MetLife 2012 Annual Report Download - page 18

Download and view the complete annual report

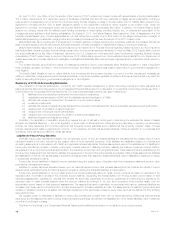

Please find page 18 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On April 13, 2011, the Office of the Comptroller of the Currency (“OCC”) entered into consent orders with several banks, including MetLife Bank.

The consent orders require an independent review of foreclosure practices and set forth new residential mortgage servicing standards, including a

requirement for a designated point of contact for a borrower during the loss mitigation process. In the first quarter of 2013, MetLife Bank entered intoan

agreement in principle with the OCC to settle obligations related to the independent foreclosure review required by its consent order. Under the

agreement in principle, the foreclosure review will end and MetLife Bank will pay approximately $46 million. In addition, the Federal Reserve Board

entered into consent orders with the affiliated bank holding companies of these banks, including MetLife, Inc., to enhance the supervision of the

mortgage servicing activities of their banking subsidiaries. On August 6, 2012, the Federal Reserve Board issued an Order of Assessment of a Civil

Monetary Penalty Issued Upon Consent against MetLife, Inc. that will impose a penalty of up to $3.2 million for the alleged deficiencies in oversight of

MetLife Bank’s servicing of residential mortgage loans and processing foreclosures that were the subject of the 2011 consent order.

MetLife Bank also had a meeting with the Department of Justice regarding mortgage servicing and foreclosure practices. It is possible that various

state or federal regulatory and law enforcement authorities may seek monetary penalties from MetLife Bank relating to foreclosure practices.

MetLife Bank has also responded to a subpoena issued by the Department of Financial Services regarding hazard insurance and flood insurance

that MetLife Bank obtains to protect the lienholder’s interest when the borrower’s insurance has lapsed. In April and May 2012, MetLife Bank received

two subpoenas issued by the Office of Inspector General for the U.S. Department of Housing and Urban Development regarding Federal Housing

Administration (“FHA”) insured loans. In June and September 2012, MetLife Bank received two Civil Investigative Demands that the U.S. Department of

Justice issued as part of a False Claims Act investigation of allegations that MetLife Bank had improperly originated and/or underwritten loans insured by

the FHA.

The consent decrees, as well as the inquiries or investigations referred to above, could adversely affect MetLife’s reputation or result in significant

fines, penalties, equitable remedies or other enforcement actions, and result in significant legal costs in responding to governmental investigations or

other litigation.

The MetLife Bank Divestiture may not relieve MetLife from complying with the consent decrees, or protect it from the inquiries and investigations

relating to residential mortgage servicing and foreclosure activities, or any fines, penalties, equitable remedies or enforcement actions that may result, the

costs of responding to any such governmental investigations, or other litigation.

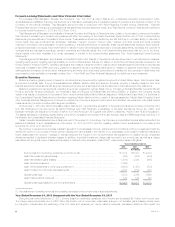

Summary of Critical Accounting Estimates

The preparation of financial statements in conformity with GAAP requires management to adopt accounting policies and make estimates and

assumptions that affect amounts reported in the Consolidated Financial Statements. For a discussion of our significant accounting policies, see Note 1

of the Notes to the Consolidated Financial Statements. The most critical estimates include those used in determining:

(i) liabilities for future policyholder benefits and the accounting for reinsurance;

(ii) capitalization and amortization of DAC and the establishment and amortization of VOBA;

(iii) estimated fair values of investments in the absence of quoted market values;

(iv) investment impairments;

(v) estimated fair values of freestanding derivatives and the recognition and estimated fair value of embedded derivatives requiring bifurcation;

(vi) measurement of goodwill and related impairment;

(vii) measurement of employee benefit plan liabilities;

(viii) measurement of income taxes and the valuation of deferred tax assets; and

(ix) liabilities for litigation and regulatory matters.

In addition, the application of acquisition accounting requires the use of estimation techniques in determining the estimated fair values of assets

acquired and liabilities assumed — the most significant of which relate to aforementioned critical accounting estimates. In applying our accounting

policies, we make subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many of these

policies, estimates and related judgments are common in the insurance and financial services industries; others are specific to our business and

operations. Actual results could differ from these estimates.

Liability for Future Policy Benefits

Generally, future policy benefits are payable over an extended period of time and related liabilities are calculated as the present value of future

expected benefits to be paid, reduced by the present value of future expected premiums. Such liabilities are established based on methods and

underlying assumptions in accordance with GAAP and applicable actuarial standards. Principal assumptions used in the establishment of liabilities for

future policy benefits are mortality, morbidity, policy lapse, renewal, retirement, disability incidence, disability terminations, investment returns, inflation,

expenses and other contingent events as appropriate to the respective product type and geographical area. These assumptions are established at the

time the policy is issued and are intended to estimate the experience for the period the policy benefits are payable. Utilizing these assumptions, liabilities

are established on a block of business basis. If experience is less favorable than assumed, additional liabilities may be established, resulting in a charge

to policyholder benefits and claims.

Future policy benefit liabilities for disabled lives are estimated using the present value of benefits method and experience assumptions as to claim

terminations, expenses and interest.

Liabilities for unpaid claims are estimated based upon our historical experience and other actuarial assumptions that consider the effects of current

developments, anticipated trends and risk management programs, reduced for anticipated salvage and subrogation.

Future policy benefit liabilities for minimum death and income benefit guarantees relating to certain annuity contracts are based on estimates of the

expected value of benefits in excess of the projected account balance, recognizing the excess ratably over the accumulation period based on total

expected assessments. Liabilities for universal and variable life secondary guarantees and paid-up guarantees are determined by estimating the

expected value of death benefits payable when the account balance is projected to be zero and recognizing those benefits ratably over the

accumulation period based on total expected assessments. The assumptions used in estimating the secondary and paid-up guarantee liabilities are

consistent with those used for amortizing DAC, and are thus subject to the same variability and risk. The assumptions of investment performance and

volatility for variable products are consistent with historical experience of the appropriate underlying equity index, such as the Standard & Poor’s Rating

Services 500 Index.

We regularly review our estimates of liabilities for future policy benefits and compare them with our actual experience. Differences between actual

experience and the assumptions used in pricing these policies and guarantees, as well as in the establishment of the related liabilities, result in variances

in profit and could result in losses.

See Note 4 of the Notes to the Consolidated Financial Statements for additional information on our liability for future policy benefits.

12 MetLife, Inc.