MetLife 2012 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

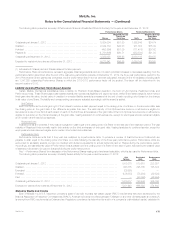

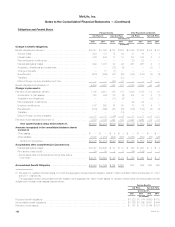

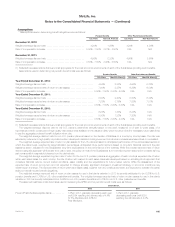

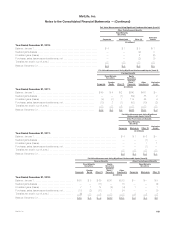

Pension Benefits Other Postretirement Benefits

U.S. Plans Non-U.S. Plans U.S. Plans Non-U.S. Plans

Years Ended December 31,

2012 2011 2010 2012 2011 2010 2012 2011 2010 2012 2011 2010

(In millions)

Net Periodic Benefit Costs:

Service costs ................................... $ 224 $ 187 $ 172 $ 75 $ 64 $ 8 $ 21 $ 16 $ 16 $ 1 $ 1 $ 1

Interest costs ................................... 406 404 393 17 16 6 103 106 111 2 2 2

Settlement and curtailment costs ................... —————8———111

Expected return on plan assets ..................... (484) (448) (444) (6) (6) (6) (77) (76) (79) (1) (1) —

Amortization of net actuarial (gains) losses ............ 195 194 196 — — — 57 43 38 — — —

Amortization of prior service costs (credit) ............. 6 4 7 — — — (104) (108) (83) — — —

Total net periodic benefit costs (credit) ............. 347 341 324 86 74 16 — (19) 3 3 3 4

Other Changes in Plan Assets and Benefit

Obligations Recognized in Other Comprehensive

Income (Loss):

Net actuarial (gains) losses ........................ 744 575 37 18 34 (15) 234 262 49 2 5 1

Prior service costs (credit) ......................... — 17 — (1) — 1 — — (81) (1) — 1

Amortization of net actuarial gains (losses) ............ (195) (194) (196) — — — (57) (43) (38) — — —

Amortization of prior service (costs) credit ............. (6) (4) (7) — — — 104 108 83 — — —

Total recognized in other comprehensive

income (loss) ............................... 543 394 (166) 17 34 (14) 281 327 13 1 5 2

Total recognized in net periodic benefit costs and

other comprehensive income (loss) ............ $ 890 $ 735 $ 158 $ 103 $ 108 $ 2 $ 281 $ 308 $ 16 $ 4 $ 8 $ 6

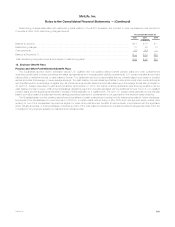

For the year ended December 31, 2012, included within other comprehensive income (loss) were other changes in plan assets and benefit

obligations associated with pension benefits of $543 million for the U.S. plans and $17 million for the non-U.S. plans and other postretirement benefits

of $281 million for the U.S. plans and $1 million for the non-U.S. plans for an aggregate reduction in other comprehensive income (loss) of $842 million

before income tax and $546 million, net of income tax.

The estimated net actuarial (gains) losses and prior service costs (credit) for the U.S. pension plans and the U.S. defined benefit other postretirement

benefit plans that will be amortized from accumulated other comprehensive income (loss) into net periodic benefit costs over the next year are

$225 million and $6 million, and $73 million and ($75) million, respectively.

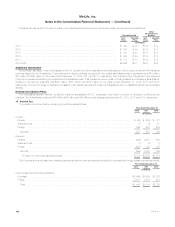

The Medicare Modernization Act of 2003 created various subsidies for all U.S. sponsors of retiree drug programs. Two common ways of providing

subsidies were the Retiree Drug Subsidy (“RDS”) and Medicare Part D Prescription Drug Plans (“PDP”). From 2006 through 2010, the Company applied

for and received the RDS each year. The RDS program provides the subsidy through cash payments made by Medicare to the Company, resulting in

smaller net claims paid by the Company. A summary of the reduction to the APBO and the related reduction to the components of net periodic other

postretirement benefits plan costs resulting from receipt of the RDS is presented below. As of January 1, 2011, as a result of changes made under the

Patient Protection and Affordable Care Act of 2010, the Company no longer applies for the RDS. Instead it has joined PDP and will indirectly receive

Medicare subsidies in the form of smaller gross benefit payments for prescription drug coverage.

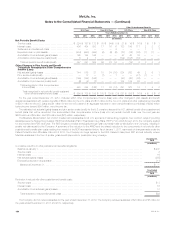

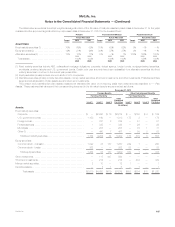

December 31,

2010

(In millions)

Cumulative reduction in other postretirement benefits obligations:

Balance at January 1, ..................................................................................... $247

Service costs ............................................................................................ 3

Interest costs ............................................................................................ 16

Net actuarial (gains) losses ................................................................................. (255)

Expected prescription drug subsidy ........................................................................... (11)

Balance at December 31, ................................................................................ $ —

Year Ended

December 31,

2010

(In millions)

Reduction in net periodic other postretirement benefit costs:

Service costs ............................................................................................ $ 3

Interest costs ............................................................................................ 16

Amortization of net actuarial (gains) losses ...................................................................... 10

Total reduction in net periodic benefit costs ................................................................... $29

The Company did not receive subsidies for the year ended December 31, 2012. The Company received subsidies of $3 million and $8 million for

the years ended December 31, 2011 and 2010, respectively.

184 MetLife, Inc.