MetLife 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

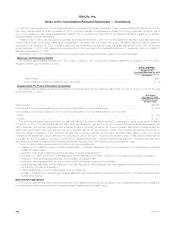

Group, Voluntary & Worksite Benefits

The Group, Voluntary & Worksite Benefits segment offers a broad range of protection products and services to individuals and corporations, as well

as other institutions and their respective employees, and is organized into two businesses: Group and Voluntary & Worksite. Group insurance products

and services include variable life, universal life and term life products. Group insurance products and services also include dental, group short- and

long-term disability and accidental death & dismemberment coverages. The Voluntary & Worksite business includes personal lines property & casualty

insurance, including private passenger automobile, homeowners and personal excess liability insurance offered to employees on a voluntary basis. The

Voluntary & Worksite business also includes LTC, prepaid legal plans and critical illness products.

Corporate Benefit Funding

The Corporate Benefit Funding segment offers a broad range of annuity and investment products, including guaranteed interest products and other

stable value products, income annuities, and separate account contracts for the investment management of defined benefit and defined contribution

plan assets. This segment also includes certain products to fund postretirement benefits and company-, bank- or trust-owned life insurance used to

finance non-qualified benefit programs for executives.

Latin America

The Latin America segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective

employees, which include life insurance, accident and health insurance, group medical, dental, credit insurance, endowment and retirement & savings

products.

Asia

The Asia segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective employees,

which include whole life, term life, variable life, universal life, accident and health insurance, fixed and variable annuities and endowment products.

EMEA

The EMEA segment offers a broad range of products to both individuals and corporations, as well as other institutions and their respective

employees, which include life insurance, accident and health insurance, credit insurance, annuities, endowment and retirement & savings products.

Corporate & Other

In addition, the Company reports certain of its results of operations in Corporate & Other, which includes MetLife Bank, National Association (“MetLife

Bank”) (see Note 3) and other business activities. Corporate & Other contains the excess capital not allocated to the segments, external integration

costs, internal resource costs for associates committed to acquisitions, enterprise-wide strategic initiative restructuring charges, and various start-up and

certain run-off entities. Corporate & Other also includes assumed reinsurance of certain variable annuity products from the Company’s former operating

joint venture in Japan. Under this in-force reinsurance agreement, the Company reinsures living and death benefit guarantees issued in connection with

variable annuity products. Additionally, Corporate & Other includes interest expense related to the majority of the Company’s outstanding debt,

expenses associated with certain legal proceedings and income tax audit issues. Corporate & Other also includes the elimination of intersegment

amounts, which generally relate to intersegment loans, which bear interest rates commensurate with related borrowings.

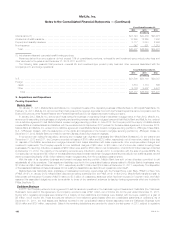

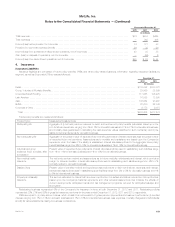

Financial Measures and Segment Accounting Policies

Operating earnings is the measure of segment profit or loss the Company uses to evaluate segment performance and allocate resources.

Consistent with GAAP guidance for segment reporting, operating earnings is the Company’s measure of segment performance and is reported below.

Operating earnings should not be viewed as a substitute for GAAP income (loss) from continuing operations, net of income tax. The Company believes

the presentation of operating earnings as the Company measures it for management purposes enhances the understanding of its performance by

highlighting the results of operations and the underlying profitability drivers of the business.

Operating earnings is defined as operating revenues less operating expenses, both net of income tax.

Operating revenues and operating expenses exclude results of discontinued operations and other businesses that have been or will be sold or

exited by MetLife, Inc. Operating revenues also excludes net investment gains (losses) and net derivative gains (losses). Operating expenses also

excludes goodwill impairments.

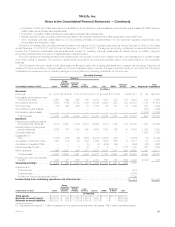

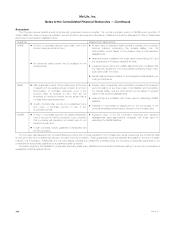

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

‰Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and

net derivative gains (losses) and certain variable annuity GMIB fees (“GMIB Fees”);

‰Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are

hedges of investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes

certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that

are VIEs consolidated under GAAP; and

‰Other revenues are adjusted for settlements of foreign currency earnings hedges.

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

‰Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment

gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed

investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of

assets, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or

terminations of contracts (“Market Value Adjustments”);

‰Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium

on derivatives that are hedges of PABs but do not qualify for hedge accounting treatment and excludes amounts related to net investment income

earned on contractholder-directed unit-linked investments;

96 MetLife, Inc.