MetLife 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

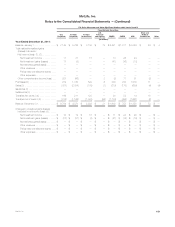

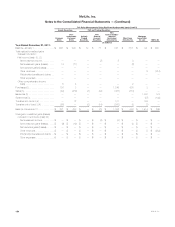

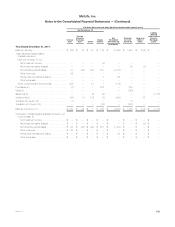

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

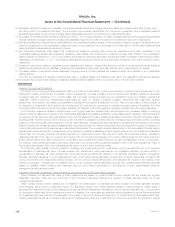

on the underlying assets, interest rates and market volatility may result in significant fluctuations in the estimated fair value of these embedded derivatives

that could materially affect net income.

The estimated fair value of the embedded equity and bond indexed derivatives contained in certain funding agreements is determined using market

standard swap valuation models and observable market inputs, including a nonperformance risk adjustment. The estimated fair value of these

embedded derivatives are included, along with their funding agreements host, within PABs with changes in estimated fair value recorded in net

derivative gains (losses). Changes in equity and bond indices, interest rates and the Company’s credit standing may result in significant fluctuations in

the estimated fair value of these embedded derivatives that could materially affect net income.

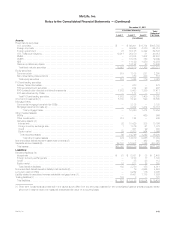

Embedded Derivatives Within Asset and Liability Host Contracts

Level 3 Valuation Techniques and Key Inputs:

Direct and Assumed Guaranteed Minimum Benefits

These embedded derivatives are principally valued using the income approach. Valuations are based on option pricing techniques, which

utilize significant inputs that may include swap yield curve, currency exchange rates and implied volatilities. These embedded derivatives result

in Level 3 classification because one or more of the significant inputs are not observable in the market or cannot be derived principally from, or

corroborated by, observable market data. Significant unobservable inputs generally include: the extrapolation beyond observable limits of the

swap yield curve and implied volatilities, actuarial assumptions for policyholder behavior and mortality and the potential variability in policyholder

behavior and mortality, nonperformance risk and cost of capital for purposes of calculating the risk margin.

Reinsurance Ceded on Certain Guaranteed Minimum Benefits

These embedded derivatives are principally valued using the income approach. The valuation techniques and significant market standard

unobservable inputs used in their valuation are similar to those described above in “— Direct and Assumed Guaranteed Minimum Benefits”

and also include counterparty credit spreads.

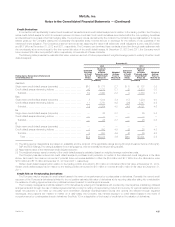

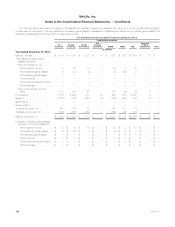

Transfers between Levels

Overall, transfers between levels occur when there are changes in the observability of inputs and market activity. Transfers into or out of any level

are assumed to occur at the beginning of the period.

Transfers between Levels 1 and 2:

Transfers between Levels 1 and 2 were not significant for assets and liabilities measured at estimated fair value and still held at December 31,

2012 and 2011.

Transfers into or out of Level 3:

Transfers into or out of Level 3 are presented in the tables which follow. Assets and liabilities are transferred into Level 3 when a significant input

cannot be corroborated with market observable data. This occurs when market activity decreases significantly and underlying inputs cannot be

observed, current prices are not available, and/or when there are significant variances in quoted prices, thereby affecting transparency. Assets and

liabilities are transferred out of Level 3 when circumstances change such that a significant input can be corroborated with market observable data.

This may be due to a significant increase in market activity, a specific event, or one or more significant input(s) becoming observable.

Transfers into Level 3 for fixed maturity securities and separate account assets were due primarily to a lack of trading activity, decreased liquidity

and credit ratings downgrades (e.g., from investment grade to below investment grade) which have resulted in decreased transparency of valuations

and an increased use of independent non-binding broker quotations and unobservable inputs, such as illiquidity premiums, delta spread adjustments,

or spreads from below investment grade curves.

Transfers out of Level 3 for fixed maturity securities and separate account assets resulted primarily from increased transparency of both new

issuances that, subsequent to issuance and establishment of trading activity, became priced by independent pricing services and existing issuances

that, over time, the Company was able to obtain pricing from, or corroborate pricing received from, independent pricing services with observable

inputs or increases in market activity and upgraded credit ratings.

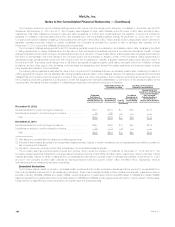

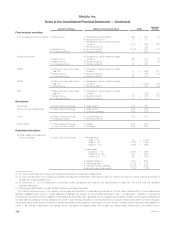

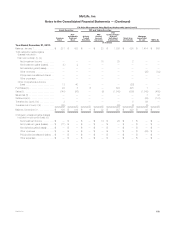

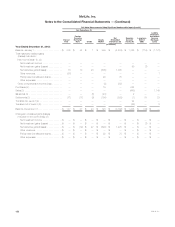

Assets and Liabilities Measured at Fair Value Using Significant Unobservable Inputs (Level 3)

The following table presents certain quantitative information about the significant unobservable inputs used in the fair value measurement for the

more significant asset and liability classes measured at fair value on a recurring basis using significant unobservable inputs (Level 3) at December 31,

2012.

MetLife, Inc. 147