MetLife 2012 Annual Report Download - page 22

Download and view the complete annual report

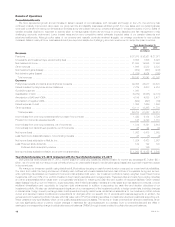

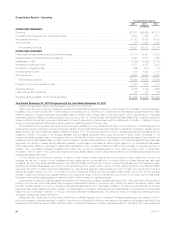

Please find page 22 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, we ceded the risk associated with certain of the variable annuities with guaranteed minimum benefits described in the preceding

paragraphs. The value of the embedded derivatives on the ceded risk is determined using a methodology consistent with that described previously for

the guarantees directly written by us with the exception of the input for nonperformance risk that reflects the credit of the reinsurer. Because certain of

the direct guarantees do not meet the definition of an embedded derivative and, thus are not accounted for at fair value, significant fluctuations in net

income may occur since the change in fair value of the embedded derivative on the ceded risk is being recorded in net income without a corresponding

and offsetting change in fair value of the direct guarantee.

See Note 9 of the Notes to the Consolidated Financial Statements for additional information on our derivatives and hedging programs.

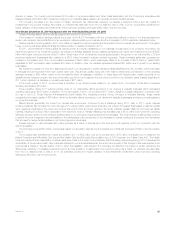

Goodwill

Goodwill is tested for impairment at least annually or more frequently if events or circumstances, such as adverse changes in the business climate,

indicate that there may be justification for conducting an interim test.

For purposes of goodwill impairment testing, if the carrying value of a reporting unit exceeds its estimated fair value, the implied fair value of the

reporting unit goodwill is compared to the carrying value of that goodwill to measure the amount of impairment loss, if any. In such instances, the implied

fair value of the goodwill is determined in the same manner as the amount of goodwill that would be determined in a business acquisition. The key

inputs, judgments and assumptions necessary in determining estimated fair value of the reporting units include projected operating earnings, current

book value, the level of economic capital required to support the mix of business, long-term growth rates, comparative market multiples, the account

value of in-force business, projections of new and renewal business, as well as margins on such business, the level of interest rates, credit spreads,

equity market levels, and the discount rate that we believe is appropriate for the respective reporting unit. The estimated fair values of the Retail Annuities

and Retail Life & Other reporting units are particularly sensitive to interest rate and equity market levels.

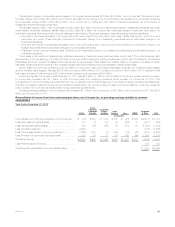

We performed the annual goodwill impairment test on our Retail Annuities reporting unit using both the market multiple and discounted cash flow

valuation approaches. Results for both approaches indicated that the fair value of the Retail Annuities reporting unit was below its carrying value. As a

result, an actuarial appraisal, which estimates the net worth of the reporting unit, the value of existing business and the value of new business, was

performed. This appraisal resulted in a fair value of the Retail Annuities reporting unit that was less than the carrying value, indicating a potential for

goodwill impairment. The actuarial appraisal reflected the expected market impact to a buyer of changes in the regulatory environment, continued low

interest rates for an extended period of time, and other market and economic factors. Specifically, in July 2012, the Department of Financial Services

initiated an inquiry into the use of captive or off-shore reinsurers, strategies many market participants have used for capital efficiency on variable annuity

products; the National Association of Insurance Commissioners (“NAIC”) has also been studying the use of captives. Additionally, in the third quarter of

2012, the Federal Reserve announced that it anticipated that low interest rates were likely to be warranted at least through mid-2015, extending the time

horizon from previous announcements and Moody’s changed its outlook for the U.S. life insurance industry to negative from stable, and stated that it

expects interest rates to remain in the low single digits for the next few years. As a result, we performed Step 2 of the goodwill impairment process,

which compares the implied fair value of the reporting unit’s goodwill with its carrying value. This analysis indicated that the recorded goodwill associated

with this reporting unit was not recoverable. Therefore, we recorded a non-cash charge of $1.9 billion ($1.6 billion, net of income tax) for the impairment

of the entire goodwill balance that is reported in goodwill impairment in the consolidated statements of operations and comprehensive income for the

year ended December 31, 2012.

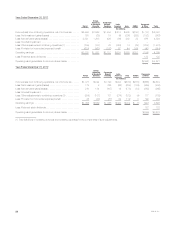

We performed the annual goodwill impairment test on our Retail Life reporting unit which passed both the market multiple valuation and the

discounted cash flow valuation approaches. The fair value of the reporting unit, calculated based on application of the discounted cash flow valuation

approach, exceeded the carrying value by approximately 3%. If we had assumed that the discount rate was 100 basis points higher than the discount

rate used, the fair value of the Retail Life reporting unit would have been less than the carrying value by approximately 1%.

In addition, we performed the annual goodwill impairment tests on our other reporting units using a market multiple and/or the discounted cash flow

approach and concluded that the fair values of all such reporting units were in excess of their carrying values and, therefore, goodwill was not impaired.

As anticipated, in the third quarter of 2012, we continued to realign certain products and businesses among our existing segments. As a result,

beginning in the third quarter of 2012, the Retail Life reporting unit was integrated with other products and businesses, including the Retail property &

casualty business, which is less sensitive to changes in interest rates. The amount of goodwill allocated to the Retail Life & Other reporting unit was

approximately $1.5 billion as of December 31, 2012. As a result of the realignment during the third quarter, we performed an analysis to identify all

reporting units under the revised structure. Based on a qualitative assessment performed, we concluded that there were no indicators of a scenario in

which it was more likely than not that any reporting units had a carrying value that exceeded fair value, and thus, no further impairment analysis was

performed. On an ongoing basis, we evaluate potential triggering events that may affect the estimated fair value of our reporting units to assess whether

any goodwill impairment exists.

We apply significant judgment when determining the estimated fair value of our reporting units and when assessing the relationship of market

capitalization to the aggregate estimated fair value of our reporting units. The valuation methodologies utilized are subject to key judgments and

assumptions that are sensitive to change. Estimates of fair value are inherently uncertain and represent only management’s reasonable expectation

regarding future developments. These estimates and the judgments and assumptions upon which the estimates are based will, in all likelihood, differ in

some respects from actual future results. Declines in the estimated fair value of our reporting units could result in goodwill impairments in future periods

which could materially adversely affect our results of operations or financial position.

See Note 11 of the Notes to the Consolidated Financial Statements for additional information on our goodwill.

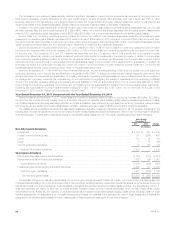

Employee Benefit Plans

Certain subsidiaries of MetLife, Inc. sponsor and/or administer various plans that provide defined benefit pension and other postretirement benefits

covering eligible employees and sales representatives. The calculation of the obligations and expenses associated with these plans requires an

extensive use of assumptions such as the discount rate, expected rate of return on plan assets, rate of future compensation increases and healthcare

cost trend rates, as well as assumptions regarding participant demographics such as rate and age of retirements, withdrawal rates and mortality. In

consultation with external actuarial firms, we determine these assumptions based upon a variety of factors such as historical experience of the plan and

its assets, currently available market and industry data, and expected benefit payout streams.

We determine the expected rate of return on plan assets based upon an approach that considers inflation, real return, term premium, credit spreads,

equity risk premium and capital appreciation, as well as expenses, expected asset manager performance, asset weights and the effect of rebalancing.

Given the amount of plan assets as of December 31, 2011, the beginning of the measurement year, if we had assumed an expected rate of return for

both our pension and other postretirement benefit plans that was 100 basis points higher or 100 basis points lower than the rates we assumed, the

change in our net periodic benefit costs would have been a decrease of $84 million and an increase of $84 million, respectively, in 2012. This

16 MetLife, Inc.