MetLife 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

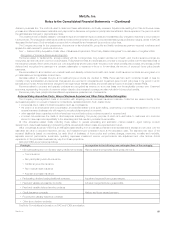

Summary of Significant Accounting Policies

The following are the Company’s significant accounting policies with references to notes providing additional information on such policies and critical

accounting estimates relating to such policies.

Accounting Policy Note

Insurance 4

Deferred Policy Acquisition Costs, Value of Business Acquired and Other Policy-Related Intangibles 5

Reinsurance 6

Investments 8

Derivatives 9

Fair Value 10

Goodwill 11

Employee Benefit Plans 18

Income Tax 19

Litigation Contingencies 21

Insurance

Future Policy Benefit Liabilities and Policyholder Account Balances

The Company establishes liabilities for amounts payable under insurance policies. Generally, amounts are payable over an extended period of time

and related liabilities are calculated as the present value of future expected benefits to be paid reduced by the present value of future expected

premiums. Such liabilities are established based on methods and underlying assumptions in accordance with GAAP and applicable actuarial standards.

Principal assumptions used in the establishment of liabilities for future policy benefits are mortality, morbidity, policy lapse, renewal, retirement, disability

incidence, disability terminations, investment returns, inflation, expenses and other contingent events as appropriate to the respective product type and

geographical area. These assumptions are established at the time the policy is issued and are intended to estimate the experience for the period the

policy benefits are payable. Utilizing these assumptions, liabilities are established on a block of business basis. For long duration insurance contracts,

assumptions such as mortality, morbidity and interest rates are “locked in” upon the issuance of new business. However, significant adverse changes in

experience on such contracts may require the establishment of premium deficiency reserves. Such reserves are determined based on the then current

assumptions and do not include a provision for adverse deviation.

Premium deficiency reserves may also be established for short duration contracts to provide for expected future losses. These reserves are based

on actuarial estimates of the amount of loss inherent in that period, including losses incurred for which claims have not been reported. The provisions for

unreported claims are calculated using studies that measure the historical length of time between the incurred date of a claim and its eventual reporting

to the Company. Anticipated investment income is considered in the calculation of premium deficiency losses for short duration contracts.

Liabilities for universal and variable life secondary guarantees and paid-up guarantees are determined by estimating the expected value of death

benefits payable when the account balance is projected to be zero and recognizing those benefits ratably over the accumulation period based on total

expected assessments. The assumptions used in estimating the secondary and paid-up guarantee liabilities are consistent with those used for

amortizing deferred policy acquisition costs (“DAC”), and are thus subject to the same variability and risk as further discussed herein. The assumptions

of investment performance and volatility for variable products are consistent with historical experience of appropriate underlying equity indices, such as

the Standard & Poor’s Ratings Services (“S&P”) 500 Index. The benefits used in calculating the liabilities are based on the average benefits payable over

a range of scenarios.

The Company regularly reviews its estimates of liabilities for future policy benefits and compares them with its actual experience. Differences result in

changes to the liability balances with related charges or credits to benefit expenses in the period in which the changes occur.

Policyholder account balances (“PABs”) relate to contract or contract features where the Company has no significant insurance risk.

The Company issues directly and assumes through reinsurance certain variable annuity products with guaranteed minimum benefits that provide the

policyholder a minimum return based on their initial deposit (i.e., the benefit base) less withdrawals. These guarantees are accounted for as insurance

liabilities or as embedded derivatives depending on how and when the benefit is paid. Specifically, a guarantee is accounted for as an embedded

derivative if a guarantee is paid without requiring (i) the occurrence of specific insurable event, or (ii) the policyholder to annuitize. Alternatively, a

guarantee is accounted for as an insurance liability if the guarantee is paid only upon either (i) the occurrence of a specific insurable event, or

(ii) annuitization. In certain cases, a guarantee may have elements of both an insurance liability and an embedded derivative and in such cases the

guarantee is split and accounted for under both models.

Guarantees accounted for as insurance liabilities in future policy benefits include guaranteed minimum death benefits (“GMDB”), the portion of

guaranteed minimum income benefits (“GMIB”) that require annuitization, and the life-contingent portion of guaranteed minimum withdrawal benefits

(“GMWB”).

Guarantees accounted for as embedded derivatives in PABs include the non life-contingent portion of GMWB, guaranteed minimum accumulation

benefits (“GMAB”) and the portion of GMIB that do not require annuitization. At inception, the Company attributes to the embedded derivative a portion

of the projected future guarantee fees to be collected from the policyholder equal to the present value of projected future guaranteed benefits. Any

additional fees represent “excess” fees and are reported in universal life and investment-type product policy fees.

Other Policy-Related Balances

Other policy-related balances include policy and contract claims, unearned revenue liabilities, premiums received in advance, policyholder dividends

due and unpaid, policyholder dividends left on deposit and negative VOBA.

The liability for policy and contract claims generally relates to incurred but not reported death, disability, long-term care (“LTC”) and dental claims, as

well as claims which have been reported but not yet settled. The liability for these claims is based on the Company’s estimated ultimate cost of settling

all claims. The Company derives estimates for the development of incurred but not reported claims principally from analyses of historical patterns of

86 MetLife, Inc.