MetLife 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

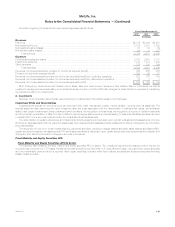

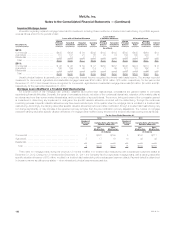

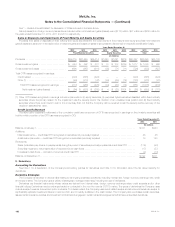

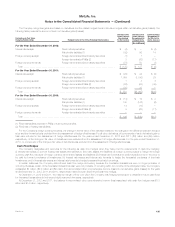

Securities Lending

As described in Note 1, the Company participates in a securities lending program. Elements of the securities lending program are presented below

at:

December 31,

2012 2011

(In millions)

Securities on loan: (1)

Amortized cost ....................................................................................... $23,380 $20,613

Estimated fair value .................................................................................... $27,077 $24,072

Cash collateral on deposit from counterparties (2) .............................................................. $27,727 $24,223

Security collateral on deposit from counterparties (3) ............................................................ $ 104 $ 371

Reinvestment portfolio — estimated fair value ................................................................. $28,112 $23,940

(1) Included within fixed maturity securities, equity securities and short-term investments.

(2) Included within payables for collateral under securities loaned and other transactions.

(3) Security collateral on deposit from counterparties may not be sold or repledged, unless the counterparty is in default, and is not reflected in the

consolidated financial statements.

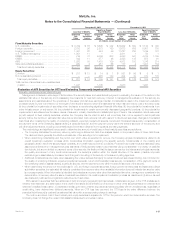

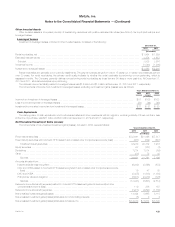

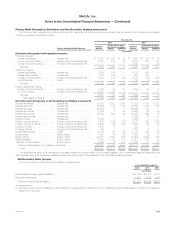

Invested Assets on Deposit, Held in Trust and Pledged as Collateral

Invested assets on deposit, held in trust and pledged as collateral are presented below at estimated fair value for cash and cash equivalents, short-

term investments, fixed maturity and equity securities, and FVO and trading securities, and at carrying value for mortgage loans.

December 31,

2012 2011

(In millions)

Invested assets on deposit (regulatory deposits) ............................................................... $ 2,362 $ 1,660

Invested assets held in trust (collateral financing arrangements and reinsurance agreements) ............................. 12,434 11,135

Invested assets pledged as collateral (1) ..................................................................... 23,251 29,899

Total invested assets on deposit, held in trust and pledged as collateral ............................................. $38,047 $42,694

(1) The Company has pledged fixed maturity securities, mortgage loans and cash and cash equivalents in connection with various agreements and

transactions, including funding and advances agreements (see Notes 4 and 12), collateral financing arrangements (see Note 13) and derivative

transactions (see Note 9).

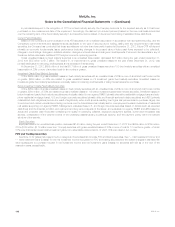

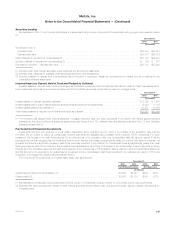

Purchased Credit Impaired Investments

Investments acquired with evidence of credit quality deterioration since origination and for which it is probable at the acquisition date that the

Company will be unable to collect all contractually required payments are classified as purchased credit impaired (“PCI”) investments. For each

investment, the excess of the cash flows expected to be collected as of the acquisition date over its acquisition-date fair value is referred to as the

accretable yield and is recognized as net investment income on an effective yield basis. If subsequently, based on current information and events, it is

probable that there is a significant increase in cash flows previously expected to be collected or if actual cash flows are significantly greater than cash

flows previously expected to be collected, the accretable yield is adjusted prospectively. The excess of the contractually required payments (including

interest) as of the acquisition date over the cash flows expected to be collected as of the acquisition date is referred to as the nonaccretable difference,

and this amount is not expected to be realized as net investment income. Decreases in cash flows expected to be collected can result in OTTI or the

recognition of mortgage loan valuation allowances (see Note 1).

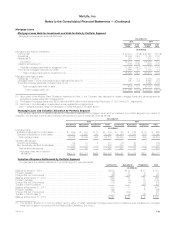

The Company’s PCI investments, by invested asset class, were as follows at:

December 31,

2012 2011 2012 2011

Fixed Maturity Securities Mortgage Loans

(In millions)

Outstanding principal and interest balance (1) ............................................... $4,905 $4,547 $440 $471

Carrying value (2) ..................................................................... $3,900 $3,130 $199 $173

(1) Represents the contractually required payments, which is the sum of contractual principal, whether or not currently due, and accrued interest.

(2) Estimated fair value plus accrued interest for fixed maturity securities and amortized cost, plus accrued interest, less any valuation allowances, for

mortgage loans.

MetLife, Inc. 125