MetLife 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

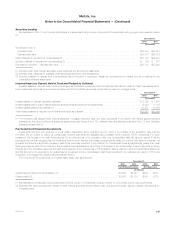

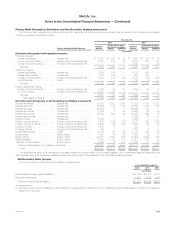

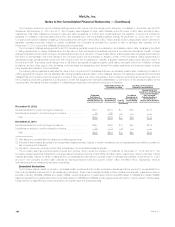

The following table presents earned income on derivatives for the:

Years Ended December 31,

2012 2011 2010

(In millions)

Qualifying hedges:

Net investment income ............................................................................... $111 $ 98 $ 83

Interest credited to policyholder account balances .......................................................... 164 214 233

Other expenses ..................................................................................... (5) (4) (6)

Non-qualifying hedges: .................................................................................

Net investment income ............................................................................... (6) (8) (3)

Other revenues ..................................................................................... 47 75 108

Net derivative gains (losses) ........................................................................... 476 411 65

Policyholder benefits and claims ........................................................................ (120) 17 —

Total ............................................................................................ $667 $803 $480

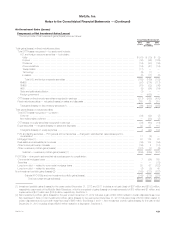

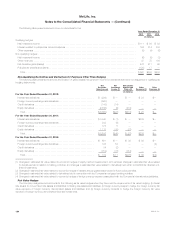

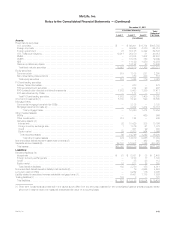

Non-Qualifying Derivatives and Derivatives for Purposes Other Than Hedging

The following table presents the amount and location of gains (losses) recognized in income for derivatives that were not designated or qualifying as

hedging instruments:

Net

Derivative

Gains (Losses)

Net

Investment

Income (1)

Policyholder

Benefits and

Claims (2) Other

Revenues (3) Other

Expenses (4)

(In millions)

For the Year Ended December 31, 2012:

Interest rate derivatives ............................................ $ (296) $ — $ — $ 28 $—

Foreign currency exchange rate derivatives ............................. (660) — — — —

Credit derivatives ................................................. (148) (14) — — —

Equity derivatives ................................................. (2,556) (9) (419) — —

Total ......................................................... $(3,660) $(23) $(419) $ 28 $—

For the Year Ended December 31, 2011:

Interest rate derivatives ............................................ $3,940 $ (1) $ — $236 $—

Foreign currency exchange rate derivatives ............................. 343 (9) — — —

Credit derivatives ................................................. 175 5 — — —

Equity derivatives ................................................. 1,178 (35) (87) — —

Total ......................................................... $5,636 $(40) $ (87) $236 $—

For the Year Ended December 31, 2010:

Interest rate derivatives ............................................ $ 691 $— $ 39 $ 89 $—

Foreign currency exchange rate derivatives ............................. 196 54 — — (4)

Credit derivatives ................................................. 34 (2) — — —

Equity derivatives ................................................. (782) (41) (314) — —

Total ......................................................... $ 139 $11 $(275) $ 89 $ (4)

(1) Changes in estimated fair value related to economic hedges of equity method investments in joint ventures; changes in estimated fair value related

to derivatives held in relation to trading portfolios; and changes in estimated fair value related to derivatives held within contractholder-directed unit-

linked investments.

(2) Changes in estimated fair value related to economic hedges of variable annuity guarantees included in future policy benefits.

(3) Changes in estimated fair value related to derivatives held in connection with the Company’s mortgage banking activities.

(4) Changes in estimated fair value related to economic hedges of foreign currency exposure associated with the Company’s international subsidiaries.

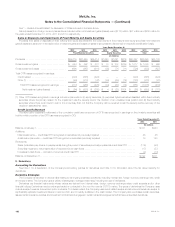

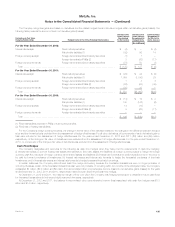

Fair Value Hedges

The Company designates and accounts for the following as fair value hedges when they have met the requirements of fair value hedging: (i) interest

rate swaps to convert fixed rate assets and liabilities to floating rate assets and liabilities; (ii) foreign currency swaps to hedge the foreign currency fair

value exposure of foreign currency denominated assets and liabilities; and (iii) foreign currency forwards to hedge the foreign currency fair value

exposure of foreign currency denominated fixed rate investments.

134 MetLife, Inc.