MetLife 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

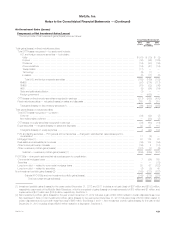

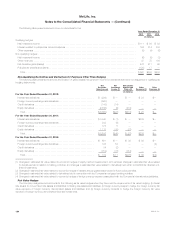

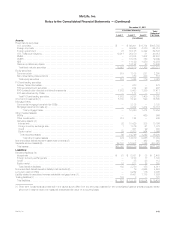

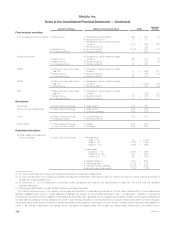

The following table presents the estimated fair value and balance sheet location of the Company’s embedded derivatives that have been separated

from their host contracts at:

December 31,

Balance Sheet Location 2012 2011

(In millions)

Net embedded derivatives within asset host contracts:

Ceded guaranteed minimum benefits .................... Premiums, reinsurance and other receivables $ 439 $ 327

Funds withheld on assumed reinsurance ................. Other invested assets 66 35

Options embedded in debt or equity securities ............. Investments (88) (70)

Other ............................................. Other invested assets 1 1

Net embedded derivatives within asset host contracts ......................................................... $ 418 $ 293

Net embedded derivatives within liability host contracts:

Direct guaranteed minimum benefits ..................... PABs $ 923 $2,104

Assumed guaranteed minimum benefits .................. PABs 2,582 2,340

Funds withheld on ceded reinsurance .................... Other liabilities 162 122

Other ............................................. PABs 17 18

Net embedded derivatives within liability host contracts ........................................................ $3,684 $4,584

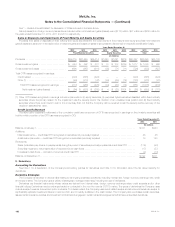

The following table presents changes in estimated fair value related to embedded derivatives:

Years Ended December 31,

2012 2011 2010

(In millions)

Net derivative gains (losses) (1) ....................................................................... $1,239 $(1,284) $(387)

Policyholder benefits and claims ...................................................................... $ 75 $ 86 $ 8

(1) The valuation of guaranteed minimum benefits includes a nonperformance risk adjustment. The amounts included in net derivative gains (losses), in

connection with this adjustment, were ($1.7) billion, $1.8 billion and ($96) million for the years ended December 31, 2012, 2011 and 2010,

respectively.

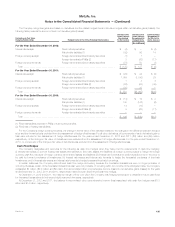

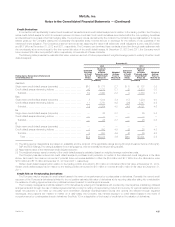

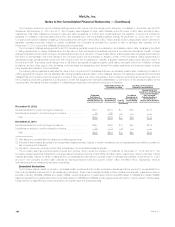

10. Fair Value

When developing estimated fair values, the Company considers three broad valuation techniques: (i) the market approach, (ii) the income approach,

and (iii) the cost approach. The Company determines the most appropriate valuation technique to use, given what is being measured and the availability

of sufficient inputs, giving priority to observable inputs. The Company categorizes its assets and liabilities measured at estimated fair value into a three-

level hierarchy, based on the significant input with the lowest level in its valuation. The input levels are as follows:

Level 1 Unadjusted quoted prices in active markets for identical assets or liabilities. The Company defines active markets based on average trading

volume for equity securities. The size of the bid/ask spread is used as an indicator of market activity for fixed maturity securities.

Level 2 Quoted prices in markets that are not active or inputs that are observable either directly or indirectly. These inputs can include quoted

prices for similar assets or liabilities other than quoted prices in Level 1, quoted prices in markets that are not active, or other significant

inputs that are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the

assets or liabilities.

Level 3 Unobservable inputs that are supported by little or no market activity and are significant to the determination of estimated fair value of the

assets or liabilities. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants

would use in pricing the asset or liability.

Financial markets are susceptible to severe events evidenced by rapid depreciation in asset values accompanied by a reduction in asset liquidity.

The Company’s ability to sell securities, or the price ultimately realized for these securities, depends upon the demand and liquidity in the market and

increases the use of judgment in determining the estimated fair value of certain securities.

Considerable judgment is often required in interpreting market data to develop estimates of fair value, and the use of different assumptions or

valuation methodologies may have a material effect on the estimated fair value amounts.

MetLife, Inc. 139