MetLife 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Forward-Looking Statements and Other Financial Information

For purposes of this discussion, “MetLife,” the “Company,” “we,” “our” and “us” refer to MetLife, Inc., a Delaware corporation incorporated in 1999,

its subsidiaries and affiliates. Following this summary is a discussion addressing the consolidated results of operations and financial condition of the

Company for the periods indicated. This discussion should be read in conjunction with “Note Regarding Forward-Looking Statements,” “Selected

Financial Data” and the Company’s consolidated financial statements included elsewhere herein, and “Risk Factors” included in MetLife’s Annual Report

for the year ended December 31, 2012 (the “2012 Form 10-K”).

This Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain or incorporate by reference information

that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or

current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and other words and terms of similar

meaning in connection with a discussion of future operating or financial performance. In particular, these include statements relating to future actions,

prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of

contingencies such as legal proceedings, trends in operations and financial results. Any or all forward-looking statements may turn out to be wrong.

Actual results could differ materially from those expressed or implied in the forward-looking statements. See “Note Regarding Forward-Looking

Statements.”

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes references to our performance measures,

operating earnings and operating earnings available to common shareholders, that are not based on accounting principles generally accepted in the

United States of America (“GAAP”). Operating earnings is the measure of segment profit or loss we use to evaluate segment performance and allocate

resources. Consistent with GAAP accounting guidance for segment reporting, operating earnings is our measure of segment performance. Operating

earnings is also a measure by which senior management’s and many other employees’ performance is evaluated for the purposes of determining their

compensation under applicable compensation plans. See “— Non-GAAP and Other Financial Disclosures” for definitions of such measures.

Executive Summary

MetLife is a leading global provider of insurance, annuities and employee benefit programs throughout the United States, Japan, Latin America, Asia,

Europe and the Middle East. Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, property & casualty insurance, and other

financial services to individuals, as well as group insurance and retirement & savings products and services to corporations and other institutions.

MetLife is organized into six segments, reflecting three broad geographic regions: Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit

Funding; and Latin America (collectively, the “Americas”); Asia; and Europe, the Middle East and Africa (“EMEA”). In addition, the Company reports

certain of its results of operations in Corporate & Other, which includes MetLife Bank, National Association (“MetLife Bank”) (see Note 3 of the Notes to

the Consolidated Financial Statements for information regarding MetLife Bank’s exit from certain of its businesses (the “MetLife Bank Divestiture”)) and

other business activities. Management continues to evaluate the Company’s segment performance and allocated resources and may adjust related

measurements in the future to better reflect segment profitability.

On November 1, 2010 (the “ALICO Acquisition Date”), MetLife, Inc. completed the acquisition of American Life Insurance Company (“American Life”)

from AM Holdings LLC (formerly known as ALICO Holdings LLC) (“AM Holdings”), a subsidiary of American International Group, Inc. (“AIG”), and

Delaware American Life Insurance Company (“DelAm”) from AIG (American Life, together with DelAm, collectively, “ALICO”) (the “ALICO Acquisition”).

The assets, liabilities and operating results relating to the ALICO Acquisition are included in the Latin America, Asia and EMEA segments. See Note 3 of

the Notes to the Consolidated Financial Statements.

Certain international subsidiaries have a fiscal year-end of November 30. Accordingly, the Company’s consolidated financial statements reflect the

assets and liabilities of such subsidiaries as of November 30, 2012 and 2011 and the operating results of such subsidiaries for the years ended

November 30, 2012, 2011 and 2010.

We continue to experience an increase in sales in several of our businesses; however, global economic conditions continue to negatively impact the

demand for some of our products. Portfolio growth, resulting from strong sales in the majority of our businesses, drove positive investment results and

higher asset-based fee revenue. Changes in interest rates and the impact of the nonperformance risk adjustment on variable annuity embedded

derivatives resulted in significant derivative losses. In addition, a goodwill impairment charge was recorded in the current year, as well as a charge

associated with the global review of assumptions related to deferred policy acquisition costs (“DAC”), reserves and certain intangibles.

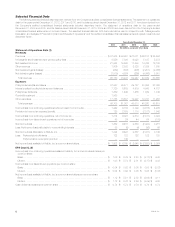

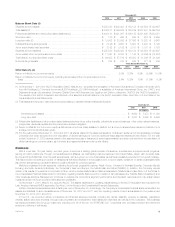

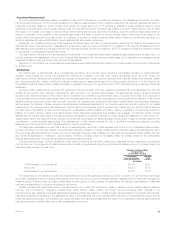

Years Ended December 31,

2012 2011 2010

(In millions)

Income (loss) from continuing operations, net of income tax ............................. $1,314 $ 6,391 $ 2,619

Less: Net investment gains (losses) ................................................ (352) (867) (408)

Less: Net derivative gains (losses) ................................................. (1,919) 4,824 (265)

Less: Goodwill impairment ....................................................... (1,868) — —

Less: Other adjustments to continuing operations (1) .................................. (2,550) (1,451) (708)

Less: Provision for income tax (expense) benefit ...................................... 2,195 (914) 304

Operating earnings ............................................................. 5,808 4,799 3,696

Less: Preferred stock dividends ................................................... 122 122 122

Operating earnings available to common shareholders ................................. $5,686 $ 4,677 $ 3,574

(1) See definitions of operating revenues and operating expenses for the components of such adjustments.

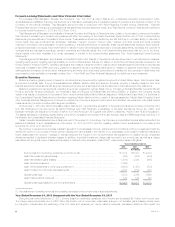

Year Ended December 31, 2012 Compared with the Year Ended December 31, 2011

During the year ended December 31, 2012, income (loss) from continuing operations, net of income tax, decreased $5.1 billion from the prior year.

The change was predominantly due to a $6.7 billion ($4.4 billion, net of income tax), unfavorable change in net derivative gains (losses) primarily driven

by changes in interest rates, the weakening of the U.S. dollar and Japanese yen, equity market movements, decreased volatility and the impact of a

6MetLife, Inc.