MetLife 2012 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

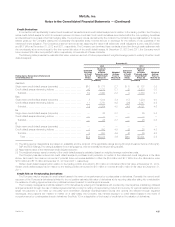

The Company enters into various collateral arrangements which require both the pledging and accepting of collateral in connection with its OTC

derivatives. At December 31, 2012 and 2011, the Company was obligated to return cash collateral under its control of $6.0 billion and $9.5 billion,

respectively. This cash collateral is included in cash and cash equivalents or in short-term investments and the obligation to return it is included in

payables for collateral under securities loaned and other transactions in the consolidated balance sheets. At December 31, 2012 and 2011, the

Company had received collateral consisting of various securities with a fair market value of $3.7 billion and $2.5 billion, respectively, which were held in

separate custodial accounts. Subject to certain constraints, the Company is permitted by contract to sell or repledge this collateral, but at

December 31, 2012, none of the collateral had been sold or repledged.

The Company’s collateral arrangements for its OTC derivatives generally require the counterparty in a net liability position, after considering the effect

of netting agreements, to pledge collateral when the fair value of that counterparty’s derivatives reaches a pre-determined threshold. Certain of these

arrangements also include credit-contingent provisions that provide for a reduction of these thresholds (on a sliding scale that converges toward zero) in

the event of downgrades in the credit ratings of the Company and/or the counterparty. In addition, certain of the Company’s netting agreements for

derivatives contain provisions that require both the Company and the counterparty to maintain a specific investment grade credit rating from each of

Moody’s and S&P. If a party’s credit ratings were to fall below that specific investment grade credit rating, that party would be in violation of these

provisions, and the other party to the derivatives could terminate the transactions and demand immediate settlement and payment based on such

party’s reasonable valuation of the derivatives.

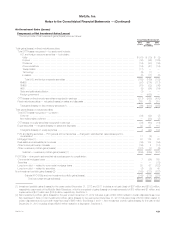

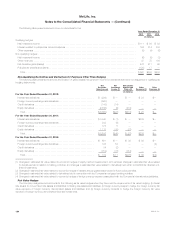

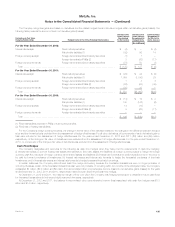

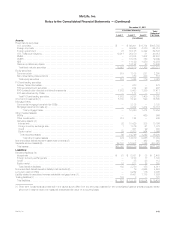

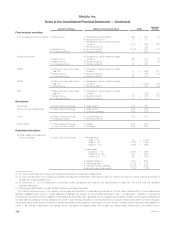

The following table presents the estimated fair value of the Company’s OTC derivatives that are in a net liability position after considering the effect of

netting agreements, together with the estimated fair value and balance sheet location of the collateral pledged. The table also presents the incremental

collateral that the Company would be required to provide if there was a one notch downgrade in the Company’s credit rating at the reporting date or if

the Company’s credit rating sustained a downgrade to a level that triggered full overnight collateralization or termination of the derivative position at the

reporting date. Derivatives that are not subject to collateral agreements are not included in the scope of this table.

Estimated Fair Value of

Collateral Provided: Fair Value of Incremental

Collateral Provided Upon:

Estimated

Fair Value of

Derivatives in Net

Liability Position (1) Fixed Maturity

Securities (2) Cash (3)

One Notch

Downgrade in

the Company’s

Credit Rating

Downgrade in the

Company’s Credit Rating

to a Level that Triggers

Full Overnight

Collateralization or

Termination of

the Derivative Position

(In millions)

December 31, 2012:

Derivatives subject to credit-contingent provisions ................... $771 $775 $— $35 $ 73

Derivatives not subject to credit-contingent provisions ................ 79 100 1 — —

Total .................................................... $850 $875 $ 1 $35 $ 73

December 31, 2011:

Derivatives subject to credit-contingent provisions ................... $447 $405 $ 4 $48 $104

Derivatives not subject to credit-contingent provisions ................ 28 11 4 — —

Total .................................................... $475 $416 $ 8 $48 $104

(1) After taking into consideration the existence of netting agreements.

(2) Included in fixed maturity securities in the consolidated balance sheets. Subject to certain constraints, the counterparties are permitted by contract to

sell or repledge this collateral.

(3) Included in premiums, reinsurance and other receivables in the consolidated balance sheets.

The Company also has exchange-traded futures and options, which require the pledging of collateral. At December 31, 2012 and 2011, the

Company pledged securities collateral for exchange-traded futures and options of $40 million and $42 million, respectively, which is included in fixed

maturity securities. Subject to certain constraints, the counterparties are permitted by contract to sell or repledge this collateral. At December 31, 2012

and 2011, the Company provided cash collateral for exchange-traded futures and options of $441 million and $680 million, respectively, which is

included in premiums, reinsurance and other receivables.

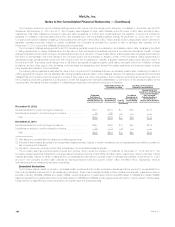

Embedded Derivatives

The Company issues certain products or purchases certain investments that contain embedded derivatives that are required to be separated from

their host contracts and accounted for as freestanding derivatives. These host contracts principally include: variable annuities with guaranteed minimum

benefits, including GMWBs, GMABs and certain GMIBs; ceded reinsurance of guaranteed minimum benefits related to GMABs and certain GMIBs;

assumed reinsurance of guaranteed minimum benefits related to GMWBs and GMABs; funding agreements with equity or bond indexed crediting rates;

funds withheld on assumed and ceded reinsurance; and certain debt and equity securities.

138 MetLife, Inc.