MetLife 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

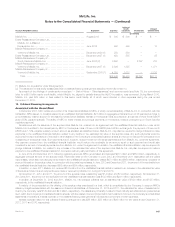

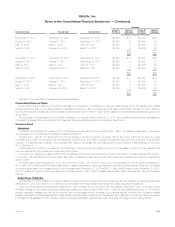

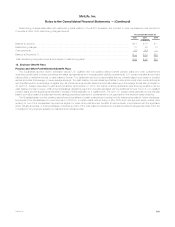

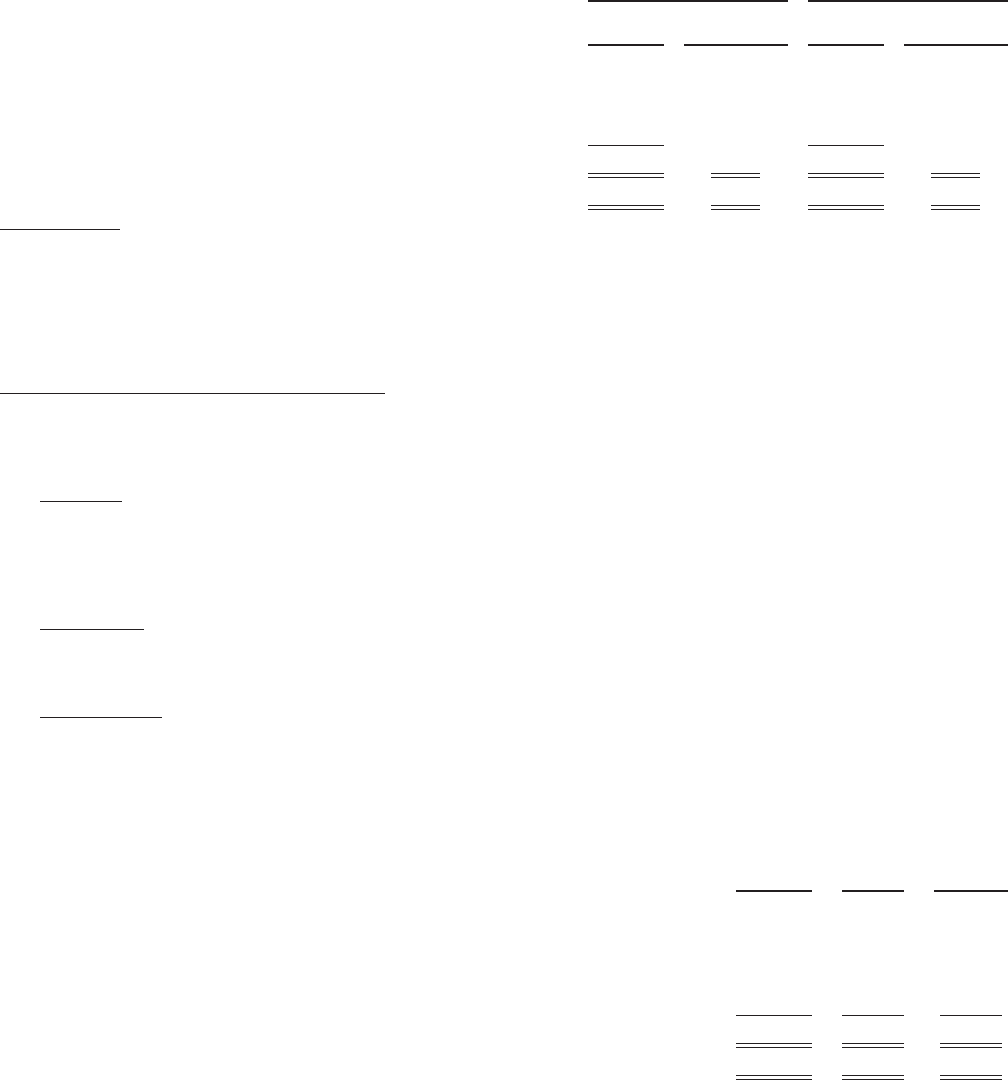

The following table presents a summary of Performance Share and Restricted Stock Unit activity for the year ended December 31, 2012:

Performance Shares Restricted Stock Units

Shares

Weighted Average

Grant Date

Fair Value Units

Weighted Average

Grant Date

Fair Value

Outstanding at January 1, 2012 .......................................... 5,024,094 $31.50 1,562,849 $34.74

Granted ............................................................. 2,042,133 $35.38 971,304 $35.39

Forfeited ............................................................ (452,590) $37.36 (171,475) $37.62

Payable (1) .......................................................... (1,791,609) $20.71 (282,530) $21.88

Outstanding at December 31, 2012 ....................................... 4,822,028 $36.93 2,080,148 $36.55

Expected to vest at a future date as of December 31, 2012 .................... 4,817,941 $36.98 2,080,148 $36.55

(1) Includes both Shares paid and Shares deferred for later payment.

Performance Share amounts above represent aggregate initial target awards and do not reflect potential increases or decreases resulting from the

performance factor determined after the end of the respective performance periods. At December 31, 2012, the three year performance period for the

2010 Performance Share grants was completed, but the performance factor had not yet been calculated. Included in the immediately preceding table

are 1,347,025 outstanding Performance Shares to which the 2010-2012 performance factor will be applied. The factor will be determined in the

second quarter of 2013.

Liability Awards (Phantom Stock-Based Awards)

Certain MetLife international subsidiaries have a liability for Phantom Stock-Based Awards in the form of Unit Options, Restricted Units, and

Performance Units. These Share-based cash settled awards are recorded as liabilities until payout is made. Unlike Share-settled awards, which have a

fixed grant-date fair value, the fair value of unsettled or unvested liability awards is remeasured at the end of each reporting period based on the change

in fair value of one Share. The liability and corresponding expense are adjusted accordingly until the award is settled.

Unit Options

Each Unit Option is the contingent right of the holders to receive a cash payment equal to the closing price of a Share on the surrender date, less

the closing price on the grant date, if the difference is greater than zero. The vast majority of Unit Options have become or will become eligible for

surrender at a rate of one-third of each award on each of the first three anniversaries of the grant date. Other Unit Options have become or will become

eligible for surrender on the third anniversary of the grant date. Vesting is subject to continued service, except for employees who are retirement eligible

and in certain other limited circumstances.

Restricted Units

Restricted Units are units that, if they vest, are payable in cash equal to the closing price of a Share on the last day of the restriction period. The vast

majority of Restricted Units normally vest in their entirety on the third anniversary of their grant date. Vesting is subject to continued service, except for

employees who are retirement eligible and in certain other limited circumstances.

Performance Units

Performance Units are units that, if they vest, are multiplied by a performance factor to produce a number of final Performance Units which are

payable in cash equal to the closing price of a Share on a date following the last day of the three-year performance period. Performance Units are

accounted for as liability awards, but are not credited with dividend-equivalents for actual dividends paid on Shares during the performance period.

Accordingly, the estimated fair value of Performance Units is based upon the closing price of a Share on the date of grant, reduced by the present value

of estimated dividends to be paid on that stock during the performance period.

See “— Performance Shares” for a discussion of the Performance Shares vesting period and award calculation, which is also used for Performance Units.

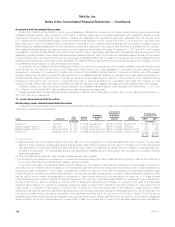

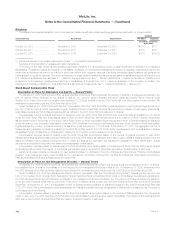

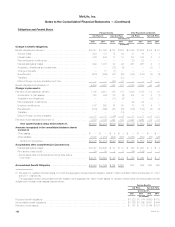

The following table presents a summary of Liability Award activity for the year ended December 31, 2012:

Unit

Options Restricted

Units Performance

Units

Outstanding at January 1, 2012 .......................................................... 1,083,370 510,681 233,257

Granted ............................................................................. 440,185 395,765 158,724

Exercised ............................................................................ (26,855) — —

Forfeited ............................................................................. (126,383) (75,930) (39,823)

Paid ................................................................................ — (90,080) (46,994)

Outstanding at December 31, 2012 ....................................................... 1,370,317 740,436 305,164

Expected to vest at a future date as of December 31, 2012 ..................................... 1,281,440 666,392 274,648

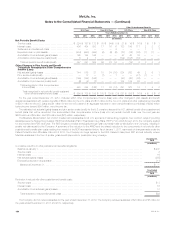

Statutory Equity and Income

Each of MetLife, Inc.’s U.S. insurance company’s state of domicile imposes risk-based capital (“RBC”) requirements that were developed by the

National Association of Insurance Commissioners (“NAIC”). American Life does not write business in Delaware or any other domestic state and, as such,

is exempt from RBC requirements by Delaware law. Regulatory compliance is determined by a ratio of a company’s total adjusted capital, calculated in

MetLife, Inc. 175