MetLife 2012 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

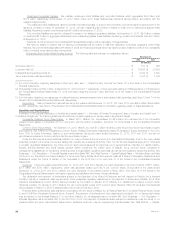

Related Risks — We Have Been, and May Continue to be, Prevented from Repurchasing Our Stock and Paying Dividends at the Level We Wish as

a Result of Regulatory Restrictions and Restrictions Under the Terms of Certain of Our Securities” in the 2012 Form 10-K and Note 16 of the Notes

to the Consolidated Financial Statements.

Debt Repayments. See Notes 12 and 13 of the Notes to the Consolidated Financial Statements for further information on long-term and short-

term debt and collateral financing arrangements, respectively, including:

‰In June and December 2012, MetLife, Inc. repaid at maturity its $397 million and $400 million senior notes, respectively;

‰In December 2011, MetLife, Inc. repaid at maturity its $750 million senior note;

‰During the years ended December 31, 2012, 2011 and 2010, MetLife Bank made to the FHLB of NY long-term repayments of

$374 million, $750 million and $349 million, and short-term debt repayments of $735 million, $9.7 billion and $12.9 billion,

respectively; and

‰In June 2012 and December 2011, following regulatory approval, MetLife Reinsurance Company of Charleston, a wholly-owned

subsidiary of MetLife, Inc., repurchased and canceled $451 million and $650 million, respectively, in aggregate principal amounts of

surplus notes.

Debt and Facility Covenants. Certain of our debt instruments, credit facilities and committed facilities contain various administrative, reporting,

legal and financial covenants. We believe we were in compliance with all such covenants at December 31, 2012.

Debt Repurchases. We may from time to time seek to retire or purchase our outstanding debt through cash purchases and/or exchanges for

other securities, in open market purchases, privately negotiated transactions or otherwise. Any such repurchases or exchanges will be dependent

upon several factors, including our liquidity requirements, contractual restrictions, general market conditions, and applicable regulatory, legal and

accounting factors. Whether or not to repurchase any debt and the size and timing of any such repurchases is determined at our discretion.

Support Agreements. MetLife, Inc. and several of its subsidiaries (each, an “Obligor”) are parties to various capital support commitments,

guarantees and contingent reinsurance agreements with certain subsidiaries of MetLife, Inc. Under these arrangements, each Obligor, with respect

to the applicable entity, has agreed to cause such entity to meet specified capital and surplus levels, has guaranteed certain contractual obligations

or has agreed to provide, upon the occurrence of certain contingencies, reinsurance for such entity’s insurance liabilities. We anticipate that in the

event that these arrangements place demands upon us, there will be sufficient liquidity and capital to enable us to meet anticipated demands.

In July 2012, in connection with an operating agreement with the OCC governing MetLife Bank’s operations during its wind-down process,

MetLife Bank and MetLife, Inc. entered into a capital support agreement with the OCC and MetLife, Inc. and MetLife Bank entered into an

indemnification and capital maintenance agreement under which agreements MetLife, Inc. will provide financial and other support to MetLife Bank to

ensure that MetLife Bank can wind down its operations in a safe and sound manner.

See “— MetLife, Inc. — Liquidity and Capital Uses — Support Agreements.”

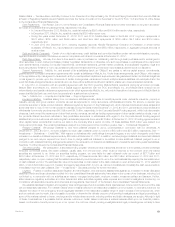

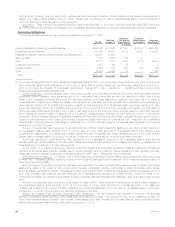

Insurance Liabilities. Liabilities arising from our insurance activities primarily relate to benefit payments under various life insurance, property &

casualty, annuity and group pension products, as well as payments for policy surrenders, withdrawals and loans. For annuity or deposit type

products, surrender or lapse product behavior differs somewhat by segment. In the Retail segment, which includes individual annuities, lapses and

surrenders tend to occur in the normal course of business. During the years ended December 31, 2012 and 2011, general account surrenders and

withdrawals from annuity products were $4.3 billion and $4.1 billion, respectively. In the Corporate Benefit Funding segment, which includes pension

closeouts, bank-owned life insurance and other fixed annuity contracts, as well as funding agreements and other capital market products, most of

the products offered have fixed maturities or fairly predictable surrenders or withdrawals. With regard to the Corporate Benefit Funding segment

liabilities that provide customers with limited rights to accelerate payments, there were $3.2 billion at December 31, 2012 of funding agreements and

other capital market products that could be put back to the Company after a period of notice. Of these liabilities, $535 million were subject to a

notice period of 90 days. The remaining liabilities are subject to a notice period of five months or greater. See “— Contractual Obligations.”

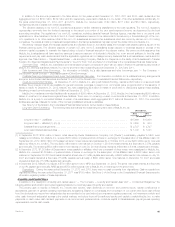

Pledged Collateral. We pledge collateral to, and have collateral pledged to us by, counterparties in connection with our derivatives. At

December 31, 2012 and 2011, we were obligated to return cash collateral under our control of $6.0 billion and $9.5 billion, respectively. See “—

Investments — Derivatives — Credit Risk.” With respect to derivatives with credit ratings downgrade triggers, a two-notch downgrade would have

increased our derivative collateral requirements by $53 million at December 31, 2012. In addition, we have pledged collateral and have had collateral

pledged to us, and may be required from time to time to pledge additional collateral or be entitled to have additional collateral pledged to us, in

connection with collateral financing arrangements related to the reinsurance of closed block liabilities and universal life secondary guarantee liabilities.

See Note 13 of the Notes to the Consolidated Financial Statements.

Securities Lending. We participate in a securities lending program whereby blocks of securities are loaned to third parties, primarily brokerage

firms and commercial banks. We obtain collateral, usually cash, from the borrower, which must be returned to the borrower when the loaned

securities are returned to us. Under our securities lending program, we were liable for cash collateral under our control of $27.7 billion and

$24.2 billion at December 31, 2012 and 2011, respectively. Of these amounts, $5.0 billion and $2.7 billion at December 31, 2012 and 2011,

respectively, were on open, meaning that the related loaned security could be returned to us on the next business day requiring the immediate return

of cash collateral we hold. The estimated fair value of the securities on loan related to the cash collateral on open at December 31, 2012 was $4.8

billion, of which $4.6 billion were U.S. Treasury and agency securities which, if put to us, can be immediately sold to satisfy the cash requirements to

immediately return the cash collateral. See “— Investments — Securities Lending” for further information.

Litigation. Putative or certified class action litigation and other litigation, and claims and assessments against us, in addition to those discussed

elsewhere herein and those otherwise provided for in the consolidated financial statements, have arisen in the course of our business, including, but

not limited to, in connection with our activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer. Further,

state insurance regulatory authorities and other federal and state authorities regularly make inquiries and conduct investigations concerning our

compliance with applicable insurance and other laws and regulations. See Note 21 of the Notes to the Consolidated Financial Statements.

We establish liabilities for litigation and regulatory loss contingencies when it is probable that a loss has been incurred and the amount of the loss

can be reasonably estimated. For material matters where a loss is believed to be reasonably possible but not probable, no accrual is made but we

disclose the nature of the contingency and an aggregate estimate of the reasonably possible range of loss in excess of amounts accrued, when

such an estimate can be made. It is not possible to predict or determine the ultimate outcome of all pending investigations and legal proceedings. In

some of the matters referred to herein, very large and/or indeterminate amounts, including punitive and treble damages, are sought. Although in light

of these considerations, it is possible that an adverse outcome in certain cases could have a material adverse effect upon our financial position,

based on information currently known by us, in our opinion, the outcome of such pending investigations and legal proceedings are not likely to have

MetLife, Inc. 59