MetLife 2012 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

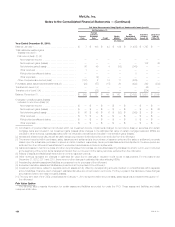

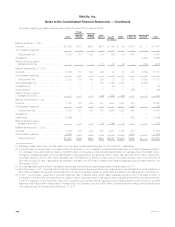

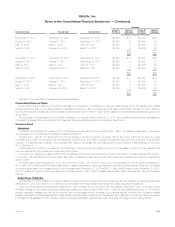

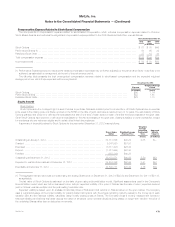

Short-term Debt

Short-term debt with maturities of one year or less was as follows:

December 31,

2012 2011

(In millions)

Commercial paper ..................................................................................... $ 100 $ 101

MetLife Bank, N.A. - Advances agreements with the FHLB of NY ................................................. — 585

Total short-term debt ................................................................................... $ 100 $ 686

Average daily balance ................................................................................... $ 119 $ 447

Average days outstanding ............................................................................... 40days 19 days

During the years ended December 31, 2012, 2011 and 2010, the weighted average interest rate on short-term debt was 0.17%, 0.33% and

0.35%, respectively.

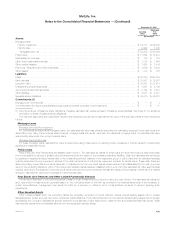

Interest Expense

Interest expense related to long-term and short-term debt included in other expenses was $871 million, $975 million and $815 million for the years

ended December 31, 2012, 2011 and 2010, respectively. Such amounts do not include interest expense on collateral financing arrangements, junior

subordinated debt securities, common equity units or long-term debt related to CSEs. See Notes 8, 13, 14 and 15.

Credit and Committed Facilities

The Company maintains unsecured credit facilities and committed facilities, which aggregated $4.0 billion and $12.4 billion, respectively, at

December 31, 2012. When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements.

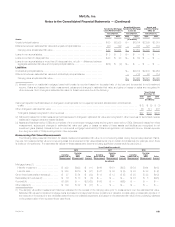

Credit Facilities

The unsecured credit facilities are used for general corporate purposes, to support the borrowers’ commercial paper programs and for the issuance

of letters of credit. Total fees expensed associated with these credit facilities were $30 million, $35 million and $17 million for the years ended

December 31, 2012, 2011 and 2010, respectively, and are included in other expenses. Information on these credit facilities at December 31, 2012

was as follows:

Borrower(s) Expiration Capacity

Letter of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. ............................ September 2017 (1) $1,000 $ 365 $— $ 635

MetLife, Inc. and MetLife Funding, Inc. ............................ August 2016 3,000 2,203 — 797

Total .................................................... $4,000 $2,568 $— $1,432

(1) In September 2012, MetLife, Inc. and MetLife Funding, Inc. entered into a $1.0 billion five-year credit agreement which amended and restated the

three-year agreement dated October 2010. All borrowings under the 2012 five-year credit agreement must be repaid by September 2017, except

that letters of credit outstanding on that date may remain outstanding until no later than September 2018. MetLife, Inc. incurred costs of $4 million

related to the amended and restated credit facility, which have been capitalized and included in other assets. These costs will be amortized over the

remaining term of the amended and restated credit facility.

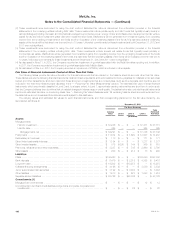

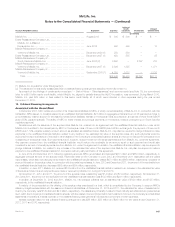

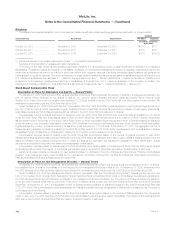

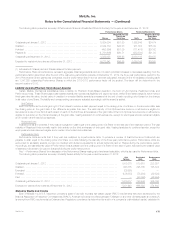

Committed Facilities

The committed facilities are used for collateral for certain of the Company’s affiliated reinsurance liabilities. Total fees expensed associated with these

committed facilities were $96 million, $93 million and $92 million for the years ended December 31, 2012, 2011 and 2010, respectively, and are

included in other expenses. Information on these committed facilities at December 31, 2012 was as follows:

166 MetLife, Inc.