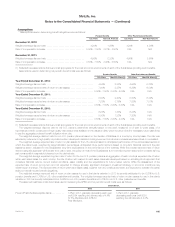

MetLife 2012 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

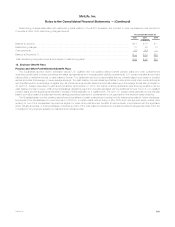

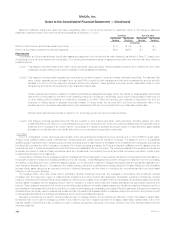

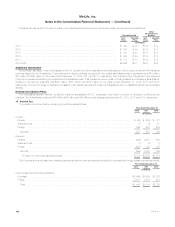

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Other Postretirement Benefits

Fixed Maturity

Securities:

Corporate Municipals Other (1) Derivative

Assets

(In millions)

Year Ended December 31, 2012:

Balance, January 1, .................................................... $ 4 $ 1 $ 5 $ 1

Realized gains (losses) .................................................. — — (2) 2

Unrealized gains (losses) ................................................ — — 2 (2)

Purchases, sales, issuances and settlements, net ............................ — — (2) (1)

Transfers into and/or out of Level 3 ........................................ — — — —

Balance, December 31, ................................................. $ 4 $ 1 $ 3 $—

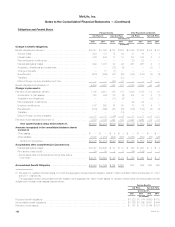

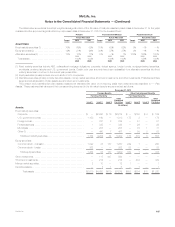

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Pension Benefits

Fixed Maturity

Securities: Equity

Securities:

Corporate Foreign

Bonds Other (1)

Common

Stock -

Domestic Other

Investments Derivative

Assets

(In millions)

Year Ended December 31, 2011:

Balance, January 1, ................................................. $49 $ 4 $2 $240 $471 $—

Realized gains (losses) ............................................... — — (1) (59) 85 2

Unrealized gains (losses) ............................................. (4) (1) 1 118 45 4

Purchases, sales, issuances and settlements, net .......................... (13) 2 (1) (93) (70) (2)

Transfers into and/or out of Level 3 ..................................... — — 1 — — —

Balance, December 31, .............................................. $32 $ 5 $2 $206 $531 $ 4

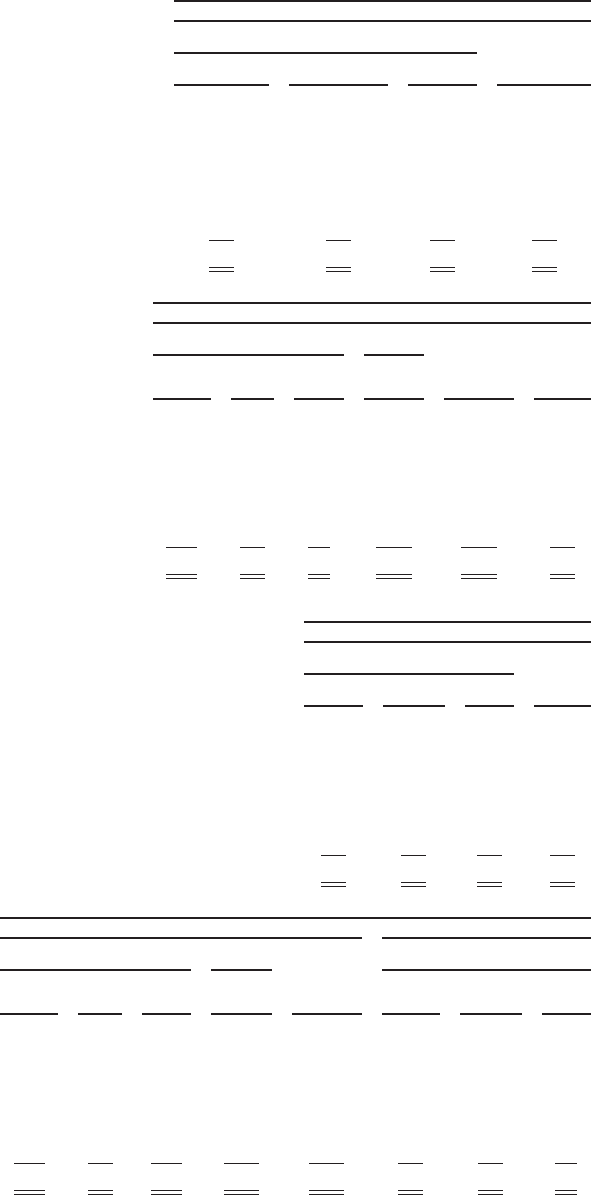

Fair Value Measurements Using Significant

Unobservable Inputs (Level 3)

Other Postretirement Benefits

Fixed Maturity

Securities:

Corporate Municipals Other (1) Derivative

Assets

(In millions)

Year Ended December 31, 2011:

Balance, January 1, ................................................................... $ 4 $ 1 $ 6 $—

Realized gains (losses) ................................................................. — — (1) —

Unrealized gains (losses) ................................................................ — — 1 1

Purchases, sales, issuances and settlements, net ............................................ — — (1) —

Transfers into and/or out of Level 3 ....................................................... — — — —

Balance, December 31, ................................................................ $ 4 $ 1 $ 5 $ 1

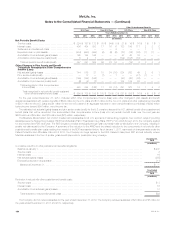

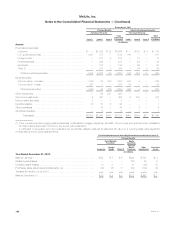

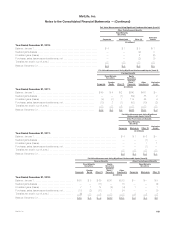

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Pension Benefits Other Postretirement Benefits

Fixed Maturity

Securities: Equity

Securities: Fixed Maturity

Securities:

Corporate Foreign

Bonds Other (1)

Common

Stock -

Domestic Other

Investments Corporate Municipals Other (1)

(In millions)

Year Ended December 31, 2010:

Balance, January 1, ............................... $68 $ 5 $69 $241 $373 $— $— $9

Realized gains (losses) ............................. — — (11) — 78 — — (4)

Unrealized gains (losses) ........................... 7 1 14 (2) (4) 1 — 1

Purchases, sales, issuances and settlements, net ........ (17) (2) (71) 1 24 — — (1)

Transfers into and/or out of Level 3 ................... (9) — 1 — — 3 1 1

Balance, December 31, ............................ $49 $ 4 $ 2 $240 $471 $ 4 $ 1 $ 6

MetLife, Inc. 189