MetLife 2012 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

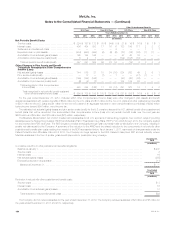

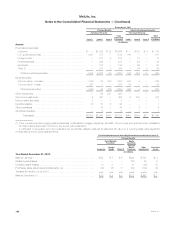

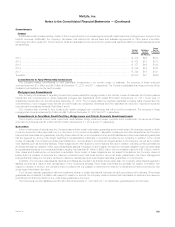

The reconciliation of the income tax provision at the U.S. statutory rate to the provision for income tax as reported for continuing operations was as

follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Tax provision at U.S. statutory rate ..................................................................... $505 $3,215 $1,306

Tax effect of:

Tax-exempt investment income ..................................................................... (256) (246) (242)

State and local income tax ......................................................................... (3) (4) 9

Prior year tax .................................................................................... 23 (4) 59

Tax credits ...................................................................................... (178) (138) (82)

Foreign tax rate differential .......................................................................... (45) (41) 37

Goodwill impairment .............................................................................. 408 — —

Deferred tax benefit of converting Japan branch to subsidiary .............................................. (324) — —

Change in valuation allowance ...................................................................... 15 16 7

Other, net ...................................................................................... (17) (5) 16

Provision for income tax expense (benefit) ........................................................... $128 $2,793 $1,110

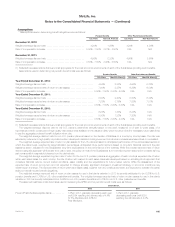

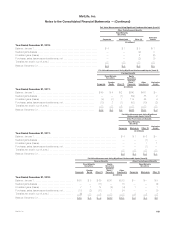

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred income tax

assets and liabilities consisted of the following at:

December 31,

2012 2011

(In millions)

Deferred income tax assets:

Policyholder liabilities and receivables ...................................................................... $ 6,233 $ 5,939

Net operating loss carryforwards .......................................................................... 1,408 1,595

Employee benefits ..................................................................................... 1,234 916

Capital loss carryforwards ............................................................................... 160 449

Tax credit carryforwards ................................................................................ 545 1,692

Litigation-related and government mandated ................................................................ 197 207

Other ............................................................................................... 484 483

Total gross deferred income tax assets .................................................................. 10,261 11,281

Less: Valuation allowance ............................................................................... 368 1,083

Total net deferred income tax assets .................................................................... 9,893 10,198

Deferred income tax liabilities:

Investments, including derivatives ......................................................................... 3,149 3,371

Intangibles ........................................................................................... 2,668 5,309

Net unrealized investment gains .......................................................................... 7,854 4,453

DAC ............................................................................................... 4,775 3,268

Other ............................................................................................... 140 192

Total deferred income tax liabilities ...................................................................... 18,586 16,593

Net deferred income tax asset (liability) ................................................................... $(8,693) $ (6,395)

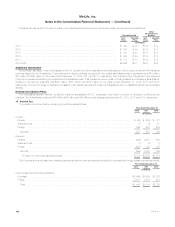

The following table sets forth the domestic, state, and foreign net operating and capital loss carryforwards for tax purposes at December 31, 2012.

Net Operating Loss

Carryforwards Capital Loss

Carryforwards

Amount Expiration Amount Expiration

(In millions) (In millions)

Domestic ............................................... $3,249 Beginning in 2018 $405 Beginning in 2014

State .................................................. $ 453 Beginning in 2013 $ — N/A

Foreign ................................................ $1,438 Beginning in 2013 $ 52 Beginning in 2014

Tax credit carryforwards of $545 million at December 31, 2012 will expire beginning in 2017.

For U.S. federal income tax purposes, the Company made an election under Section 338 of the Code (the “Section 338 Election”) relating to the

acquisition of American Life. Pursuant to such election, the historical tax basis in the acquired assets and liabilities was adjusted to the fair market value

as of the ALICO Acquisition Date resulting in a change to the related deferred income taxes.

MetLife, Inc. 193