MetLife 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

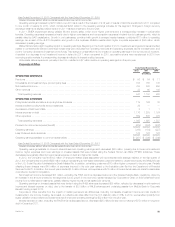

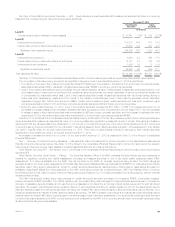

Historically, we have managed our exposure to sub-prime RMBS holdings by reducing our overall exposure, stress testing the portfolio with severe

loss assumptions and closely monitoring the performance of the portfolio. At December 31, 2012 and 2011, approximately 53% and 79%, respectively,

of our sub-prime RMBS holdings were in a vintage year of 2005 or prior. These older vintage years benefit from better underwriting, improved credit

enhancement levels and higher residential property price appreciation. In 2012, we increased our exposure to sub-prime RMBS by purchasing sub-

prime RMBS at significant discounts to the expected principal recovery value of these securities. The 2012 sub-prime RMBS purchases are performing

within our expectations and were in an unrealized gain position of $59 million at December 31, 2012.

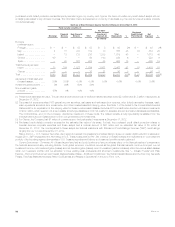

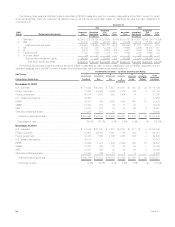

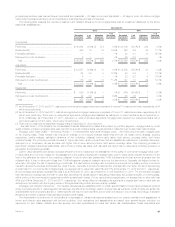

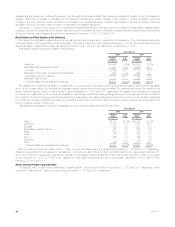

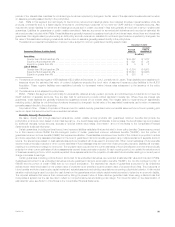

CMBS. The following tables present our CMBS holdings by rating agency designation and by vintage year at:

December 31, 2012

Aaa Aa A Baa

Below

Investment

Grade Total

Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

(In millions)

2003 .................... $ 2,957 $ 2,997 $ 113 $ 114 $ 82 $ 82 $ 37 $ 36 $ 33 $ 33 $ 3,222 $ 3,262

2004 .................... 3,466 3,606 380 401 97 99 52 51 21 9 4,016 4,166

2005 .................... 3,348 3,636 303 329 275 296 144 142 — — 4,070 4,403

2006 .................... 2,283 2,484 263 284 44 44 47 50 38 36 2,675 2,898

2007 .................... 1,070 1,143 112 117 87 95 194 187 20 21 1,483 1,563

2008 - 2010 .............. 2 3 — — — — 56 60 26 24 84 87

2011 .................... 598 650 12 11 108 112 — — 7 6 725 779

2012 .................... 524 559 403 417 939 956 — — 36 39 1,902 1,971

Total .................. $14,248 $ 15,078 $ 1,586 $ 1,673 $ 1,632 $ 1,684 $ 530 $ 526 $ 181 $ 168 $18,177 $ 19,129

Ratings Distribution ......... 78.8% 8.7% 8.8% 2.8% 0.9% 100.0%

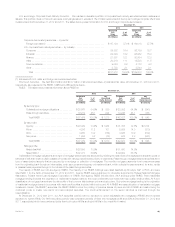

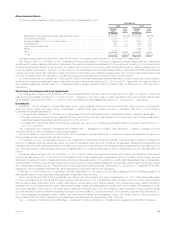

December 31, 2011

Aaa Aa A Baa

Below

Investment

Grade Total

Amortized

Cost

Estimated

Fair

Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value Amortized

Cost Estimated

Fair Value

(In millions)

2003 ......................$ 5,574 $ 5,677 $ 176 $ 176 $ 91 $ 88 $ 54 $ 52 $ 29 $ 27 $ 5,924 $ 6,020

2004 ...................... 3,586 3,730 430 440 135 129 83 80 32 25 4,266 4,404

2005 ...................... 3,081 3,318 427 432 277 269 184 175 31 28 4,000 4,222

2006 ...................... 1,712 1,835 245 237 89 83 118 110 123 106 2,287 2,371

2007 ...................... 643 665 395 332 163 138 67 71 94 88 1,362 1,294

2008 - 2010 ................ 3 3 — — — — 60 66 25 27 88 96

2011 ...................... 536 557 1 1 92 96 — — 9 8 638 662

Total .....................$15,135 $ 15,785 $ 1,674 $ 1,618 $ 847 $ 803 $ 566 $ 554 $ 343 $ 309 $18,565 $ 19,069

Ratings Distribution ........... 82.8% 8.5% 4.2% 2.9% 1.6% 100.0%

The tables above reflect rating agency designations assigned by nationally recognized rating agencies including Moody’s, S&P, Fitch and Realpoint,

LLC. CMBS rated NAIC 1 were 98.5% and 96.5% of total CMBS at December 31, 2012 and 2011, respectively.

42 MetLife, Inc.