MetLife 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

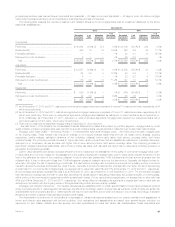

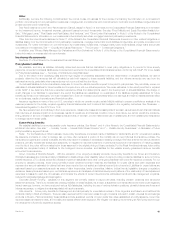

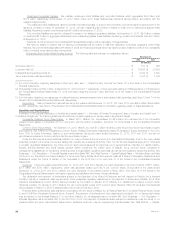

The table below contains the carrying value for guarantees at:

Future Policy Benefits Policyholder Account

Balances

December 31, December 31,

2012 2011 2012 2011

(In millions)

Americas:

GMDB .............................................................. $ 343 $ 249 $ — $ —

GMIB .............................................................. 1,432 723 200 988

GMAB .............................................................. — — 23 52

GMWB ............................................................. 30 19 428 710

Asia:

GMDB .............................................................. 54 58 — —

GMAB .............................................................. — — 11 11

GMWB ............................................................. 183 141 190 175

EMEA:

GMDB .............................................................. 6 4 — —

GMAB .............................................................. — — 28 168

GMWB ............................................................. 20 17 43 —

Corporate & Other:

GMDB .............................................................. 39 72 — —

GMAB .............................................................. — — 387 515

GMWB ............................................................. 95 30 2,195 1,825

Total ............................................................... $2,202 $1,313 $3,505 $4,444

The carrying amounts for guarantees included in PABs above include nonperformance risk adjustments of $1.2 billion and $2.9 billion at

December 31, 2012 and December 31, 2011, respectively. These nonperformance risk adjustments represent the impact of including a credit spread

when discounting the underlying risk neutral cash flows to determine the estimated fair values. Therefore, the amount of the nonperformance risk

adjustment is a function of both the size of the economic liability and credit spreads. In certain periods, changes in the nonperformance risk adjustment

can be a significant driver of net derivative gains (losses). Additionally, changes in the underlying cash flows can have a greater impact on the

nonperformance risk adjustment than changes in credit spreads. The nonperformance risk adjustment does not have an economic impact on us as it

cannot be monetized given the nature of these policyholder liabilities. The change in valuation arising from the nonperformance risk adjustment is not

hedged.

The carrying values of these guarantees can change significantly during periods of sizable and sustained shifts in equity market performance, equity

volatility, interest rates or foreign currency exchange rates. Carrying values are also impacted by our assumptions around mortality, separate account

returns and policyholder behavior including lapse rates.

The above mentioned actuarial assumptions are updated periodically as credible experience emerges which shows variances from the current

assumptions. Where appropriate, these assumptions are consistent with those used in DAC amortization. See “— Summary of Critical Accounting

Estimates — Deferred Policy Acquisition Costs and Value of Business Acquired.” The significant impacts to variable annuity guarantees from this year’s

update were primarily related to the inputs for policyholder behavior and separate account returns. For policyholder behavior, the most significant update

was to our lapse assumptions which included an update to reflect how policyholder surrender behavior has responded to in-the-moneyness of the

guarantees. Actual experience for this update has only begun to emerge as surrender charge periods have recently started to expire. With respect to

separate account returns, which only impact liabilities included in future policy benefits, in our Retail segment we have lowered our long-term return

assumptions from 7.5% to 7.25% to reflect the impact of the sustained low interest rate environment on the fixed income portion of the separate

accounts. The effect of an increase (decrease) by 100 basis points in the assumed future rate of separate account returns in our Retail segment is

reasonably likely to result in a decrease (increase) in future policy benefits of approximately $300 million.

As discussed below, we use a combination of product design, reinsurance, hedging strategies, and other risk management actions to mitigate the

risks related to these benefits. Within each type of guarantee, there is a range of product offerings reflecting the changing nature of these products over

time. Changes in product features and terms are in part driven by customer demand but, more importantly, reflect our risk management practices of

continuously evaluating the guaranteed benefits and their associated asset-liability matching.

The sections below provide further detail by total contract account value for certain of our most popular guarantees. Total contract account values

include amounts not reported in the consolidated balance sheets from assumed reinsurance, contractholder-directed investments which do not qualify

for presentation as separate account assets, and amounts included in our general account.

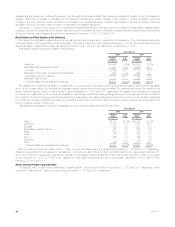

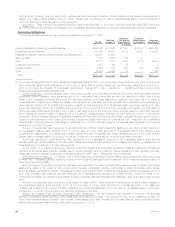

GMDB

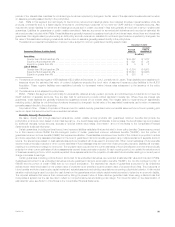

We offer a range of GMDB to our contractholders. The table below presents GMDB, by benefit type, at December 31, 2012:

Total Contract

Account Value (1)

Americas Corporate

& Other

(In millions)

Return of premium or five to seven year step-up .............................................. $ 94,334 $17,300

Annual step-up ........................................................................ 28,590 —

Roll-up and step-up combination .......................................................... 35,135 —

Total ............................................................................... $158,059 $17,300

(1) Total contract account value above excludes $2.3 billion for contracts with no GMDB and approximately $11 billion of total contract account value in

the EMEA and Asia regions.

Based on total contract account value, less than 40% of our GMDB included enhanced death benefits such as the annual step-up or roll-up and

step-up combination products. We expect the above GMDB risk profile to be relatively consistent for the foreseeable future.

52 MetLife, Inc.