MetLife 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

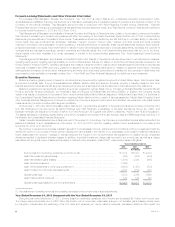

SIFI Designation and Prudential Regulation

Last month, MetLife successfully completed the process of deregistering as a bank holding company, which means

that we are no longer regulated by the Federal Reserve. However, substantial uncertainty remains on the regulatory front

as we face the possibility of being named a non-bank systemically important financial institution (SIFI), which would place

us back under Federal Reserve supervision.

It is difficult to find experts in financial regulation who believe that traditional life insurance activities represent a threat

to the financial stability of the United States, and with good reason. Regulated life insurance activities were not

responsible for the financial crisis. Perhaps that is why the federal government’s own report on the crisis, the Financial

Crisis Inquiry Report, mentions “life insurance” only once in 663 pages.

The relevant question to ask of MetLife is: Would the failure of our company “threaten the financial stability of the

United States”? We believe the answer is no. Not only would we pose no threat to the broader economy, we cannot

think of a single firm that would be brought down by its exposure to MetLife. The risk is that the federal government could

undermine competition in our industry by imposing a potentially onerous layer of federal regulation on a select few life

insurance companies, which are already regulated by the states. A more sensible approach would be to identify and

regulate those activities that fueled the financial crisis in the first place.

Nevertheless, if MetLife is deemed to be systemically important, it is imperative that the final prudential rules be

tailored to the life insurance business model, which differs dramatically from that of banks. Naming the nation’s largest life

insurers as SIFIs and subjecting them to unmodified bank-style capital and liquidity rules would constrain our ability to

issue guarantees. Faced with costly requirements, life insurers would have to raise the price of the products they offer,

reduce the amount of risk they take on, or stop offering certain products altogether. At a time when government social

safety nets are under increasing pressure and corporate pensions are disappearing, sound public policy should preserve

competitively priced financial protection for consumers.

Conclusion

MetLife’s achievements in 2012 raised the bar for our performance in 2013. In light of the economic headwinds and

policy uncertainty we face, it is imperative that MetLife stay focused on the swift execution of our strategy. Our goal is

simple: build a business that makes us the insurance company of choice for customers and achieve returns in excess of

our long-term cost of capital for you, our shareholders. In the modern age, that is how MetLife will demonstrate “more

solicitude for the character of its business than for its mere volume.”

On behalf of the entire MetLife team, thank you for the continued trust you place in us to run your company.

Sincerely,

Steven A. Kandarian

Chairman of the Board, President and Chief Executive Officer

MetLife, Inc.

March 15, 2013

iv MetLife, Inc.