losses) ...Mortgage Loans: Ending carrying value ...Investment income ...Investment gains (losses) ...Cash... -

Page 45

...value. The estimated fair value of publicly-traded fixed maturity, equity and trading and other securities, as well as short-term securities is determined by management after considering one of three primary sources of information: quoted market prices in active markets, independent pricing services... -

Page 46

...foreign government fixed maturity securities, residential mortgage-backed securities ("RMBS"), principally to-be-announced securities, exchange-traded common stock and mutual fund interests, registered mutual fund interests priced using daily net asset value provided by fund managers included within... -

Page 47

... fair value pricing sources and fair value hierarchy are as follows: December 31, 2010 Fixed Maturity Equity Securities Securities (In millions) Level 1: Quoted prices in active markets for identical assets ...Level 2: Independent pricing source ...Internal matrix pricing or discounted cash flow... -

Page 48

...the year ended December 31, 2010, fixed maturity securities transfers into Level 3 of $1,736 million resulted primarily from current market conditions characterized by a lack of trading activity, decreased liquidity and credit ratings downgrades (e.g., from investment grade to below investment grade... -

Page 49

... of at December 31, 2010 and 2009: Fixed Maturity Securities - by Sector & Credit Quality Rating at December 31, 2010 NAIC Rating Rating Agency Designation: 1 Aaa/Aa/A 2 Baa 3 Ba 4 B 5 Caa and Lower 6 In or Near Default Total Estimated Fair Value (In millions) U.S. corporate securities ...Foreign... -

Page 50

... of OTTI loss, and estimated fair value of fixed maturity and equity securities on a sector basis, and selected information about certain fixed maturity securities held by the Company that were below investment grade or non-rated, non-income producing, credit enhanced by financial guarantor insurers... -

Page 51

... Available-for-Sale - Concentrations of Credit Risk (Fixed Maturity Securities) - ABS" in Note 3 of the Notes to the Consolidated Financial Statements for tables that present the Company's holdings of ABS supported by sub-prime mortgage loans by rating agency designation and by vintage year and by... -

Page 52

...in value of non-redeemable preferred stock with a severe or an extended unrealized loss. The Company also considered whether any non-redeemable preferred stock with an unrealized loss held by the Company, regardless of credit rating, have deferred any dividend payments. No such dividend payments had... -

Page 53

...which are included in fixed maturity securities and short-term investments, are loaned to third parties, primarily brokerage firms and commercial banks. The Company generally obtains collateral, generally cash, in an amount equal to 102% of the estimated fair value of the loaned securities, which is... -

Page 54

... unit-linked variable annuity type liabilities which do not qualify for presentation as separate account summary total assets and liabilities. These investments are primarily mutual funds, and to a lesser extent, fixed maturity and equity securities, short-term investments and cash and cash... -

Page 55

... securities acquired from ALICO of $582 million. See "- Summary of Critical Accounting Estimates" for further information on the estimates and assumptions that affect the amounts reported above. Mortgage Loans The Company's mortgage loans are principally collateralized by commercial real estate... -

Page 56

... lien residential mortgage loans and home equity lines of credit. See "Investments - Mortgage Loans" in Note 3 of the Notes to the Consolidated Financial Statements for tables that present, by portfolio segment, mortgage loans by credit quality indicator and impaired loans, as well as information on... -

Page 57

... Such changes in the valuation allowance are recorded in net investment gains (losses). See "Investments - Mortgage Loans" in Note 3 of the Notes to the Consolidated Financial Statements for a table that presents the activity in the Company's valuation allowances, by portfolio segment, for the years... -

Page 58

... value of other limited partnership interests (which primarily represent ownership interests in pooled investment funds that principally make private equity investments in companies in the U.S. and overseas) was $6.4 billion and $5.5 billion, or 1.3% and 1.6% of total cash and invested assets... -

Page 59

... ...Other comprehensive income (loss) ...Purchases, sales, issuances and settlements ...Transfer in and/or out of Level 3 ...Balance, at December 31, ... $356 (5) (81) (75) (22) $173 See "- Summary of Critical Accounting Estimates - Derivative Financial Instruments" for further information on the... -

Page 60

... business for the purpose of enhancing the Company's total return on its investment portfolio. The amounts of these mortgage loan commitments were $3.8 billion and $2.2 billion at December 31, 2010 and 2009, respectively. Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate... -

Page 61

... life policies, the fixed account of variable life insurance policies, specialized life insurance products for benefit programs and general account universal life policies. Policyholder account balances are credited interest at a rate set by the Company, which are influenced by current market rates... -

Page 62

... unit-linked-type funds are impacted by changes in the fair value of the associated underlying investments, as the return on assets is generally passed directly to the policyholder. See "- Variable Annuity Guarantees." Variable Annuity Guarantees The Company issues certain variable annuity products... -

Page 63

...International: Guaranteed minimum death benefit ...Guaranteed minimum income benefit ...Total ...66 116 $856 23 - $554 $167 507 $137 394 Included in policyholder benefits and claims for the year ended December 31, 2010 is a charge of $302 million and for the year ended December 31, 2009 is a credit... -

Page 64

...many of its products, including general account institutional pension products (generally group annuities, including funding agreements, and certain deposit fund liabilities) sold to employee benefit plan sponsors. Certain of these provisions prevent the customer from making withdrawals prior to the... -

Page 65

... activities ...Net cash provided by changes in policyholder account balances ...Net cash provided by changes in payables for collateral under securities loaned and other transactions ...Net cash provided by changes in bank deposits ...Net cash provided by short-term debt issuances ...Long-term... -

Page 66

... a month. To meet the variable funding requirements from this mortgage activity, as well as to increase overall liquidity from time to time, MetLife Bank takes advantage of short-term collateralized borrowing opportunities with the Federal Home Loan Bank of New York ("FHLB of NY"). MetLife Bank has... -

Page 67

... Insurance Company and General American Life Insurance Company, subsidiaries of MetLife, Inc., each became a member of the Federal Home Loan Bank of Des Moines ("FHLB of Des Moines"), and each purchased $10 million of FHLB of Des Moines common stock. Membership in the FHLB of Des Moines provides... -

Page 68

... Holding Company is entitled to the return on the investment portfolio held by trusts established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial institution of 3-month LIBOR plus 0.70%, payable quarterly... -

Page 69

...agreed-upon minimum holding periods. See "- The Company - Liquidity and Capital Sources - Equity Units." In August 2010, the Holding Company issued 86,250,000 new shares of its common stock at a price of $42.00 per share for gross proceeds of $3,623 million. In connection with the offering of common... -

Page 70

... of business. During the years ended December 31, 2010 and 2009, general account surrenders and withdrawals from annuity products were $3.8 billion and $4.3 billion, respectively. In the Corporate Benefit Funding segment, which includes pension closeouts, bank owned life insurance and other fixed... -

Page 71

..., its financial strength and credit ratings, general market conditions and the price of MetLife, Inc.'s common stock compared to management's assessment of the stock's underlying value and applicable regulatory, legal and accounting factors. Whether or not to purchase any common stock and the... -

Page 72

... contracts, guaranteed interest contracts associated with formal offering programs, funding agreements, individual and group annuities, total control accounts, individual and group universal life, variable universal life and company-owned life insurance. Included within policyholder account balances... -

Page 73

... interest payments. Liquid deposits, including demand deposit accounts, money market accounts and savings accounts, are assumed to mature at carrying value within one year. Certificates of deposit are assumed to pay all interest and principal at maturity. Short-term debt, long-term debt, collateral... -

Page 74

... herein and those otherwise provided for in the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer... -

Page 75

...profile and capital structure. A disruption in the financial markets could limit the Holding Company's access to liquidity. The Holding Company's ability to maintain regular access to competitively priced wholesale funds is fostered by its current credit ratings from the major credit rating agencies... -

Page 76

... dividend payments to the parent to a portion of the prior year's statutory income, as determined by the local accounting principles. The regulators of the non-U.S. operations, including the Japan branch of American Life, may also limit or not permit profit repatriations or other transfers of funds... -

Page 77

... the Holding Company to make payments on debt, make cash dividend payments on its preferred, convertible preferred and common stock, contribute capital to its subsidiaries, pay all general operating expenses and meet its cash needs. Acquisitions. For information regarding the purchase price of the... -

Page 78

... term life insurance issued by MLIC. In December 2009, the Holding Company, in connection with MetLife Reinsurance Company of Vermont ("MRV")'s reinsurance of certain universal life and term life insurance risks, committed to the Vermont Department of Banking, Insurance, Securities and Health Care... -

Page 79

... to certain investment type contracts, and net embedded derivatives on variable annuities with guaranteed minimum benefits which have the same type of interest rate exposure (medium- and long-term interest rates) as fixed maturity securities. The Company employs product design, pricing and ALM... -

Page 80

...The lines of business are responsible for establishing limits and managing any foreign exchange rate exposure caused by the sale or issuance of insurance products. MetLife uses foreign currency swaps and forwards to hedge its foreign currency denominated fixed income investments, its equity exposure... -

Page 81

... to Living Guarantee Benefits - The Company uses a wide range of derivative contracts to hedge the risk associated with variable annuity living guarantee benefits. These hedges include equity and interest rate futures, interest rate swaps, currency futures/ forwards, equity indexed options and... -

Page 82

...13) - $(6,848) Mortgage loans, net ...Policy loans ...Real estate joint ventures(1) ...Other limited partnership interests(1) ...Short-term investments ...Other invested assets: Mortgage servicing rights ...Other ...Cash and cash equivalents ...Accrued investment income ...Premiums, reinsurance and... -

Page 83

...use of derivatives employed by the Company ($445 million), an increase in the duration of the investment portfolio ($389 million), and an increase in premiums, reinsurance and other receivables ($120 million). This increase in risk was partially offset by a decrease in interest rates across the long... -

Page 84

..., net ...Policy loans ...Short-term investments ...Other invested assets: Mortgage servicing rights ...Other ...Cash and cash equivalents ...Accrued investment income ...Premiums, reinsurance and other receivables Total Assets ...Liabilities: Policyholder account balances ...Bank deposits ...Long... -

Page 85

...change in equity at December 31, 2010 by type of asset or liability: December 31, 2010 Assuming a Estimated 10% Decrease Fair in Equity Value(1) Prices (In millions) Notional Amount Assets: Equity securities ...Other invested assets: Net embedded derivatives within asset host contracts(2) ...Total... -

Page 86

... to perform an assessment of ALICO's internal control over financial reporting in time for this current year-end. Management expects to complete the process of integrating ALICO's internal control over financial reporting over the course of 2011. The ALICO acquisition represents a material change in... -

Page 87

...into the Company's financial reporting systems and, as such, the Company did not have the practical ability to perform an assessment of ALICO's internal control over financial reporting in time for this current year-end. ALICO represents 17% of total assets and 2% of total revenues of the Company as... -

Page 88

...Financial Statements Page Report of Independent Registered Public Accounting Firm ...Financial Statements at December 31, 2010 and 2009 and for the Years Ended December 31, 2010, 2009, and 2008: Consolidated Balance Sheets ...Consolidated Statements of Operations ...Consolidated Statements of Equity... -

Page 89

(This page intentionally left blank) -

Page 90

... the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of December 31, 2010, based on the criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the... -

Page 91

...Equity Liabilities Future policy benefits ...Policyholder account balances ...Other policy-related balances ...Policyholder dividends payable ...Policyholder dividend obligation ...Payables for collateral under securities loaned and other transactions ...Bank deposits ...Short-term debt ...Long-term... -

Page 92

...For the Years Ended December 31, 2010, 2009 and 2008 (In millions, except per share data) 2010 2009 2008 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses): Other-than-temporary impairments on fixed... -

Page 93

... issued shares related to business acquisition ...Issuance of stock purchase contracts related to common equity units ...Stock-based compensation ...Dividends on preferred stock ...Dividends on common stock ...Change in equity of noncontrolling interests . . Comprehensive income (loss): Net income... -

Page 94

... Comprehensive Income (Loss) MetLife, Inc. Preferred Common Stock Stock Total Defined Foreign Net MetLife, Inc.'s Benefit Currency Other-ThanUnrealized Treasury Additional Stockholders' Noncontrolling Plans Translation Temporary Investment Stock Paid-in Retained Equity Interests Capital Earnings... -

Page 95

... Other Comprehensive Income (Loss) F-6 Preferred Common Stock Stock Net Foreign Defined Total Noncontrolling Interests Treasury Unrealized Additional Currency Benefit MetLife, Inc.'s Stock Paid-in Retained Investment Translation Plans Stockholders' Discontinued Continuing Capital Earnings at... -

Page 96

... ...Interest credited to bank deposits ...Universal life and investment-type product policy fees ...Change in trading and other securities ...Change in residential mortgage loans held-for-sale, net ...Change in mortgage servicing rights ...Change in accrued investment income ...Change in premiums... -

Page 97

...) 2010 2009 2008 Cash flows from financing activities Policyholder account balances: Deposits ...Withdrawals ...Net change in payables for collateral under securities loaned and other transactions ...Net change in bank deposits ...Net change in short-term debt ...Long-term debt issued ...Long-term... -

Page 98

... and Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and homeowners insurance, mortgage and deposit products and other financial services to individuals, as well as group insurance and retirement & savings products and services to... -

Page 99

...trade date basis. Investment gains and losses on sales of securities are determined on a specific identification basis. Interest income on fixed maturity securities is recorded when earned using an effective yield method giving effect to amortization of premiums and accretion of discounts. Dividends... -

Page 100

... future cash flows. The Company purchases and receives beneficial interests in special purpose entities ("SPEs"), which enhance the Company's total return on its investment portfolio principally by providing equity-based returns on fixed maturity securities. These investments are MetLife, Inc... -

Page 101

... variable annuity type liabilities which do not qualify for presentation and reporting as separate account summary total assets and liabilities. These investments are primarily mutual funds and, to a lesser extent, fixed maturity and equity securities, short-term investments and cash and cash... -

Page 102

...Generally, the higher the loan-to-value ratio, the higher the risk of experiencing a credit loss. The values utilized in calculating these ratios are developed in connection with the ongoing review of the agricultural loan portfolio and are routinely updated. Residential Mortgage Loans - The Company... -

Page 103

... value of the mortgage loan at the date of foreclosure. Real Estate Joint Ventures and Other Limited Partnership Interests. The Company uses the equity method of accounting for investments in real estate joint ventures and other limited partnership interests consisting of leveraged buy-out funds... -

Page 104

...business. To a lesser extent, the Company uses credit derivatives, such as credit default swaps, to synthetically replicate investment risks and returns which are not readily available in the cash market. The Company also purchases certain securities, issues certain insurance policies and investment... -

Page 105

... future policy benefits; (ii) in net investment income for economic hedges of equity method investments in joint ventures, or for all derivatives held in relation to the trading portfolios; (iii) in other revenues for derivatives held in connection with the Company's mortgage banking activities; and... -

Page 106

... with the host contract and changes in their estimated fair value are generally reported in net derivative gains (losses) except for those in policyholder benefits and claims related to ceded reinsurance of guaranteed minimum income benefits ("GMIBs"). If the Company is unable to properly identify... -

Page 107

... Company also periodically reviews other long-term assumptions underlying the projections of estimated gross margins and profits. These include investment returns, policyholder dividend scales, interest crediting rates, mortality, persistency and expenses to administer business. Management annually... -

Page 108

... for international business, and mortality rates guaranteed in calculating the cash surrender values described in such contracts); and (ii) the liability for terminal dividends for domestic business. Participating business represented approximately 6% of the Company's life insurance in-force at both... -

Page 109

... of investment performance and volatility for variable products are consistent with historical S&P experience. The benefits used in calculating the liabilities are based on the average benefits payable over a range of scenarios. The Company establishes policyholder account balances for guaranteed... -

Page 110

... in universal life and investment-type product policy fees. The Company accounts for the prepayment of premiums on its individual life, group life and health contracts as premium received in advance and applies the cash received to premiums when due. For certain acquired blocks of business, the... -

Page 111

... level of statutory surplus to be retained by the insurance subsidiaries. Income Taxes The Holding Company and its includable life insurance and non-life insurance subsidiaries file a consolidated U.S. federal income tax return in accordance with the provisions of the Internal Revenue Code of 1986... -

Page 112

...earnings credits, determined annually based upon the average annual rate of interest on 30-year Treasury securities, for each account balance. The Subsidiaries also provide certain postemployment benefits and certain postretirement medical and life insurance benefits for retired employees. Employees... -

Page 113

.... Assets within the Company's separate accounts primarily include: mutual funds, fixed maturity and equity securities, mortgage loans, derivatives, hedge funds, other limited partnership interests, short-term investments and cash and cash equivalents. The Company reports separately, as assets... -

Page 114

... of securities classified as trading and other securities, $6,769 million of commercial mortgage loans and $6,822 million of long-term debt based on estimated fair values at January 1, 2010 and derecognized $179 million in fixed maturity securities and less than $1 million in equity securities. The... -

Page 115

... and income tax uncertainties after the acquisition date generally affect income tax expense. • Noncontrolling interests (formerly known as "minority interests") are valued at fair value at the acquisition date and are presented as equity rather than liabilities. • Net income (loss) includes... -

Page 116

... income (loss). The Company's insurance joint venture in Japan also elected FVO for certain of its existing single premium deferred annuities and the assets supporting such liabilities. FVO was elected to achieve improved reporting of the asset/liability matching associated with these products... -

Page 117

... Purchase Contracts and an average annual rate of 1.98% on the Debt Securities) as described in Note 14. ALICO is an international life insurance company, providing consumers and businesses with products and services for life insurance, accident and health insurance, retirement and wealth management... -

Page 118

...1, 2010 (In millions) Cash ...MetLife, Inc.'s common stock (78,239,712 shares)(1) ...MetLife, Inc.'s Convertible Preferred Stock(1), (2) ...MetLife, Inc.'s Equity Units ($3.0 billion aggregate stated amount)(3) ...Total cash paid and securities issued to ALICO Holdings ...Contractual purchase price... -

Page 119

... profits embedded in acquired insurance annuity and investment-type contracts in-force at the Acquisition Date. The value of VODA and VOCRA, included in other assets, reflects the estimated fair value of ALICO's distribution agreements and customer relationships acquired at November 1, 2010 and... -

Page 120

... ALICO Holdings may satisfy certain of its indemnification and other payment obligations by delivering cash, shares of stock or Equity Units issued by MetLife, Inc. in connection with the Acquisition. The Equity Units were deposited into an indemnification collateral account on the Acquisition Date... -

Page 121

... in the Company's consolidated statement of operations from the Acquisition Date through November 30, 2010: ALICO's Operations Included in MetLife's Results for the Year Ended December 31, 2010 (In millions) Total revenues ...Income (loss) from continuing operations, net of income tax ... $950... -

Page 122

... of these acquisitions, MetLife's Insurance Products segment increased its product offering of dental and vision benefit plans, MetLife Bank, National Association ("MetLife Bank") within Banking, Corporate & Other entered the mortgage origination and servicing business and the International segment... -

Page 123

... and exchange offer, the Company received from MetLife stockholders 23,093,689 shares of the Holding Company's common stock with a market value of $1,318 million and, in exchange, delivered 29,243,539 shares of RGA's Class B common stock with a net book value of $1,716 million. The resulting loss on... -

Page 124

...of the National Association of Insurance Commissioners ("NAIC"), with the exception of certain structured securities described below held by the Company's insurance subsidiaries that file NAIC statutory financial statements. Non-agency RMBS, including RMBS backed by sub-prime mortgage loans reported... -

Page 125

..., after considering net purchased credit default swap protection at December 31, 2010 and 2009, respectively. Collectively, the net exposure in these Europe perimeter region sovereign fixed maturity securities was 2.8% of the Company's equity and 0.3% of total cash and invested assets at December... -

Page 126

..., 2010 Estimated Fair Value % of Total 2009 Estimated Fair Value % of Total (In millions) By security type: Pass-through securities ...Collateralized mortgage obligations ...Total RMBS ...By risk profile: Agency ...Prime ...Alternative residential mortgage loans ...Total RMBS ...Portion rated Aaa... -

Page 127

... 31, 2010 Amount % of Total 2009 Amount % of Total (In millions) Net unrealized gain (loss) ...Rated Aa/AA or better ...Rated NAIC 1 ...Distribution of holdings - at estimated fair value - by collateral type: Fixed rate mortgage loans collateral ...Hybrid adjustable rate mortgage loans collateral... -

Page 128

... greater than 10% of the Company's equity or 1% of total investments at December 31, 2010 and 2009. Maturities of Fixed Maturity Securities. The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date (excluding scheduled sinking funds), were as follows at... -

Page 129

... was no change in the OTTI methodology for equity securities. Net Unrealized Investment Gains (Losses) The components of net unrealized investment gains (losses), included in accumulated other comprehensive income (loss), were as follows: Years Ended December 31, 2010 2009 (In millions) 2008 Fixed... -

Page 130

... Consolidated Financial Statements - (Continued) The changes in net unrealized investment gains (losses) were as follows: Years Ended December 31, 2010 2009 2008 (In millions) Balance, beginning of period ...Cumulative effect of change in accounting principles, net of income tax ...Fixed maturity... -

Page 131

... Value Gross Unrealized Loss Total Estimated Fair Value Gross Unrealized Loss (In millions, except number of securities) Fixed Maturity Securities: U.S. corporate securities ...Foreign corporate securities ...RMBS ...Foreign government securities ...U.S. Treasury, agency and government guaranteed... -

Page 132

... a gross unrealized loss of 20% or more for twelve months or greater at December 31, 2010 were non-redeemable preferred stock, of which $115 million, or 99%, were financial services industry investment grade non-redeemable preferred stock, of which 77% were rated A or better. MetLife, Inc. F-43 -

Page 133

... An extended and severe unrealized loss position on a fixed maturity security may not have any impact on the ability of the issuer to service all scheduled interest and principal payments and the Company's evaluation of recoverability of all contractual cash flows or the ability to recover an amount... -

Page 134

... net gains (losses) on sales and disposals ...Total gains (losses) on fixed maturity securities ...Other net investment gains (losses): Equity securities ...Mortgage loans ...Real estate and real estate joint ventures ...Other limited partnership interests ...Other investment portfolio gains (losses... -

Page 135

.... Fixed Maturity Securities Years Ended December 31, 2010 2009 2008 2010 Equity Securities Years Ended December 31, 2009 2008 (In millions) 2010 Total Years Ended December 31, 2009 2008 Proceeds ...Gross investment gains ...Gross investment losses ...Total OTTI losses recognized in earnings: Credit... -

Page 136

... Financial Statements - (Continued) Equity security OTTI losses recognized in earnings related to the following sectors and industries: Years Ended December 31, 2010 2009 2008 (In millions) Sector: Non-redeemable preferred stock ...Common stock ...Total ...Industry: Financial services industry... -

Page 137

...of net investment income were as follows: Years Ended December 31, 2010 2009 2008 (In millions) Investment income: Fixed maturity securities ...Equity securities ...Trading and other securities - Actively Traded Securities and FVO general account securities ...Mortgage loans ...Policy loans ...Real... -

Page 138

... are at estimated fair value for cash and cash equivalents, short-term investments, fixed maturity, equity, trading and other securities and at carrying value for mortgage loans. December 31, 2010 2009 (In millions) Invested assets on deposit: Regulatory agencies(1) ...Invested assets held in trust... -

Page 139

...Actively Traded Securities: Net investment income ...Changes in estimated fair value included in net investment income ...FVO general account securities: Net investment income ...Changes in estimated fair value included in net investment income ...FVO contractholder-directed unit-linked investments... -

Page 140

... investment in mortgage loans held-for-investment, by portfolio segment, by method of evaluation of credit loss, and the related valuation allowances, by type of credit loss, at: December 31, Commercial 2010 2009 Agricultural 2010 2009 (In millions) Residential 2010 2009 2010 Total 2009 Mortgage... -

Page 141

...Consolidated Financial Statements - (Continued) The following tables present the changes in the valuation allowance, by portfolio segment: Mortgage Loan Valuation Allowances Commercial Agricultural Residential (In millions) Total Balance at January 1, 2008 ...Provision (release) ...Charge-offs, net... -

Page 142

...$299 Unpaid principal balance is generally prior to any charge-off. The average investment in impaired mortgage loans held-for-investment, and the related interest income, by portfolio segment, for the year ended December 31, 2010 and for all mortgage loans for the years ended December 31, 2009 and... -

Page 143

...generally records its share of earnings in its equity method investments using a three-month lag methodology and within net investment income. As of December 31, 2010, aggregate net investment income from these equity method real estate joint ventures, real estate funds and other limited partnership... -

Page 144

... entities totaled $18.7 billion, $22.8 billion and ($23.3) billion for the years ended December 31, 2010, 2009 and 2008, respectively. Aggregate net income (loss) from real estate joint ventures, real estate funds and other limited partnership interests is primarily comprised of investment income... -

Page 145

... purchased credit impaired investments, as of their respective acquisition dates, for: Year Ended December 31, 2010 Fixed Maturity Securities Mortgage Loans (In millions) Contractually required payments (including interest) ...Cash flows expected to be collected(1) (2) ...Fair value of investments... -

Page 146

... 2, all investments acquired with American Life were recorded at estimated fair value as of the Acquisition Date. This activity relates to acquired fixed maturity securities and mortgage loans with a credit impairment inherent in the estimated fair value. Variable Interest Entities The Company holds... -

Page 147

.... The maximum exposure to loss relating to the mortgage loans is equal to the carrying amounts plus any unfunded commitments of the Company. For certain of its investments in other invested assets, the Company's return is in the form of income tax credits which are guaranteed by a creditworthy third... -

Page 148

...115 Foreign currency Credit Equity market Credit default swaps ...Credit forwards ...Equity futures ...Equity options ...Variance swaps ...Total rate of return swaps ...Total ... (1) The estimated fair value of all derivatives in an asset position is reported within other invested assets in the... -

Page 149

... swaps are used by the Company primarily as economic hedges of interest rate risk associated with the Company's investments in mortgage-backed securities. In an implied volatility swap, the Company exchanges fixed payments for floating payments that are linked to certain market volatility measures... -

Page 150

... held in relation to trading portfolios for the purpose of generating profits on short-term differences in price. These credit default swaps are not designated as hedging instruments. The Company enters into forwards to lock in the price to be paid for forward purchases of certain securities. The... -

Page 151

... hedge minimum guarantees embedded in certain variable annuity products offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index within a limited time at a contracted price. The contracts will be net settled in cash based... -

Page 152

... for the: Years Ended December 31, 2010 2009 (In millions) 2008 Qualifying hedges: Net investment income ...Interest credited to policyholder account balances ...Other expenses ...Non-qualifying hedges: Net investment income ...Net derivative gains (losses) ...Other revenues ...Total ... $ 83 233... -

Page 153

...purchases of fixed-rate investments; and (vi) interest rate swaps and interest rate forwards to hedge forecasted fixed-rate borrowings. For the years ended December 31, 2010 and 2009, the Company recognized $1 million and ($3) million, respectively, of net derivative gains (losses) which represented... -

Page 154

... in Cash Flow Hedging Relationships (Effective Portion) (Effective Portion) Net Derivative Gains (Losses) Net Investment Income (In millions) For the Year Ended December 31, 2010: Interest rate swaps ...Foreign currency swaps ...Interest rate forwards ...Credit forwards ...Total ...For the Year... -

Page 155

...: Net Derivative Gains (Losses) Net Investment Income(1) Policyholder Benefits and Claims(2) (In millions) Other Revenues(3) Other Expenses(4) For the Year Ended December 31, 2010: Interest rate swaps ...Interest rate floors ...Interest rate caps ...Interest rate futures ...Equity futures... -

Page 156

... Financial Statements - (Continued) Net Derivative Gains (Losses) Net Investment Income(1) Policyholder Benefits and Claims(2) (In millions) Other Revenues(3) Other Expenses(4) Variance swaps ...Swap spreadlocks ...Credit default swaps ...Total rate of return swaps ...Total ...For the Year... -

Page 157

... provide for a single net payment to be made by one counterparty to another at each due date and upon termination. Because exchange-traded futures are effected through regulated exchanges, and positions are marked to market on a daily basis, the Company has minimal exposure to credit-related losses... -

Page 158

... principally include: variable annuities with guaranteed minimum benefits, including GMWBs, GMABs and certain GMIBs; ceded reinsurance contracts of guaranteed minimum benefits related to GMABs and certain GMIBs; and funding agreements with equity or bond indexed crediting rates. The following... -

Page 159

... securities: Actively Traded Securities ...FVO general account securities ...FVO contractholder-directed unit-linked investments ...FVO securities held by consolidated securitization entities Total trading and other securities ...Short-term investments(1) ...Mortgage loans: Mortgage loans held by... -

Page 160

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) December 31, 2010 Fair Value Measurements at Reporting Date Using Quoted Prices in Active Markets for Identical Assets and Liabilities (Level 1) Significant Unobservable Inputs (Level 3) Total Estimated Fair Value ... -

Page 161

..., Equity Securities, Trading and Other Securities and Short-term Investments When available, the estimated fair value of the Company's fixed maturity, equity and trading and other securities are based on quoted prices in active markets that are readily and regularly obtainable. Generally, these... -

Page 162

... certain direct, assumed and ceded variable annuity guarantees and equity or bond indexed crediting rates within certain funding agreements. Embedded derivatives are recorded in the consolidated financial statements at estimated fair value with changes in estimated fair value reported in net income... -

Page 163

... value of the underlying assets owned by the separate account. Assets within the Company's separate accounts include: mutual funds, fixed maturity securities, equity securities, mortgage loans, derivatives, hedge funds, other limited partnership interests, short-term investments and cash and cash... -

Page 164

... Notes to the Consolidated Financial Statements - (Continued) regularly available. Contractholder-directed unit-linked investments reported within trading and other securities include certain registered mutual fund interests priced using daily NAV provided by the fund managers. Derivative Assets and... -

Page 165

... Valuation of the mutual funds and hedge funds is based upon quoted prices or reported NAV provided by the fund managers. Long-term Debt of CSEs The estimated fair value of the long-term debt of the Company's CSEs is based on quoted prices when traded as assets in active markets or, if not available... -

Page 166

... such, the Company relies primarily on a discounted cash flow model to estimate the fair value of the MSRs. The model requires inputs such as type of loan (fixed vs. variable and agency vs. other), age of loan, loan interest rates and current market interest rates that are generally observable. The... -

Page 167

...31, 2010, fixed maturity securities transfers into Level 3 of $1,736 million and separate account assets transfers into Level 3 of $46 million, resulted primarily from current market conditions characterized by a lack of trading activity, decreased liquidity and credit ratings downgrades (e.g., from... -

Page 168

... ...$ 1,240 Trading and other securities: Actively Traded Securities ...$ FVO general account securities ...FVO contractholder-directed unit-linked investments ...Total trading and other securities ...$ Short-term investments ...$ Mortgage loans held-for-sale ...$ MSRs(5), (6) ...$ Net derivatives... -

Page 169

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) Fair Value Measurements Using Significant Unobservable Inputs (Level 3) Purchases, Other Sales, Transfer Into Balance, Comprehensive Issuances and and/or Out Balance, January 1, Earnings(1), (2) Income (Loss) Settlements(3) ... -

Page 170

... and certain mortgage loans are included within net investment gains (losses) which are reported within the earnings caption of total gains (losses); while changes in estimated fair value of certain mortgage loans and MSRs are recorded in other revenues. Lapses associated with embedded derivatives... -

Page 171

...10) The long-term debt at January 1, 2010 of the CSEs is reported within the purchases, sales, issuances and settlements activity column of the rollforward. (11) The impact of adoption of fair value measurement guidance represents the amount recognized in earnings resulting from a change in estimate... -

Page 172

...FVO general account securities ...FVO contractholder-directed unit-linked investments ...Total trading and other securities ...Short-term investments ...Mortgage loans held-for-sale ...MSRs ...Net derivatives: Interest rate contracts ...Foreign currency contracts ...Credit contracts ...Equity market... -

Page 173

...Earnings Net Investment Income Net Investment Gains (Losses) Net Derivative Gains (Losses) Policyholder Benefits and Claims Other Revenues (In millions) Other Expenses Total Year Ended December 31, 2009: Assets: Fixed maturity securities: U.S. corporate securities ...Foreign corporate securities... -

Page 174

...: Actively Traded Securities ...FVO general account securities ...FVO contractholder-directed unit-linked investments ...Total trading and other securities ...Short-term investments ...Mortgage loans held-for-sale MSRs ...Net derivatives: Interest rate contracts ...Foreign currency contracts Credit... -

Page 175

... Financial Statements - (Continued) Changes in Unrealized Gains (Losses) Relating to Assets and Liabilities Held at December 31, 2009 Net Net Investment Policyholder Derivative Gains Benefits and Other Gains Other (Losses) Claims Expenses (Losses) Revenues (In millions) Net Investment Income Total... -

Page 176

... is recorded in net investment income. Interest expense on long-term debt of CSEs is recorded in other expenses. Gains and losses from initial measurement, subsequent changes in estimated fair value and gains or losses on sales of both the commercial mortgage loans and long-term debt are recognized... -

Page 177

... such mortgage loans. (2) Other limited partnership interests - The impaired investments presented above were accounted for using the cost method. Impairments on these cost method investments were recognized at estimated fair value determined from information provided in the financial statements of... -

Page 178

... Value Assets Mortgage loans:(1) Held-for-investment ...Held-for-sale ...Mortgage loans, net ...Policy loans ...Real estate joint ventures(2) ...Other limited partnership interests(2) ...Short-term investments(3) ...Other invested assets(2) ...Cash and cash equivalents ...Accrued investment income... -

Page 179

... Value Assets Mortgage loans:(1) Held-for-investment ...Held-for-sale ...Mortgage loans, net ...Policy loans ...Real estate joint ventures(2) ...Other limited partnership interests(2) ...Short-term investments(3) ...Other invested assets(2) ...Cash and cash equivalents ...Accrued investment income... -

Page 180

... mortgage loans originated for sale, the estimated fair value is determined principally from observable market pricing or from internal models. Policy Loans For policy loans with fixed interest rates, estimated fair values are determined using a discounted cash flow model applied to groups... -

Page 181

... certain funding agreements, fixed deferred annuities, modified guaranteed annuities, fixed term payout annuities and total control accounts. The fair values for these investment contracts are estimated by discounting best estimate future cash flows using current market risk-free interest rates and... -

Page 182

... using interest rates that incorporate current credit risk for similar instruments on the reporting date and the principal amounts of the commitments. 6. Deferred Policy Acquisition Costs and Value of Business Acquired Information regarding DAC and VOBA is as follows: DAC VOBA (In millions) Total... -

Page 183

...Business: Insurance Products: Group life ...Individual life ...Non-medical health ...Total Insurance Products ...Retirement Products ...Corporate Benefit Funding ...Auto & Home ...Total U.S. Business ...International: Latin America ...Asia Pacific ...Europe and the Middle East ...Total International... -

Page 184

... Policy-Related Balances 2010 2009 U.S. Business: Insurance Products: Group life ...Individual life ...Non-medical health ...Total Insurance Products ...Retirement Products ...Corporate Benefit Funding ...Auto & Home ...Total U.S. Business ...International ...Banking, Corporate & Other ...Total... -

Page 185

..., MetLife Investors Insurance Company ("MLIIC") and General American Life Insurance Company ("GALIC") became members of the Federal Home Loan Bank of Des Moines ("FHLB of Des Moines) and each held $10 million of common stock of the FHLB of Des Moines at December 31, 2010, which is included in equity... -

Page 186

... anniversary date minus any withdrawals following the contract anniversary, or total deposits made to the contract less any partial withdrawals plus a minimum return ("anniversary contract value" or "minimum return"). The Company also issues annuity contracts that apply a lower rate of funds... -

Page 187

... types of guarantees relating to annuity contracts and universal and variable life contracts is as follows: December 31, 2010 In the Event of Death At Annuitization 2009 In the Event of Death At Annuitization (In millions) Annuity Contracts(1) Return of Net Deposits Separate account value ...Net... -

Page 188

...is as follows: Annuity Contracts Guaranteed Death Benefits Guaranteed Annuitization Benefits Universal and Variable Life Contracts Secondary Guarantees (In millions) Paid-Up Guarantees Total Direct Balance at January 1, 2008 ...Incurred guaranteed benefits ...Paid guaranteed benefits ...Balance at... -

Page 189

.... The Company's Retirement Products segment reinsures a portion of the living and death benefit guarantees issued in connection with its variable annuities. Under these reinsurance agreements, the Company pays a reinsurance premium generally based on fees associated with the guarantees collected... -

Page 190

... is as follows: Years Ended December 31, 2010 2009 (In millions) 2008 Premiums: Direct premiums ...Reinsurance assumed ...Reinsurance ceded ...Net premiums ...Universal life and investment-type product policy fees: Direct universal life and investment-type product policy fees ...Reinsurance assumed... -

Page 191

... 31, 2010 Total Balance Sheet Total, Net of Reinsurance Assumed Ceded (In millions) Assets: Premiums, reinsurance and other receivables ...Deferred policy acquisition costs and value of business acquired ...Total assets ...Liabilities: Future policy benefits ...Policyholder account balances... -

Page 192

... Financial Statements - (Continued) The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the Demutualization Date. However, the Company establishes a policyholder dividend obligation for earnings that will be paid... -

Page 193

... . . Mortgage loans ...Policy loans ...Real estate and real estate joint ventures held-for-investment ...Short-term investments ...Other invested assets ...Total investments ...Cash and cash equivalents ...Accrued investment income ...Premiums, reinsurance and other receivables ...Current income tax... -

Page 194

... impairments on fixed maturity securities transferred to other comprehensive income (loss) ...Other net investment gains (losses) ...Total net investment gains (losses) ...Net derivative gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Policyholder dividends ...Other... -

Page 195

... were originally issued in 2005 in connection with certain common equity units. See Notes 13 and 14. Advances from the Federal Home Loan Bank of New York MetLife Bank is a member of the FHLB of NY and held $187 million and $124 million of common stock of the FHLB of NY at December 31, 2010 and 2009... -

Page 196

... credit facilities are used for general corporate purposes, to support the borrowers' commercial paper programs and for the issuance of letters of credit. Total fees expensed associated with these credit facilities were $17 million, $43 million and $17 million for the years ended December 31, 2010... -

Page 197

..., MRC issued, to investors placed by an unaffiliated financial institution, $2.5 billion in aggregate principal amount of 35-year surplus notes to provide statutory reserve support for the assumed closed block liabilities. Interest on the surplus notes accrues at an annual rate of 3-month LIBOR plus... -

Page 198

... entitled to the return on the investment portfolio held by the trusts established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial institution of 3-month LIBOR plus 0.70%, payable quarterly. The collateral... -

Page 199

... (the "Threshold Appreciation Price"), the number of shares to be issued in settlement of the Purchase Contract will equal $25 divided by the Threshold Appreciation Price, as so calculated (the "Minimum Settlement Rate"). If the market value of MetLife, Inc.'s common stock is greater than the... -

Page 200

...31, 2010. Acquisition of The Travelers Insurance Company In connection with financing the acquisition of The Travelers Insurance Company on July 1, 2005, the Holding Company distributed and sold 82.8 million 6.375% common equity units for $2,070 million in proceeds in a registered public offering on... -

Page 201

... the following: December 31, 2010 2009 (In millions) Deferred income tax assets: Policyholder liabilities and receivables ...Net operating loss carryforwards ...Employee benefits ...Capital loss carryforwards ...Tax credit carryforwards ...Net unrealized investment losses ...Litigation-related and... -

Page 202

... prior years included $169 million from the acquisition of American Life. Settlements with tax authorities amounted to $59 million, all of which was reclassified to current and deferred income tax payable, as applicable, with $3 million paid in 2010. At December 31, 2009, the Company's total amount... -

Page 203

... ("DRD"), related to variable life insurance and annuity contracts. The DRD reduces the amount of dividend income subject to tax and is a significant component of the difference between the actual tax expense and expected amount determined using the federal statutory tax rate of 35%. Any regulations... -

Page 204

..., based on information currently known by management, management does not believe any such charges are likely to have a material adverse effect on the Company's financial position. During 1998, MLIC paid $878 million in premiums for excess insurance policies for asbestos-related claims. The excess... -

Page 205

... estimable losses for these sales practices-related investigations or inquiries. Retained Asset Account Matters The New York Attorney General announced on July 29, 2010 that his office had launched a major fraud investigation into the life insurance industry for practices related to the use of... -

Page 206

...MSI's summary judgment motion. Sales Practices Claims. Over the past several years, the Company has faced numerous claims, including class action lawsuits, alleging improper marketing or sales of individual life insurance policies, annuities, mutual funds or other products. Some of the current cases... -

Page 207

... and those otherwise provided for in the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer... -

Page 208

... be responsible for managing the funds of those participants that transferred to the government system. This change resulted in the establishment of a liability for future servicing obligations and the elimination of the Company's obligations under death and disability policy coverages. During 2008... -

Page 209

... benefit plans covering employees and sales representatives who meet specified eligibility requirements. Pension benefits are provided utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits that are primarily based upon years of credited service... -

Page 210

... of year ...Service costs ...Interest costs ...Plan participants' contributions ...Net actuarial (gains) losses ...Acquisition, settlements and curtailments ...Change in benefits ...Prescription drug subsidy ...Benefits paid ...Transfers ...Benefit obligations at end of year ...Change in plan assets... -

Page 211

... net periodic other postretirement benefit plan costs are comprised of the following: i) Service Costs - Service costs are the increase in the projected (expected) pension benefit obligation resulting from benefits payable to employees of the Subsidiaries on service rendered during the current year... -

Page 212

... Part D Prescription Drug Plans ("PDP"). From 2006 through 2010, the Company applied for and received the RDS each year. The RDS program provides the subsidy through cash payments made by Medicare to the Company, resulting in smaller net claims paid by the Company. A summary of the reduction to... -

Page 213

... postretirement benefit obligations ... $ 8 $86 $ (8) $(104) Plan Assets Most Subsidiaries have issued group annuity and life insurance contracts supporting the pension and other postretirement benefit plans assets, which are invested primarily in separate accounts. F-124 MetLife, Inc... -

Page 214

... 31, 2010 Pension Benefits Fair Value Measurements at Reporting Date Using Quoted Prices In Active Markets for Identical Assets and Liabilities (Level 1) Other Postretirement Benefits Fair Value Measurements at Reporting Date Using Quoted Prices In Active Markets for Total Identical Estimated... -

Page 215

MetLife, Inc. Notes to the Consolidated Financial Statements - (Continued) December 31, 2009 Pension Benefits Fair Value Measurements at Reporting Date Using Quoted Prices In Active Markets for Identical Assets (Level 1) Other Postretirement Benefits Fair Value Measurements at Reporting Date Using ... -

Page 216

... Income (Loss) Purchases, Sales, Issuances and Settlements (In millions) Earnings Transfer Into Level 3 Transfer Out of Level 3 Balance, December 31, Year Ended December 31, 2010: Pension: Fixed maturity securities: Corporate ...Foreign bonds ...Total fixed maturity securities ...Equity... -

Page 217

... subsidiaries sponsor defined benefit plans that cover employees and sales representatives who meet specified eligibility requirements. Pension benefits are provided utilizing either a traditional formula or cash balance formula, similar to the U.S. plans discussed above. The investment objectives... -

Page 218

... ...Short-term investments ...Other invested assets ...Total assets ...The target ranges in the tables above are forward-looking. Expected Future Contributions and Benefit Payments It is the Subsidiaries' practice to make contributions to the qualified pension plan to comply with minimum funding... -

Page 219

...Current regulations do not require funding for these benefits. The Subsidiaries use their general assets, net of participant's contributions, to pay postretirement medical claims as they come due in lieu of utilizing any plan assets. Total payments equaled $154 million and $158 million for the years... -

Page 220

... information on subsequent dividends declared. Convertible Preferred Stock In connection with the financing of the Acquisition (see Note 2) in November 2010, the Holding Company issued to ALICO Holdings 6,857,000 shares of Convertible Preferred Stock with a $0.01 par value per share, a liquidation... -

Page 221

..., its financial strength and credit ratings, general market conditions and the market price of MetLife, Inc.'s common stock compared to management's assessment of the stock's underlying value and applicable regulatory, legal and accounting factors. Whether or not to purchase any common stock and the... -

Page 222

... expense related to the 2005 Directors Stock Plan, is as follows: Years Ended December 31, 2010 2009 2008 (In millions) Stock Options ...Performance Shares(1) ...Restricted Stock Units ...Total compensation expenses related to the Incentive Plans ...Income tax benefits ... $45 29 10 $84 $29 $55... -

Page 223

... common stock traded on the open market. The Company uses a weighted-average of the implied volatility for publicly-traded call options with the longest remaining maturity nearest to the money as of each valuation date and the historical volatility, calculated using monthly closing prices of MetLife... -

Page 224

... accounted for as equity awards, but are not credited with dividend-equivalents for actual dividends paid on MetLife, Inc. common stock during the performance period. Accordingly, the estimated fair value of Performance Shares is based upon the closing price of MetLife, Inc. common stock on the date... -

Page 225

..., 2010 and 2009, respectively. Statutory net income of American Life, a Delaware domiciled insurer, of approximately $800 million will be reported in the Statutory Annual Statement for the year ended December 31, 2010. Statutory capital and surplus, to be filed with the Delaware Insurance Department... -

Page 226

...annual statutory statement requires insurance regulatory approval. Under Connecticut State Insurance Law, the Connecticut Commissioner has broad discretion in determining whether the financial condition of a stock life insurance company would support the payment of such dividends to its shareholders... -

Page 227

... determining whether the financial condition of a stock property and casualty insurance company would support the payment of such dividends to its shareholders. Other Comprehensive Income (Loss) The following table sets forth the reclassification adjustments required for the years ended December 31... -

Page 228

... to changes in estimates for variable incentive compensation, COBRA benefits, employee outplacement services and for employees whose severance status changed. In addition to the above charges, the Company has recognized lease charges of $28 million associated with the consolidation of office space... -

Page 229

...: Stock purchase contracts underlying common equity units (2) ...Exercise or issuance of stock-based awards (3) ...Weighted average common stock outstanding for diluted earnings per common share(1) ...Income (Loss) from Continuing Operations: Income (loss) from continuing operations, net of income... -

Page 230

... MetLife is organized into five segments: Insurance Products, Retirement Products, Corporate Benefit Funding and Auto & Home (collectively, "U.S. Business") and International. The assets and liabilities of ALICO as of November 30, 2010 and the operating results of ALICO from the Acquisition Date... -

Page 231

... dental insurance, short- and long-term disability, long-term care and other insurance products. Retirement Products offers asset accumulation and income products, including a wide variety of annuities. Corporate Benefit Funding offers pension risk solutions, structured settlements, stable value... -

Page 232

... Business Insurance Retirement Products Products Corporate Benefit Auto Funding & Home Banking, Corporate & Other Total Adjustments Consolidated Year Ended December 31, 2010 Total International (In millions) Total Revenues Premiums ...$17,200 Universal life and investment-type product policy... -

Page 233

... Business Insurance Retirement Products Products Corporate Benefit Auto Funding & Home Banking, Corporate & Other Total Adjustments Consolidated Year Ended December 31, 2009 Total International (In millions) Total Revenues Premiums ...$17,168 Universal life and investment-type product policy... -

Page 234

... Business Insurance Retirement Products Products Corporate Benefit Funding Auto & Home Banking, Corporate & Other Total Adjustments Consolidated Year Ended December 31, 2008 Total International (In millions) Total Revenues Premiums ...$16,402 Universal life and investment-type product policy... -

Page 235

... Company entered into a committed facility with a third-party bank to provide letters of credit for the benefit of Missouri Reinsurance (Barbados) Inc. ("MoRe"), a captive reinsurance subsidiary, to address its short-term solvency needs based on guidance from the regulator. This one-year facility... -

Page 236

(This page intentionally left blank) -

Page 237

... Officer, Tupelo Capital Management LLC Member, Finance and Risk Policy Committee and Investment Committee of Metropolitan Life Insurance Company Retired Group Executive Vice President, Listings, Marketing & Branding, NYSE Euronext Member, Audit Committee and Finance and Risk Committee 86 MetLife... -

Page 238

... leading global provider of insurance, annuities and employee benefit programs, serving 90 million customers in over 60 countries. Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia Pacific, Europe and the Middle East. For... -

Page 239

CUMULATIVE TOTAL RETURN Based upon an initial investment of $100 on December 31, 2005 with dividends reinvested $150 $100 $50 $0 31-Dec-05 31-Dec-06 31-Dec-07 31-Dec-08 31-Dec-09 31-Dec-10 MetLife Inc. Source: Capital IQ S&P 500 S&P 500 Insurance S&P 500 Financials 88 MetLife, Inc. -

Page 240

(This page intentionally left blank) -

Page 241

(This page intentionally left blank) -

Page 242

MetLife, Inc. 200 Park Avenue New York, NY 10166-0188 www.metlife.com 0710-6222 © 2011 Peanuts Worldwide LLC