MetLife 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

American Life does not conduct insurance business in Delaware or any other domestic state and, as such, is exempt from RBC requirements by

Delaware law. In addition to Delaware, American Life operations are regulated by applicable authorities of the countries in which it operates and is

subject to capital and solvency requirements in those countries.

The amount of dividends that our insurance subsidiaries can pay to MetLife, Inc. or to other parent entities is constrained by the amount of surplus

we hold to maintain our ratings and provides an additional margin for risk protection and investment in our businesses. We proactively take actions to

maintain capital consistent with these ratings objectives, which may include adjusting dividend amounts and deploying financial resources from internal

or external sources of capital. Certain of these activities may require regulatory approval. Furthermore, the payment of dividends and other distributions

to MetLife, Inc. and other parent entities by their respective insurance subsidiaries is governed by insurance laws and regulations. See “Business —

U.S. Regulation — Insurance Regulation,” and “Business — International Regulation,” in the Form 10-K. See also “— MetLife, Inc. — Liquidity and

Capital Sources — Dividends from Subsidiaries” and Note 16 of the Notes to the Consolidated Financial Statements.

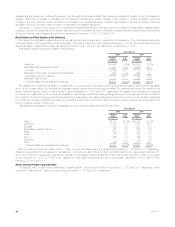

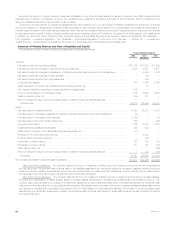

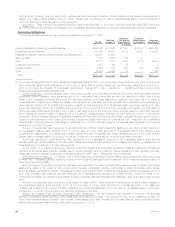

Summary of Primary Sources and Uses of Liquidity and Capital

Our primary sources and uses of liquidity and capital are summarized as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Sources:

Net cash provided by operating activities .......................................................... $17,160 $10,273 $ 7,985

Net cash provided by changes in policyholder account balances ....................................... 4,290 4,321 4,557

Net cash provided by changes in payables for collateral under securities loaned and other transactions ......... — 6,444 3,076

Net cash provided by changes in bank deposits .................................................... — 96 —

Net cash provided by short-term debt issuances .................................................... — 380 —

Long-term debt issued ........................................................................ 750 1,346 5,090

Cash received in connection with collateral financing arrangements, net .................................. — 37 —

Net change in liability for securitized reverse residential mortgage loans .................................. 1,198 — —

Common stock issued, net of issuance costs ...................................................... 1,000 2,950 3,529

Cash provided by other, net .................................................................... 609 212 —

Effect of change in foreign currency exchange rates on cash and cash equivalents balances ................. 11 — —

Total sources ............................................................................. 25,018 26,059 24,237

Uses:

Net cash used in investing activities .............................................................. 11,929 22,218 18,303

Net cash used for changes in payables for collateral under securities loaned and other transactions ............ 29 — —

Net cash used for changes in bank deposits ....................................................... 4,169 — 32

Net cash used for short-term debt repayments ..................................................... 586 — 606

Long-term debt repaid ........................................................................ 1,702 2,042 1,061

Collateral financing arrangements repaid .......................................................... 349 502 —

Cash paid in connection with collateral financing arrangements, net ..................................... 44 — —

Redemption of convertible preferred stock ......................................................... — 2,805 —

Preferred stock redemption premium ............................................................. — 146 —

Dividends on preferred stock ................................................................... 122 122 122

Dividends on common stock ................................................................... 811 787 784

Cash used in other, net ....................................................................... — — 266

Effect of change in foreign currency exchange rates on cash and cash equivalents balances ................. — 22 129

Total uses ................................................................................ 19,741 28,644 21,303

Net increase (decrease) in cash and cash equivalents ................................................. $ 5,277 $ (2,585) $ 2,934

Cash Flows from Operations. The principal cash inflows from our insurance activities come from insurance premiums, annuity considerations

and deposit funds. The principal cash outflows relate to the liabilities associated with various life insurance, property & casualty, annuity and group

pension products, operating expenses and income tax, as well as interest on outstanding debt obligations. A primary liquidity concern with respect

to these cash flows is the risk of early contractholder and policyholder withdrawal.

Cash Flows from Investments. The principal cash inflows from our investment activities come from repayments of principal on invested assets,

proceeds from maturities of invested assets, sales of invested assets, settlements of freestanding derivatives and net investment income. The

principal cash outflows relate to purchases of investments, issuances of policy loans and settlements of freestanding derivatives. Additional cash

outflows include those related to our securities lending activities. We typically have a net cash outflow from investing activities because cash inflows

from insurance operations are reinvested in accordance with our ALM discipline to fund insurance liabilities. We closely monitor and manage these

risks through our credit risk management process. The primary liquidity concerns with respect to these cash flows are the risk of default by debtors

and market disruption.

56 MetLife, Inc.