MetLife 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

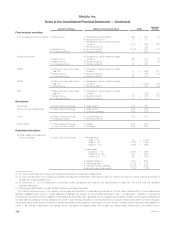

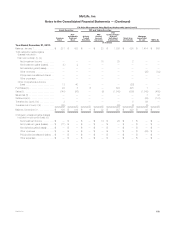

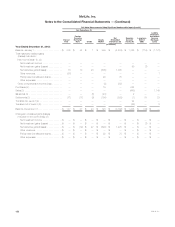

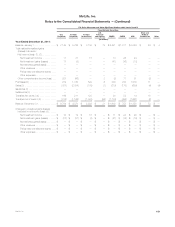

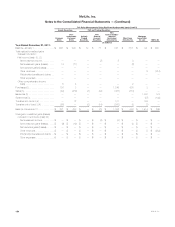

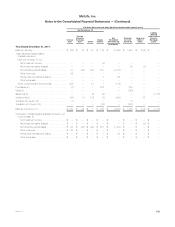

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

Level 2 Valuation Techniques and Key Inputs:

These assets are comprised of investments that are similar in nature to the instruments described under “— Securities, Short-term Investments,

Other Investments, Long-term Debt of CSEs and Trading Liabilities” and “— Derivatives — Freestanding Derivatives.” Also included are certain

mutual funds and hedge funds without readily determinable fair values as prices are not published publicly. Valuation of the mutual funds and hedge

funds is based upon quoted prices or reported NAVs provided by the fund managers.

Level 3 Valuation Techniques and Key Inputs:

These assets are comprised of investments that are similar in nature to the instruments described under “— Securities, Short-term Investments,

Other Investments, Long-term Debt of CSEs and Trading Liabilities” and “— Derivatives — Freestanding Derivatives.” Separate account assets within

this level also include other limited partnership interests. Other limited partnership interests are valued giving consideration to the value of the

underlying holdings of the partnerships and by applying a premium or discount, if appropriate, for factors such as liquidity, bid/ask spreads, the

performance record of the fund manager or other relevant variables which may impact the exit value of the particular partnership interest.

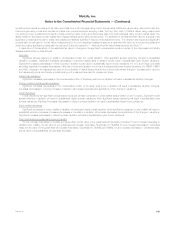

Derivatives

The estimated fair value of derivatives is determined through the use of quoted market prices for exchange-traded derivatives and interest rate

forwards to sell certain to be announced securities, or through the use of pricing models for OTC derivatives. The determination of estimated fair value,

when quoted market values are not available, is based on market standard valuation methodologies and inputs that management believes are

consistent with what other market participants would use when pricing such instruments. Derivative valuations can be affected by changes in interest

rates, foreign currency exchange rates, financial indices, credit spreads, default risk, nonperformance risk, volatility, liquidity and changes in estimates

and assumptions used in the pricing models. The valuation controls and procedures for derivatives are described in “— Investments.”

The significant inputs to the pricing models for most OTC derivatives are inputs that are observable in the market or can be derived principally from,

or corroborated by, observable market data. Significant inputs that are observable generally include: interest rates, foreign currency exchange rates,

interest rate curves, credit curves and volatility. However, certain OTC derivatives may rely on inputs that are significant to the estimated fair value that

are not observable in the market or cannot be derived principally from, or corroborated by, observable market data. Significant inputs that are

unobservable generally include references to emerging market currencies and inputs that are outside the observable portion of the interest rate curve,

credit curve, volatility or other relevant market measure. These unobservable inputs may involve significant management judgment or estimation. Even

though unobservable, these inputs are based on assumptions deemed appropriate given the circumstances and management believes they are

consistent with what other market participants would use when pricing such instruments.

The credit risk of both the counterparty and the Company are considered in determining the estimated fair value for all OTC derivatives, and any

potential credit adjustment is based on the net exposure by counterparty after taking into account the effects of netting agreements and collateral

arrangements. The Company values its derivatives using the standard swap curve which includes a spread to the risk free rate. This credit spread is

appropriate for those parties that execute trades at pricing levels consistent with the standard swap curve. As the Company and its significant derivative

counterparties consistently execute trades at such pricing levels, additional credit risk adjustments are not currently required in the valuation process.

The Company’s ability to consistently execute at such pricing levels is in part due to the netting agreements and collateral arrangements that are in place

with all of its significant derivative counterparties. An evaluation of the requirement to make additional credit risk adjustments is performed by the

Company each reporting period.

Most inputs for OTC derivatives are mid-market inputs but, in certain cases, bid level inputs are used when they are deemed more representative of

exit value. Market liquidity, as well as the use of different methodologies, assumptions and inputs, may have a material effect on the estimated fair values

of the Company’s derivatives and could materially affect net income.

Freestanding Derivatives

Level 2 Valuation Techniques and Key Inputs:

This level includes all types of derivatives utilized by the Company with the exception of exchange-traded derivatives and interest rate forwards to

sell certain to be announced securities included within Level 1 and those derivatives with unobservable inputs as described in Level 3. These

derivatives are principally valued using the income approach.

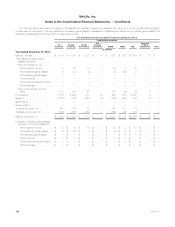

Interest rate

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve

and LIBOR basis curves.

Option-based. — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, LIBOR

basis curves and interest rate volatility.

Foreign currency exchange rate

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

LIBOR basis curves, currency spot rates and cross currency basis curves.

Option-based. — Valuations are based on option pricing models, which utilize significant inputs that may include the swap yield curve, LIBOR

basis curves, currency spot rates, cross currency basis curves and currency volatility.

Credit

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

credit curves and recovery rates.

Equity market

Non-option-based. — Valuations are based on present value techniques, which utilize significant inputs that may include the swap yield curve,

spot equity index levels and dividend yield curves.

MetLife, Inc. 145