MetLife 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

In addition, the preferred stock and the junior subordinated debentures contain provisions that would automatically suspend the payment of

preferred stock dividends and junior subordinated debenture interest payments if MetLife, Inc. fails to meet certain risk based capital ratio, net income

and stockholders’ equity tests at specified times. In such cases, however, MetLife would be permitted to make the payments if it were able to utilize a

prescribed alternative payment mechanism. As a result of the suspension of these payments, the “dividend stopper” provisions would come into effect.

MetLife, Inc. is a party to certain replacement capital covenants which limit its ability to eliminate these restrictions through the repayment,

redemption or purchase of preferred stock or junior subordinated debentures by requiring MetLife, subject to certain limitations, to receive cash

proceeds during a specified period from the sale of specified replacement securities prior to any such repayment, redemption or purchase. See

“— Preferred Stock” for a description of such covenants in effect with respect to the preferred stock, and Note 14 for a description of such covenants in

effect with respect to junior subordinated debentures.

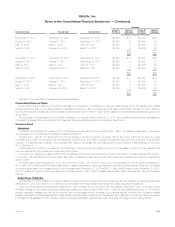

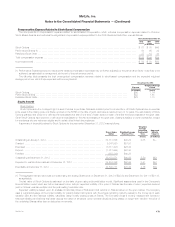

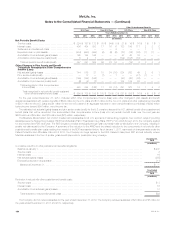

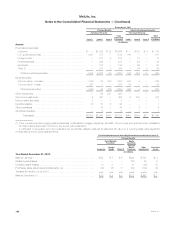

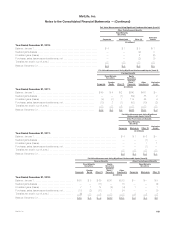

Other Comprehensive Income (Loss)

The following table sets forth the balance and changes in accumulated other comprehensive income (loss) including reclassification adjustments

required for the years ended December 31, 2012, 2011 and 2010 in other comprehensive income (loss) that are included as part of net income for the

current year that have been reported as a part of other comprehensive income (loss) in the current or prior year:

Years Ended December 31,

2012 2011 2010

(In millions)

Holding gains (losses) on investments arising during the year ............................................ $12,777 $13,945 $10,092

Income tax effect of holding gains (losses) ........................................................... (4,738) (4,783) (3,516)

Reclassification adjustments for recognized holding (gains) losses

included in current year income ................................................................. 53 755 (733)

Income tax effect of reclassification adjustments ...................................................... (20) (260) 255

Unrealized investment loss of subsidiary at the date of disposal .......................................... — (105) —

Income tax on unrealized investment loss of subsidiary at the date of disposal ............................... — 37 —

Allocation of holding (gains) losses on investments relating to other policyholder amounts ...................... (3,675) (6,248) (2,598)

Income tax effect of allocation of holding (gains) losses to other policyholder amounts ......................... 1,362 2,146 905

Allocation of holding (gains) losses on investments relating to other policyholder amounts of subsidiary at the date of

disposal ................................................................................... — 93 —

Income tax effect of allocation of holding (gains) losses on investments relating to

other policyholder amounts of subsidiary at the date of disposal ........................................ — (33) —

Net unrealized investment gains (losses), net of income tax.............................................. 5,759 5,547 4,405

Foreign currency translation adjustments, net of income tax expense (benefit)

of ($249) million, $162 million and ($226) million .................................................... 110 (146) (354)

Foreign currency translation adjustments of subsidiary at the date of disposal ............................... — (7) —

Defined benefit plans adjustment, net of income tax expense (benefit)

of ($296) million, ($266) million and $69 million ..................................................... (546) (494) 96

Other comprehensive income (loss), net of income tax ................................................. 5,323 4,900 4,147

Other comprehensive (income) loss attributable to noncontrolling interests .................................. (9) 38 (5)

Other comprehensive income (loss) attributable to MetLife, Inc.,

excluding cumulative effect of change in accounting principle .......................................... 5,314 4,938 4,142

Cumulative effect of change in accounting principle, net of income tax expense (benefit) of $0, $0 and $27 million

(see Note 1) ................................................................................ — — 52

Other comprehensive income (loss) attributable to MetLife, Inc. ........................................ $ 5,314 $ 4,938 $ 4,194

MetLife, Inc. 179