MetLife 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

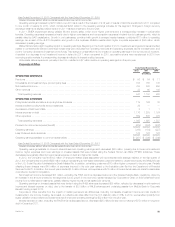

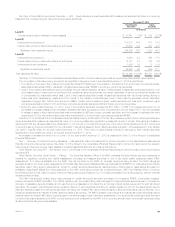

year due to growth in the businesses. Growth in our businesses contributed $144 million to operating earnings. As a result of the ALICO Acquisition and

growth in the business, Latin America’s results reflect higher corporate expenses of $18 million, which decreased operating earnings.

Changes in market factors negatively impacted investment yields, which resulted in a $63 million decrease to operating earnings. Beginning in the

fourth quarter of 2010, investment earnings and interest credited related to contractholder-directed unit-linked investments were excluded from

operating revenues and operating expenses, as the contractholder, and not the Company, directs the investment of the funds. This change in

presentation had no impact on operating earnings in the current period; however, it resulted in a decrease in net investment income in Brazil in 2011,

when compared to 2010, as positive returns were experienced in 2010 from recovering equity markets. A corresponding decrease is reflected in

interest credited expense.

Operating earnings were also adversely impacted by a tax refund in the prior period which reduced operating earnings by $23 million.

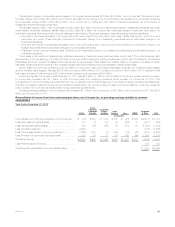

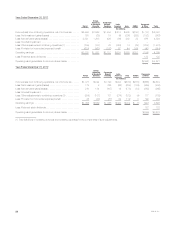

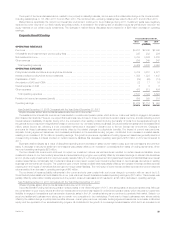

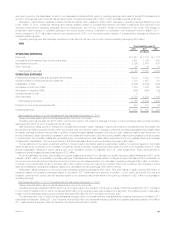

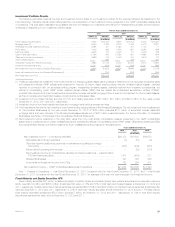

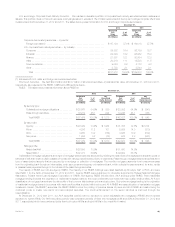

Asia

Years Ended December 31,

2012 2011 2010

(In millions)

OPERATING REVENUES

Premiums .................................................................................... $ 8,344 $ 7,716 $ 1,716

Universal life and investment-type product policy fees .................................................. 1,491 1,343 502

Net investment income .......................................................................... 2,895 2,475 497

Other revenues ................................................................................ 26 36 14

Total operating revenues ....................................................................... 12,756 11,570 2,729

OPERATING EXPENSES

Policyholder benefits and claims and policyholder dividends ............................................. 5,819 5,239 1,351

Interest credited to policyholder account balances ..................................................... 1,784 1,607 183

Capitalization of DAC ........................................................................... (2,288) (2,045) (459)

Amortization of DAC and VOBA ................................................................... 1,563 1,486 290

Amortization of negative VOBA .................................................................... (456) (560) (49)

Interest expense on debt ........................................................................ 5 — 1

Other expenses ............................................................................... 4,738 4,522 1,142

Total operating expenses ...................................................................... 11,165 10,249 2,459

Provision for income tax expense (benefit) ........................................................... 554 441 46

Operating earnings ............................................................................. $ 1,037 $ 880 $ 224

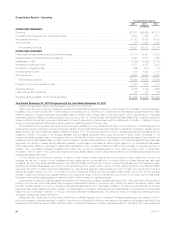

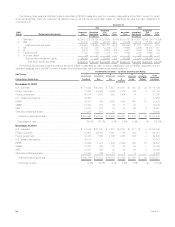

Year Ended December 31, 2012 Compared with the Year Ended December 31, 2011

Unless otherwise stated, all amounts discussed below are net of income tax.

Operating earnings increased by $157 million over the prior period. The impact of changes in foreign currency exchange rates reduced operating

earnings by $3 million for 2012 compared to the prior year.

Asia experienced sales growth in ordinary and universal life products in Japan, resulting in higher premiums and universal life fees, and variable life

and accident & health products in Korea, which drove higher fees over the prior period. Changes in premiums for these businesses were partially offset

by related changes in policyholder benefits. In addition, average invested assets increased over the prior year, reflecting positive cash flows from our

annuity business in Japan generating increases in both net investment income and policy fee income, partially offset by an increase in interest credited

to policyholders. The increase in sales also generated higher commissions and other sales-related expenses, which were partially offset by an increase

in related DAC capitalization. The combined impact of the items discussed above improved operating earnings by $99 million.

The repositioning of the Japan investment portfolio to longer duration and higher yielding investments in addition to improved results on our private

equity investments, contributed to an increase in investment yields. In addition, yields improved as a result of growth in the Australian and U.S. dollar

annuity businesses, reflecting a higher yielding and more diversified portfolio of Australian and U.S. dollar investments. These improvements in

investment yields increased operating earnings by $132 million.

On an annual basis, we review and update our long-term assumptions used in our calculation of certain insurance-related liabilities and DAC, which

resulted in a $51 million net decrease to operating earnings. This adjustment was primarily related to changes in Japan that assumed the continuation of

the current lower interest rates and reflected the trend of lower long-term lapses resulting in a decrease in operating earnings of $44 million. In addition,

in Korea more policyholders chose to annuitize rather than receive a lump sum payment at maturity; this trend, combined with changes in future

expected persistency, expenses and lapses, resulted in a decrease in operating earnings of $9 million in Korea.

Unfavorable claims experience in the current year decreased operating earnings by $38 million. Prior year results in Japan included $39 million of

insurance claims and operating expenses related to the March 2011 earthquake and tsunami. In addition, a prior period tax benefit in Korea and

Australia, combined with current year tax expense related to net operating loss carryforwards in Hong Kong, resulted in a $21 million net decrease in

operating earnings.

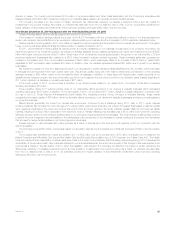

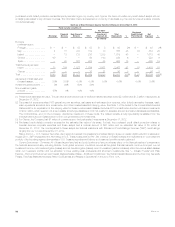

Year Ended December 31, 2011 Compared with the Year Ended December 31, 2010

Unless otherwise stated, all amounts discussed below are net of income tax.

Operating earnings increased by $656 million over 2010 as a result of the inclusion of a full year of results of ALICO’s operations for 2011 compared

to one month of results for 2010, which contributed $796 million to the operating earnings increase for the segment. The positive impact of changes in

foreign currency exchange rates improved reported earnings by $6 million for 2011 compared to the prior year.

The Japanese economy, to which we face substantial exposure given our operations there, was significantly negatively impacted by the March 2011

earthquake and tsunami. During 2011, the Company incurred $39 million of incremental insurance claims and operating expenses related to the March

2011 earthquake and tsunami, which is included in the aforementioned ALICO results.

MetLife, Inc. 31