MetLife 2012 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

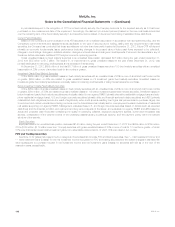

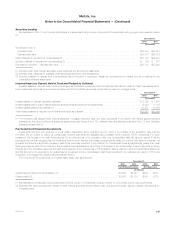

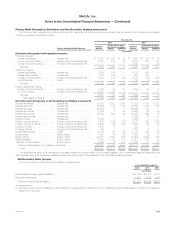

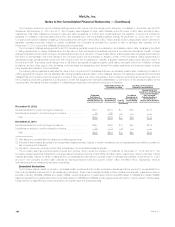

Net Investment Income

The components of net investment income were as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Investment income:

Fixed maturity securities ......................................................................... $15,218 $15,037 $12,407

Equity securities ............................................................................... 133 141 128

FVO and trading securities — Actively Traded Securities and FVO general account securities (1) ................ 88 31 73

Mortgage loans ............................................................................... 3,191 3,164 2,824

Policy loans .................................................................................. 626 641 649

Real estate and real estate joint ventures ............................................................ 834 688 372

Other limited partnership interests ................................................................. 845 681 879

Cash, cash equivalents and short-term investments ................................................... 163 167 101

International joint ventures ....................................................................... 19 (12) (92)

Other ....................................................................................... 131 178 236

Subtotal ................................................................................. 21,248 20,716 17,577

Less: Investment expenses .................................................................... 1,090 1,019 882

Subtotal, net .............................................................................. 20,158 19,697 16,695

FVO and trading securities — FVO contractholder-directed unit-linked investments (1) ......................... 1,473 (453) 372

Securitized reverse residential mortgage loans ........................................................ 177 — —

FVO CSEs - interest income:

Commercial mortgage loans .................................................................... 172 332 411

Securities ................................................................................... 4 9 15

Subtotal ................................................................................. 1,826 (112) 798

Net investment income .................................................................... $21,984 $19,585 $17,493

(1) Changes in estimated fair value subsequent to purchase for securities still held as of the end of the respective years included in net investment

income were:

Years Ended December 31,

2012 2011 2010

(In millions)

Actively Traded Securities and FVO general account securities ................................................. $ 51 $ (3) $ 30

FVO contractholder-directed unit-linked investments ......................................................... $1,170 $(647) $322

See “— Variable Interest Entities” for discussion of CSEs included in the table above.

128 MetLife, Inc.