MetLife 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

outstanding Debt Securities of the applicable tranche of the remarketed series, whether or not the holder participated in the remarketing and will become

effective on the settlement date of such remarketing. If the first remarketing attempt with respect to a series is unsuccessful, the applicable Purchase

Contract settlement date will be delayed for three calendar months, at which time a second remarketing attempt will occur in connection with settlement.

If the second remarketing attempt is unsuccessful, one additional delay may occur on the same basis. If both additional remarketing attempts are

unsuccessful, a “final failed remarketing” will have occurred, and the interest rate on such series of Debt Securities will not be reset and the holder may

put such series of Debt Securities to MetLife, Inc. at a price equal to its principal amount plus accrued and unpaid interest, if any, and apply the principal

amount against the holder’s obligations under the related Purchase Contract.

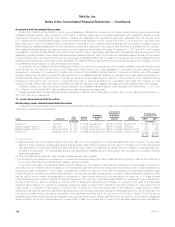

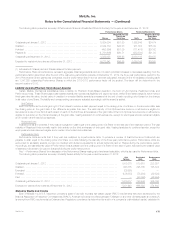

Remarketing of Debt Securities and Settlement of Purchase Contracts

In October 2012, MetLife, Inc. closed the successful remarketing of the Series C Debt Securities underlying the common equity units. The Series C

Debt Securities were remarketed as 1.756% Series C senior debt securities Tranche 1 and 3.048% Series C senior debt securities Tranche 2, due

December 2017 and December 2022, respectively. MetLife, Inc. did not receive any proceeds from the remarketing. Common equity unit holders used

the remarketing proceeds to settle their payment obligations under the applicable Series C Purchase Contracts. The subsequent settlement of the

Series C Purchase Contracts occurred in October 2012, providing proceeds to MetLife, Inc. of $1.0 billion in exchange for shares of MetLife, Inc.’s

common stock. MetLife, Inc. delivered 28,231,956 shares of its newly issued common stock to settle the stock purchase contracts.

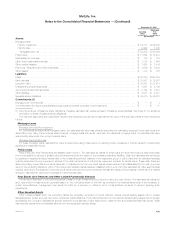

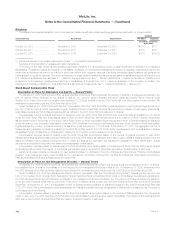

16. Equity

Preferred Stock

There are 200,000,000 authorized shares of preferred stock, of which 6,857,000 shares were designated for issuance of convertible preferred

stock in connection with the financing of the ALICO Acquisition in 2010. See “— Convertible Preferred Stock” below.

MetLife, Inc. has outstanding 24 million shares of Floating Rate Non-Cumulative Preferred Stock, Series A (the “Series A preferred shares”) with a

$0.01 par value per share, and a liquidation preference of $25 per share.

MetLife, Inc. has outstanding 60 million shares of 6.50% Non-Cumulative Preferred Stock, Series B (the “Series B preferred shares”), with a

$0.01 par value per share, and a liquidation preference of $25 per share.

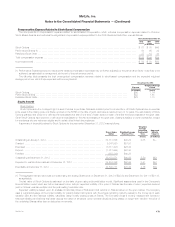

The preferred stock ranks senior to the common stock with respect to dividends and liquidation rights. Dividends on the preferred stock are not

cumulative. Holders of the preferred stock will be entitled to receive dividend payments only when, as and if declared by MetLife, Inc.’s Board of

Directors or a duly authorized committee of the Board. If dividends are declared on the Series A preferred shares, they will be payable quarterly, in

arrears, at an annual rate of the greater of: (i) 1.00% above three-month LIBOR on the related LIBOR determination date; or (ii) 4.00%. Any dividends

declared on the Series B preferred shares will be payable quarterly, in arrears, at an annual fixed rate of 6.50%. Accordingly, in the event that dividends

are not declared on the preferred stock for payment on any dividend payment date, then those dividends will cease to accrue and be payable. If a

dividend is not declared before the dividend payment date, MetLife, Inc. has no obligation to pay dividends accrued for that dividend period whether or

not dividends are declared and paid in future periods. No dividends may, however, be paid or declared on MetLife, Inc.’s common stock — or any other

securities ranking junior to the preferred stock — unless the full dividends for the latest completed dividend period on all preferred stock, and any parity

stock, have been declared and paid or provided for.

MetLife, Inc. is prohibited from declaring dividends on the preferred stock if it fails to meet specified capital adequacy, net income and equity levels.

See “— Dividend Restrictions.”

The preferred stock does not have voting rights except in certain circumstances where the dividends have not been paid for an equivalent of six or

more dividend payment periods whether or not those periods are consecutive. Under such circumstances, the holders of the preferred stock have

certain voting rights with respect to members of the Board of Directors of MetLife, Inc.

The preferred stock is not subject to any mandatory redemption, sinking fund, retirement fund, purchase fund or similar provisions. The preferred

stock is redeemable at MetLife, Inc.’s option in whole or in part, at a redemption price of $25 per share of preferred stock, plus declared and unpaid

dividends.

In December 2008, MetLife, Inc. entered into an RCC related to the preferred stock. As part of such RCC, MetLife, Inc. agreed that it will not repay,

redeem or purchase the preferred shares on or before December 31, 2018, unless, subject to certain limitations, it has received proceeds during a

specified period from the sale of specified replacement securities. The RCC is for the benefit of the holders of the related Covered Debt, which was

initially the Senior Notes. As a result of the issuance of the 10.750% JSDs, the 10.750% JSDs became the Covered Debt with respect to, and in

accordance with, the terms of the RCC relating to the preferred shares. The RCC will terminate upon the occurrence of certain events, including the

date on which MetLife, Inc. has no series of outstanding eligible debt securities.

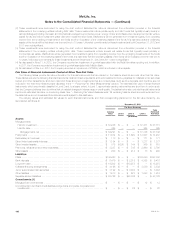

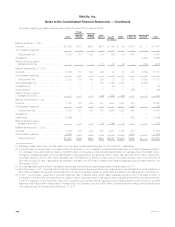

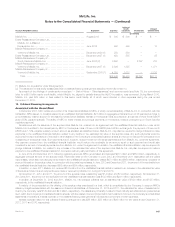

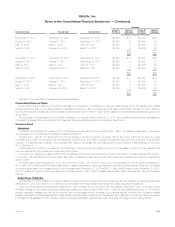

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Series A and Series B

preferred shares was as follows:

170 MetLife, Inc.